Medi-Cal has constructed flow charts for determining household size and whose income counts for eligibility.

Determining if your adult child is eligible for Medi-Cal or Covered California on your account can be complicated. This is because the expanded ACA Medi-Cal coverage and Covered California all revolve around the primary applicant’s tax household and income. Medi-Cal has put together flow charts for determining the composition of the household and whose income counts toward the eligibility determination.

Whose Income Counts For Medi-Cal & Covered California?

When your son or daughter is earning money from a job, but still living at home, it can be a bit confusing when applying for health insurance through Covered California. When do you count your child’s income for Medi-Cal or Covered California? Should your child have their own health plan? Do they file their own taxes? Are they still going to school?

MAGI Medi-Cal based solely on the income of the family has different conditions from other Medi-Cal programs. MAGI Medi-Cal is derived from an eligibility determination for Covered California and the monthly subsidies. If the household income is below 138% of the federal poverty level, then all of the adults and children are eligible for Medi-Cal. But when your children start earning money from a part-time job, when is that income counted for determining Medi-Cal Eligibility?

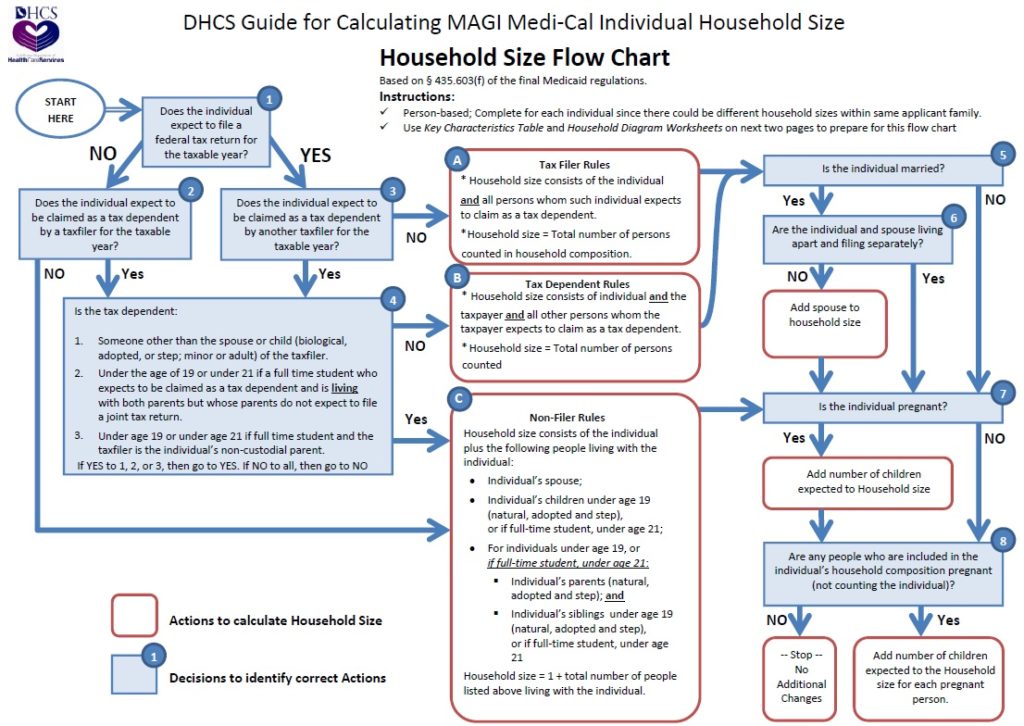

In order to help visualize the eligibility determination Medi-Cal has developed flow charts. The flow charts are a series of If-Then conditions. If the household member is going to school, Then move to the next step. The flow charts are another way to view the eligibility process, as opposed to a set of linear questions.

Household Size Flow Chart

The first flow chart is to assist in determining who is actually in the household. The first question, which applies to everyone, adults and young adults, is if the person is expected to file a federal tax return. If your son or daughter expects to file a tax return, and you are not going to take them as a tax dependent on your taxes, then your son or daughter is their own tax filer and not part of your household. This also applies to Covered California.

There are other conditions that allow your son or daughter to be filing their own tax return and the parent still list the child as a tax dependent. Some of these have to do with going to school full-time and their age. Some young adults plan to file taxes not because they owe federal income tax on their earnings, but in order to get back some of the taxes withheld from their paychecks.

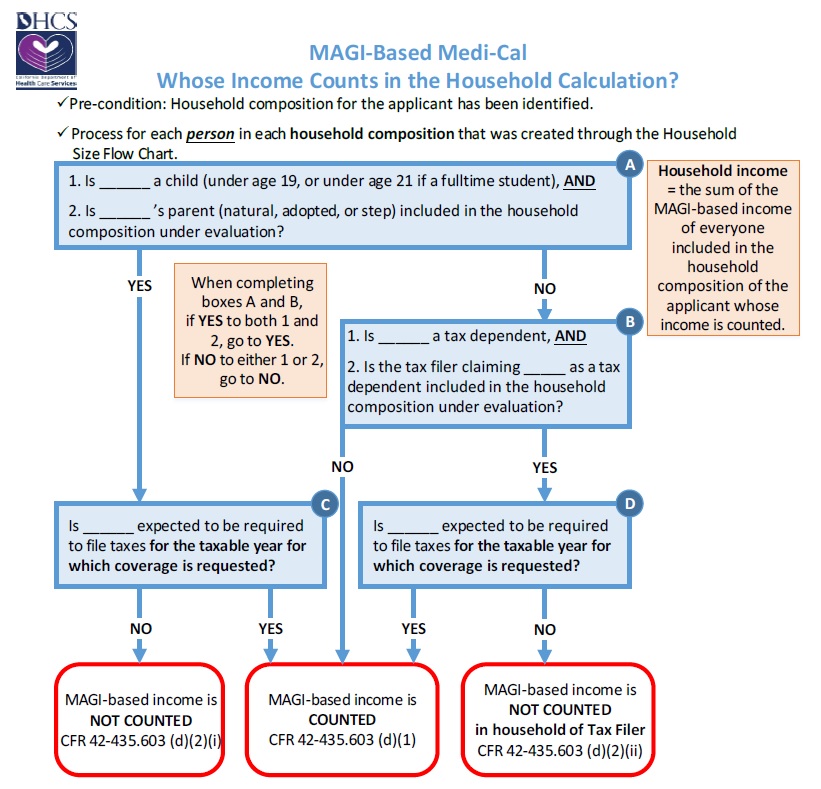

Countable Sources Of Income For Medi-Cal

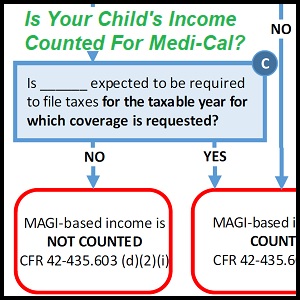

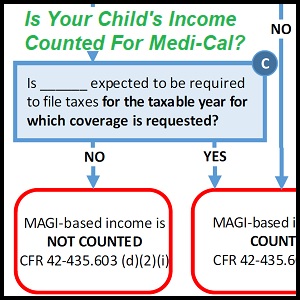

Once the household size has been determined, the next step is to determine whose income is counted toward Med-Cal, and ultimately, Covered California eligibility. The big question, “Is your son or daughter expected to be required to file taxes for the taxable year for which coverage is requested?” The operative word is “required”. The dependent not only plans to file taxes, but is required to file taxes.

The requirement to file taxes falls on the definitions and conditions outlined by the IRS. From page 9 of the instructions for form 1040 for 2017, single dependents must file taxes if they had unearned income of $1,050, earned income of $6,350, or the gross income was the larger of $1,050 or earned income (up to $6,000) plus $350. The income that is required to be reported on a federal income tax return is the amount added to the household income for the determination of MAGI Medi-Cal or Covered California.

Advance Premium Tax Credit Subsidy

From the instructions for form 8962 Premium Tax Credit reconciliation for 2017 the definition of Household income,

For the purposes of the Premium Tax Credit (PTC), household income is the modified adjusted gross income of you and your spouse, …, plus the modified adjusted gross income of each individual whom you claim as a dependent and who is required to file an income tax return because his or her income meets the income tax return filing threshold. Household income does not include the modified AGI of those individuals whom you claim as dependents and who are filing a 2017 return only to claim a refund of withheld income tax or estimated tax.

The issue surrounding whether you can take your child as a dependent is filtered though many IRS conditions. Review the instructions for line 6c of the 2017 Form 1040 for more guidance. Even the flow charts were developed by Medi-Cal, the also apply to Covered California eligibility determinations for the monthly premium tax credit subsidy. The most difficult aspect is that you are estimating your income and that of your child for the next year. Just because you include your child as dependent on in your household, things can change in the middle of the year.

When your son or daughter gets a job, and it looks like they will be required to file taxes, reach out to your agent, Medi-Cal (if you enrolled), or Covered California with assistance. It can be easier to adjust incomes and households in the middle of the year instead of waiting until you have to file your taxes.

Top Frequently Asked Questions for Filing Requirements, Status, Dependents, Exemptions

https://www.irs.gov/faqs/filing-requirements-status-dependents-exemptions

Household size flow chart https://www.dhcs.ca.gov/services/medi-cal/eligibility/Documents/Co-OPS-Sup/MAGIHouseholdSizeFlowChart.pdf

Whose Income Counts? https://www.dhcs.ca.gov/services/medi-cal/eligibility/Documents/Co-OPS-Sup/Whose_Income_Counts_Flowchart.pdf

Medi-Cal Supplement Income Verification https://www.dhcs.ca.gov/services/medi-cal/eligibility/Documents/ACWDL/2018/18-21.pdf

MAGI Household Size Flow Chart

Medi-Cal MAGI Household Size Flow Chart

Income Sources MAGI Medi_Cal_Whose_Income_Counts_Flowchart

Does your child's income count for Medi-Cal or Covered California eligibility?