Of all the Medicare plans, the Part D Prescription (PDP) plans are the most confusing. The confusion arises because Medicare allows the Part D plans to offer alternate plans that differ from the standard plan. The alternate plans must be as good as the standard plan for the average Medicare beneficiary.

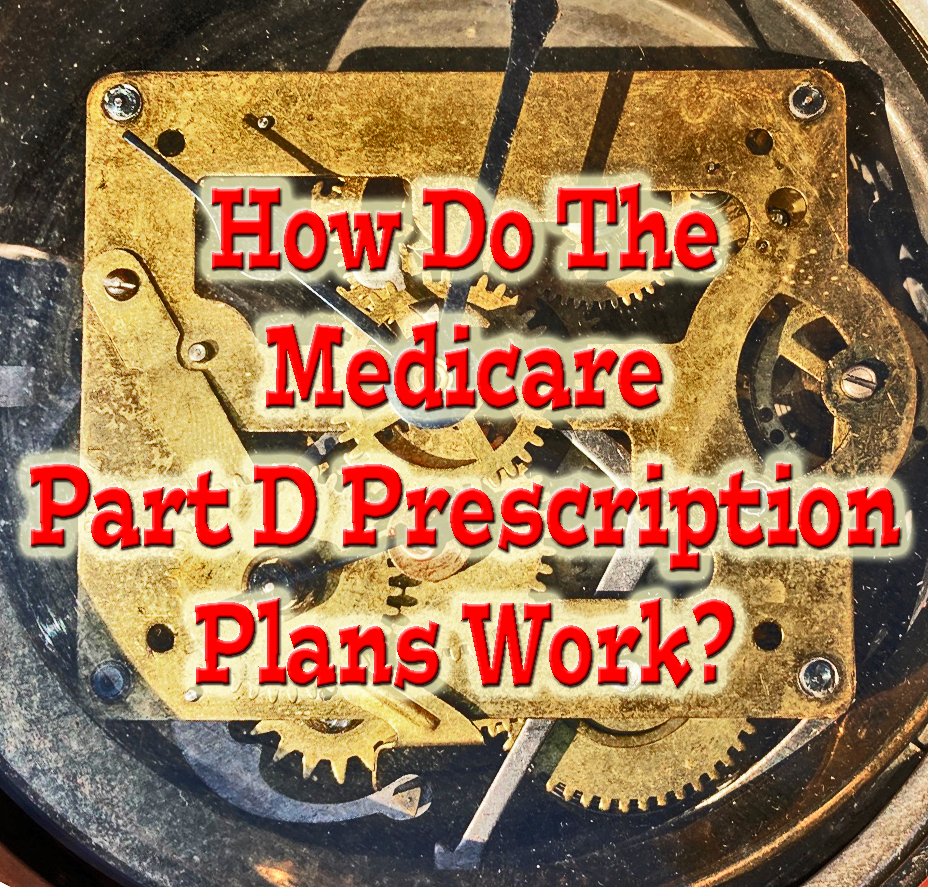

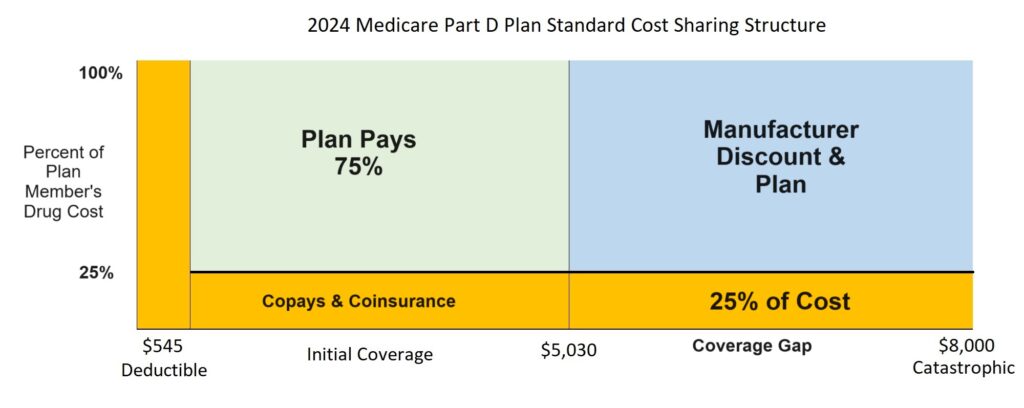

Cost Sharing of the Standard Medicare Part D Prescription drug plans for 2024

The standard Medicare Part D Prescription drug plan has a specific structure for the plan member’s cost-sharing of the drug costs. For 2024, the standard cost-sharing design begins with a $545 deductible. The plan member must pay the full negotiated cost of the drug from their retail pharmacy.

After the deductible is met, the plan member enters the initial coverage phase and is responsible for 25 percent of the drug cost either. Once the plan member’s drug costs total $5,030 (deductible + initial coverage), they enter the coverage gap. In the coverage gap the plan member pays 25 percent of the drug cost.

In the coverage gap phase, a manufacturer’s discount also accumulates on the member’s behalf. When the member’s gap costs plus the discount equals $8,000, the plan covers the cost of all the drugs for the remainder of the year.

Confusing Alternate Part D Plans with different Cost Sharing elements

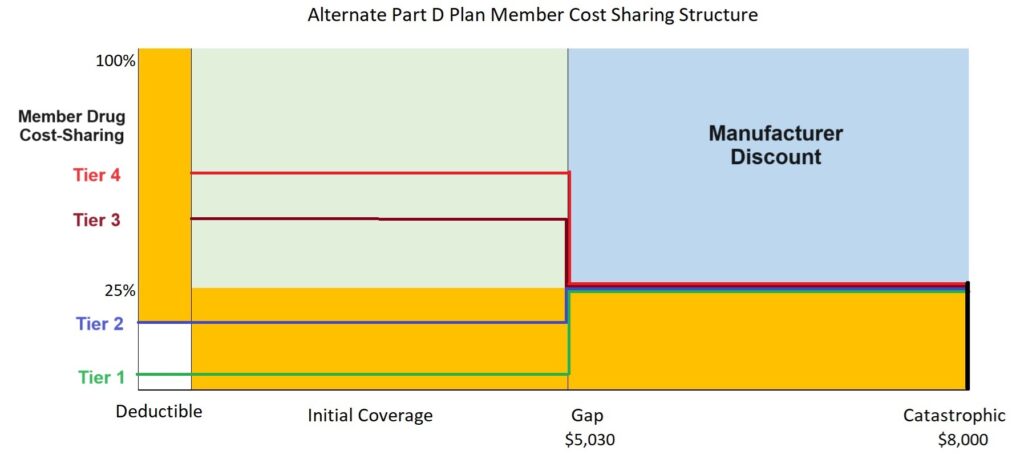

While the standard Medicare Part D plan cost-sharing structure is straight forward, Medicare allows the plans to deviate from the standard design. This is where all the confusion is created.

Instead of a set 25 percent coinsurance cost for drug during the initial coverage phase, many plans will use a combination of set copayments and coinsurance. The copayments – some drugs will have a $0 copay – may be less than 25 percent of the drug cost. In addition, some of the drug tiers may not be subject to any deductible phase, the member goes straight into the copayment structure.

Other drug tiers may be subject to a plan deductible. After the deductible is met for these drug tiers, the copayments and coinsurance may be higher than 25 percent of the drug cost. The lower drug tiers represent generic, preferred generic, and non-preferred generic drugs. The higher drug tiers, usually 3, 4, 5, represent the higher cost brand name drugs.

Once the plan member hits the coverage gap phase of $5,030, the drug costs will usually set to a 25 percent coinsurance rate. This means that some tier 1 and 2 drugs will increase in price, while the higher tier drugs will drop in cost. At the $8,000 cost accumulation mark, the plan covers the cost of all drugs on the formulary for the remainder of the year.

Some plans may have no drug deductible. Other plans may hold the cost of some drugs below the 25 percent coinsurance rate of the gap phase. The variety of different member cost-sharing structures, in addition to how some drugs are placed in different pricing tiers, results in landscape of Part D plans that is bewildering to many Medicare beneficiaries.

Just as the drug plans are trying to maximize their profits with the various plan designs, the Medicare beneficiary can minimize their costs. There is no average Medicare beneficiary when it comes to prescription drugs. You may find a drug plan where your drugs will be very low for the entire year. Some alternate plan structures may have your particular mix of prescriptions at costs below the 25 percent coinsurance level for the entire year.

You may not even get out of the deductible phase. The trick is to compare the plans using the Medicare.gov website. While the plans may not seem to meet the standard PDP cost structure, they do on an actuarial value test. Because you are not average, you should be able to find a plan that minimizes your prescription drug costs for the year.