One of the confounding issues with the Covered California application is the income section relative to MAGI Medi-Cal eligibility. Medi-Cal is updating the income calculation for eligibility and these changes will be integrated into the Covered California application in 2021. The changes should help some families with fluctuating income – and who are not really eligible or Medi-Cal – avoid time-consuming phone calls to Medi-Cal to properly characterize their household income.

Covered California screens applicants for their eligibility for the health insurance subsidies and if any of the household members are eligible for MAGI Medi-Cal based on income. In general, the business rules engine of the Covered California online application (CalHEERS) compares the monthly income of an applicant against the latest federal poverty level income. If the monthly income is below 138 percent for adults (266 percent for dependents 18 years old and younger), a MAGI Medi-Cal eligibility determination is returned.

Income for MAGI Medi-Cal and Covered California

Covered California and Medi-Cal are governed by different sets of rules regarding eligibility. While there is significant overlap, there are enough differences that lead to MAGI Medi-Cal eligibility, leaving the applicant wondering what they did wrong. Medi-Cal is a very big and complicated government program. The Medi-Cal system screens for a variety of different programs such as conditional Medi-Cal, Access Program for pregnant women, Access Infant Program, County Children’s Health Initiative, CalFresh, etc. Some Medi-Cal programs use gross income, while Covered California uses Modified Adjusted Gross Income.

The Department of Health Care Services (DHCS), the agency that manages the county based Medi-Cal system, has worked, and struggled, to efficiently determine MAGI Medi-Cal eligibility from the income section of the Covered California application. In a February 19, 2021, All County Welfare Directors letter, No. 21-04, DHCS outlined some of the changes to Modified Adjusted Gross Income (MAGI) calculations for MAGI Medi-Cal eligibility determinations.

Greater emphasis will be placed on annual income budget periods verses a current monthly income period. Below are some highlights from the ACWD letter No. 21-04. The full letter is available for downloading at the end of the post.

All County Welfare Directors Letter No.: 21-04

IV. Income Budget Periods

Budget periods offer different ways to utilize reported income over certain time periods. They can affect what income and over what period of time the income is counted, which may reduce some income for a specified period of time. Budget periods also help reduce excessive movement by Medi-Cal beneficiaries to ineligibility or between other IAPs, such as Covered California.

When the ACA was enacted, the Center for Medicare and Medicaid Services (CMS) allowed states to select three different budget periods to base MAGI Medi-Cal eligibility. California elected to use all three budget period methodologies. The methodologies are as follows:

- Current Monthly Income (CMI);

- Reasonably Projected Annual Income (RPAI); and

- Projected Annual Income (PAI)- beneficiaries only

The California Healthcare Eligibility, Enrollment, and Retention System (CalHEERS) will have enhanced functionality with Change Request (CR) 151332 that will be released in the future to properly apply each of the budget periods.

Note: Until CalHEERS is updated to include this functionality, counties are to continue processing cases using existing county processes where PAI and RPAI are merged into one budget period due to system functionality.

The amount of an applicant/beneficiary’s income for MAGI Medi-Cal is determined based on the budget period with the lowest income calculation between CMI and RPAI. The CEW shall only use the budget period of PAI when the beneficiary is not eligible using the other budget periods and the PAI is within the MAGI Medi-Cal Federal Poverty Level (FPL) threshold.

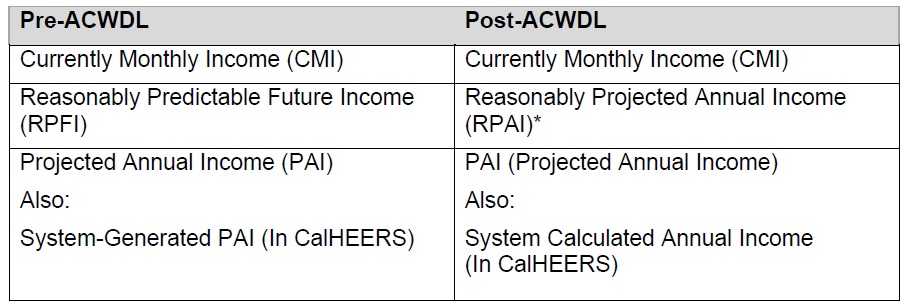

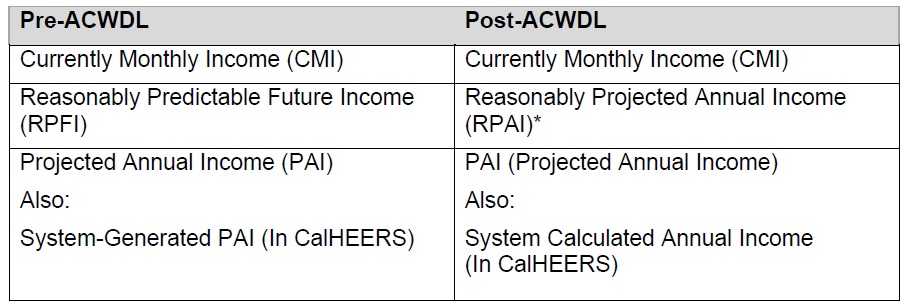

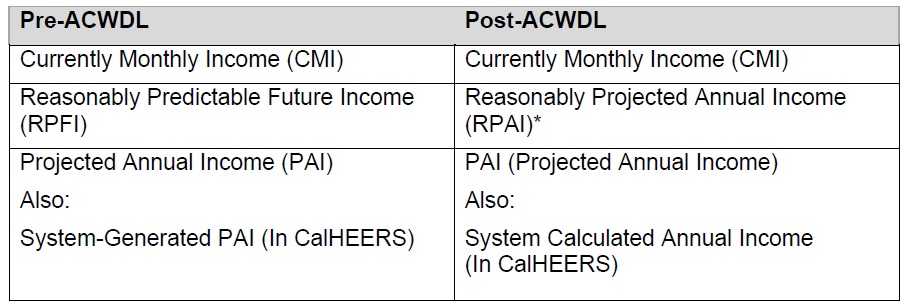

In order to align Covered California and Medi-Cal policies, CalHEERS may use different terminology in the online application when referring to budget periods. CalHEERS refers to PAI as System Calculated Annual Income (SCAI) (see chart below). Additionally, DHCS previously referred to RPAI as Reasonably Predictable Future Income (RPFI). Counties are to use the new RPAI terminology with the release of this letter.

*Note: This is MAGI Medi-Cal specific terminology. Due to policy differences, Covered CA will continue to reference the MAGI Medi-Cal RPAI as PAI.

Current Monthly Income (CMI)

CMI is the amount of income an applicant or beneficiary expects to receive in the month under evaluation for eligibility. The CEW shall use CMI for the MAGI Medi-Cal eligibility determination when:

- An applicant or beneficiary does not provide income information for a different budget period to be applied at application, annual renewal, or reported changes in circumstance; or

- CMI is the budget period with the lowest income amount.

Author note: This is the current methodology in use at Covered California. In the month you apply, if your income is in the range for MAGI Medi-Cal, you are determined eligible for the program, even if your income the next month is above the threshold for MAGI Medi-Cal eligibility.

Reasonably Projected Annual Income (RPAI)

RPAI is the total amount of income that an applicant or beneficiary expects to receive in a twelve-month period, starting at the month of application, annual renewal, or reported change in circumstance. The RPAI budget period promotes continued coverage to those who would otherwise not qualify for MAGI Medi-Cal because of their fluctuating income.

CEWs (County Eligibility Worker) shall only use RPAI for applicants or beneficiaries whose income fluctuates (refer to ACWDL 15-06). Income from past months cannot be included in the calculation for RPAI, however historic income information can be used to reasonably predict future income. For example, if a beneficiary works seasonally every year from May through September and receives unemployment from October through April, and the beneficiary does not expect there to be any changes, then the CEW can reasonably predict their future income because of past months income information.

To calculate the monthly RPAI, the CEW shall divide the provided RPAI amount by twelve. The CEW shall then compare the applicant or beneficiary’s CMI amount to the RPAI amount and use whichever budget period has the lowest monthly income amount.

Note: CalHEERS and SAWS already have functionality for RPAI labeled as ‘overridden projected annual income’ in CalHEERS and PAI in SAWS. However, this title may be updated during a future systems enhancement.

Projected Annual Income (PAI)

PAI is a budget period for beneficiaries whose income increases during the calendar year and puts their CMI over the MAGI income limit, but their calendar year income would allow them to be under the MAGI income limit. PAI shall not be used for individuals whose income will fluctuate. PAI is intended to help beneficiaries maintain the same health coverage under MAGI Medi-Cal until a new health benefit year begins and they can transition to a Covered California program. The county shall only use PAI when the beneficiary is ineligible to Medi-Cal for both the CMI and RPAI (when appropriate) budget periods. Currently RPAI and PAI are treated as one combined budget period in CalHEERS. Counties may continue existing processes until the implementation and release of CR 151332 to separate the functionality of RPAI and PAI. SAWS and CalHEERS will issue additional guidance to counties regarding the functionality of the budget periods once CR 151332 is implemented.

Author note: On a regular basis I receive frantic and distressed phone calls from individuals who realized they forgot to report an income increase to their county Medi-Cal office. They are afraid they have been earning too much for Medi-Cal. The PAI budget period illustrates that your income can increase, but not necessarily make you ineligible for MAGI Medi-Cal. Never assume you do or do not qualify for MAGI Medi-Cal, even in previous years.

Covered California Income Section

The outlined budget periods for MAGI Medi-Cal and their inclusion on the Covered California application occurred before Covered California was inundated with updating the CalHEERS online application system to reflect the numerous subsidy calculation changes from the American Rescue Plan. This will delay implementation of any changes to the income section outlined in the ACWD letter. The ACWD letter is very informative and gives many examples of calculating the household income with the different income budge period scenarios. It also illustrates how complicated Medi-Cal eligibility determination can be.