The most confusing insurance product ever developed is the Part D prescription drug plans for Medicare beneficiaries. Between the four different coverage phases, different plans offered by multiple carriers in each state, and a lack of transparency in drug pricing, trying to make an informed decision is more of a gamble than an educated guess. Even with the donut hole having been closed, the coverage gap phase of the Part D prescription drug plans can still be hard to explain.

Moving Toward the Coverage Gap Cost Phase

The Part D prescription drug component of Medicare was designed by insurance companies to meet their needs, not to accommodate consumers. With that in mind, Part D drug plans have four coverage phases

- Deductible

- Initial Coverage

- Coverage Gap

- Catastrophic

Deductible Phase

In the deductible phase, the consumer pays the full negotiated price for their prescription drugs. For 2021, the deductible is $445. Not all drug plans will have a deductible phase. With some plans the consumer goes straight into set copayment or coinsurance cost structure, similar to the initial coverage phase. But don’t be fooled, all the plans have to meet an actuarial equivalent of the standard Medicare Part D plan for the coverage year.

Actuarial equivalent is an insurance term meaning that the average consumer, regardless of the plan structure, will receive the same benefits over the course of the plan year. This means that even if the Part D plan does not have deductible, the drug costs somewhere else in the plan will most likely be higher than a plan with a deductible. However, no two consumers are the same when it comes to their prescription medications.

For many people, most, if not all, of their drugs are generic. They may only be paying $30 per month for a variety of prescription medications, which only totals $360 for the year. This means they will never meet any drug deductible. The rub is that they receive that low generic price regardless of whether they have a Part D drug plan or not. This leads many people to question the necessity of a Part D drug plan. However, not enrolling in a Part D plan could trigger a Late Enrollment Penalty when you need the insurance plan the most for high cost drugs.

Initial Coverage Phase

The calculation for the deductible phase is easy because it is a set dollar amount. The initial coverage phase is where the accounting starts to get fuzzy. Technically, the consumer only pays 25 percent of the drug cost until they hit the initial coverage limit. The initial coverage limit for 2021 is $4,130. Most plans don’t use a flat 25 percent multiplier for determining the consumer’s drug cost.

Within the initial coverage phase the drug plans assign all the different medications on the drug formulary (the list of covered drugs) to different pricing tiers. At a minimum there are four drug tiers with some plans having six tiers.

- Tier 1 Generic

- Tier 2 Preferred brand-name drugs

- Tier 3 Non-preferred brand-name drugs

- Tier 4 High-cost or specialty drugs

Some plans have a non-preferred generic brand tier and another tier for drugs that are $0 cost-share to the plan member for maintenance drugs like high blood pressure medication. Drug tiers 1 – 3 will have a set copayment for a 30-day supply at a retail pharmacy or 90-day supply from a mail order pharmacy. Tier 4 drugs are usually the expensive one-of-kind brand name drugs and injectables. These drugs will be subject to coinsurance, but it will usually be higher than the 25% of the initial coverage phase.

Somehow, for the average Part D prescription plan consumer, they will have paid 25 percent of the drug costs in the initial coverage phase – the combination of copayments and coinsurance – when they reach their initial coverage limit. This is the actuarial equivalent prospect. Some consumers may pay less than 25% of the drug costs, some may pay more. After the consumer meets initial coverage limit, and the consumer moves into the coverage gap (previously known as the donut hole), the math gets tricky.

Coverage Gap

When the consumer moves into the coverage gap, similar to the initial coverage phase, they only pay 25 percent for prescription drugs. While this sounds exactly like the initial coverage phase, the set copayments and coinsurance of the drug tiers evaporates. The consumer should be paying a straight 25 percent of the generic and 25 percent of the undiscounted brand name drugs that are included on the plan’s drug formulary.

All of the out-of-pocket drug cost the consumer pays goes toward pushing them through the coverage gap and potentially into the catastrophic phase. These costs would include any deductible, copayments and coinsurance of the initial coverage phase, and the 25 percent coinsurance in the coverage gap. However, in the coverage gap, the consumer’s accumulated dollar amount is credited with the drug manufacturers 70 percent discount on brand name drugs.

Let’s assume a drug has cost of $100. The consumer is in the coverage gap phase of the Part D plan. The consumer will pay $25, the plan pays $5, and a $70 drug discount from the manufacturer make up the difference. In this scenario, the consumer would have accumulated $95 toward meeting the dollar amount for the catastrophic phase.

This odd accounting method of attributing a drug discount to the consumer’s spending column is called the True-Out-of-Pocket amount or TrOOP. But it is anything but the true actual out-of-pocket cost for the consumer. It is just another insurance accounting gimmick, somewhat in the consumer’s favor, to tally up the costs.

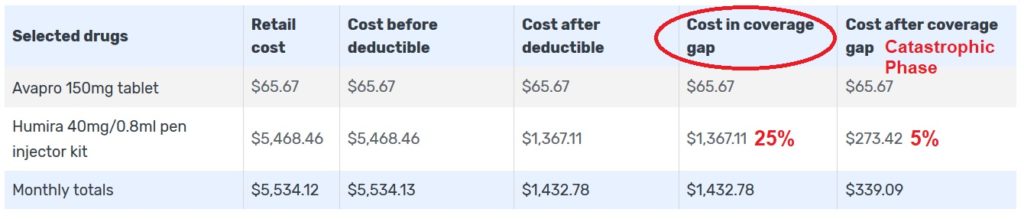

Medicare.gov is a very good source for Part D drug cost information. In this example of a consumer on the Humira for rheumatoid arthritis, the drug cost tool shows the retail price, the 25 percent coinsurance in the coverage gap, and the 5 percent coinsurance cost in the catastrophic phase. Medicare.gov will show you when your drug costs trigger the initial coverage period, coverage gap, and finally the catastrophic for the drugs entered into the system. Note, in the example, Avapro is not on the drug formulary and the plan member receives no discounts and the drug costs do not accumulate toward meeting the different phases.

Catastrophic Phase

Once a consumer spends enough money, including the 70% drug discount in the coverage gap, to meet the catastrophic phase, all the drug cost plummet. For 2021 the catastrophic phase will begin when the TrOOP dollar amount equals $6,550. In the catastrophic phase the consumer pays a set copayment for generic drugs and a higher copayment for brand name drugs, OR, coinsurance of 5 percent, whichever is greater.

Unfortunately, because of the goofy 70% drug discount, a consumer doesn’t really know when they will meet the catastrophic level. A consumer who receives a 70 percent drug discount of $300 will meet the catastrophic phase sooner than their neighbor who may only be receiving a $100 discount. The Medicare.gov drug cost tool greatly aids in determining when a consumer will enter the different phases with the different drug plans. Unfortunately, all these different numbers can be really confusing for Medicare beneficiaries just trying to make an educated guess on what plan is best for their current drug prescriptions.