Covered California and Medi-Cal answering questions on how to assist consumers with their eligibility status.

Covered California has published a nice little document discussing how agents and certified enrollment counselors can provide assistance to consumers with Medi-Cal eligibility. The document Assisting Medi-Cal Eligible Consumers FAQ Certified Enrollers also defines some of the terms that are displayed in eligibility determinations. The document address several frequently asked questions from agents, and consumers, who are new to Medi-Cal and how it operates. Covered California answers are in italics.

Medi-Cal Eligibility Status In Covered California

How do I help consumers that are determined pending eligible, conditionally eligible or eligible for Medi-Cal at initial application?

For consumers determined pending eligible, conditionally eligible, or eligible for Medi-Cal please allow for five business days before contacting the county.

Eligible Determination:

Consumers with an eligible determination status will be automatically enrolled in Med-Cal. Inform consumers determined eligible for Medi-Cal that they can expect to receive a Welcome to Medi-Cal packet within 10 days that may include a Benefits Identification Card (BIC), sometimes referred to as a “Medi-Cal” or “BIC” Card. Consumers can also immediately access services as soon as they are determined eligible.

The BIC comes from the Department of Health Care Services. Each county actually handles the final eligibility determination and enrollment in a Medi-Cal HMO plan. Some counties have multiple plans to select from while other may only have one plan. The plans are county specific so if a consumer moves to another county, they need to have their Medi-Cal case transferred to the new county of residence and enrollment in one of those plans.

Conditionally Eligible Determination:

Consumers with a conditionally eligible determination will be enrolled in Medi-Cal. Inform consumers determined conditionally eligible for Medi-Cal that they can expect to receive a notice from their local county social services office requesting additional information. Consumers may contact their local county social services office to expedite a Medi-Cal application.

Conditionally eligible is usually due to discrepancies with the reported citizenship or immigration status, or the social security number provided or not provided. If the consumer fails to provide the necessary information they may be completely denied and in some instances moved to a restricted scope Medi-Cal program.

Pending Eligible Determination:

A pending eligible determination indicates potential discrepancies (such as income limits, current incarceration, or deceased) that may delay coverage. Consumers with a pending eligible determination will not be enrolled in Medi-Cal, but will be contacted by the local county social services office to resolve the eligibility result.

Once the consumer provides the required information, the county will determine the correct eligibility. If the consumer fails to provide information, they will be denied Medi-Cal coverage.

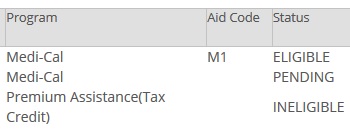

The eligibility status is found in the consumer’s account by going to View Past Application then to the link Program Eligibility by Person.

On the Covered California Eligibility by Person page it will show if the household member is Medi-Cal eligible and the status.

What happens when a current Covered California consumer becomes newly Medi-Cal eligible?

Consumers will be placed in pending eligible status for Medi-Cal and will be placed in a Carry Forward Status (CFS) while their case is being reviewed by a county eligibility worker. The CFS will maintain their Covered California plan selection and any APTC eligibility during this review period. Consumers should continue to pay their premiums to ensure there is no gap in coverage. Covered California will send a notice of CFS to the consumer and the consumer will need to keep a look out for letters from the county, as the county may need additional information to complete the determination. Once the consumer’s final eligibility determination has been made by the county, the county eligibility worker will lift the CFS and either Medi-Cal eligibility will begin or the APTC eligibility will be updated.

The Carry Forward Status can be accidently triggered when there is an inaccurate change to the consumer’s income. An income source may have been deleted when attempting to change other income sources or amounts. The loss of the income entry may drop the consumer or the dependents into the Medi-Cal range. Usually a consumer or agent can correct the income amount and the consumer won’t be enrolled in Medi-Cal before the CFS ends.

Agent Assistance With Medi-Cal

Agent Assistance With Medi-Cal

Can an agent obtain information about or make changes to a consumer’s Medi-Cal application or case?

Yes, Certified Enrollers may obtain information or make changes to a consumer’s Medi-Cal case by contacting the local county social services office. However the Certified Enroller must be designated as an Authorized Representative (AR) directly with the local county social services office.

To become an AR for Medi-Cal cases, complete an AR form such as the (MC 306) and submit it to the local county social services office. The consumer must provide their consent to the county office. The AR appointment is effective until the applicant/beneficiary cancels or modifies the AR appointment.

How do agents make changes or updates to Medi-Cal or Mixed Household cases?

Generally, the county social services office is responsible for Medi-Cal and mixed household case management.

It’s important to note that Covered California Service Center Representatives and Certified Enrollers will not make changes to cases with individuals that are Medi-Cal eligible, including Mixed Households. Please note if Certified Enrollers do make changes to a consumer’s application the changes will not be accepted by the county and the application will revert back to what was previously entered.

There are a variety of reasons why agents just can’t make a change to the consumer’s Covered California account if the individual or the dependents are Medi-Cal eligible. There are many different programs under the Medi-Cal umbrella in addition to MAGI Medi-Cal. Some families may be entitled to a different form of Medi-Cal or program within Medi-Cal. The Medi-Cal case workers are trained to screen for all the different program eligibilities. Caution is exercised not to terminate a person from Medi-Cal, and potentially leave them with no coverage, if the person may be eligible for another program.

How do agents help consumers Renew their Medi-Cal coverage?

Medi-Cal coverage is renewed annually. There is no specific renewal season, this means that Medi-Cal can renew cases all year long. Medi-Cal will attempt to electronically verify a consumer’s information prior to sending a packet or forms. If all information is verified electronically, the consumer will not get a renewal packet. If additional verification is needed once the electronic verification is made, the consumer will receive a form or packet from the county about their renewal. It is important that the consumer provides the Information requested by the date indicated on the notice.

If the consumer gets a form or packet from the county about their renewal, it is important that they provide the information requested by the date indicated in the notice. Agents and Certified Enrollment Counselors (CECs) should be aware that prior to sending a form or packet requesting information, the county will attempt to verify information electronically. If the electronic verification is successful, the consumer will not be asked to provide any additional information, so not all consumers will get a renewal packet. However, they will receive a Notice of Action (NOA) from the county with the final eligibility determination.

While consumers, Agents, and CECs are able to report changes through the Covered California account, they should follow-up directly with their county eligibility worker to verify that the changes reported in the online application were processed. If the consumer is having trouble reporting changes, it’s important that they contact the county directly and let them know of these changes. If the Agent or CEC is an Authorized Representative with the county, they should contact the local county social services office.

In most cases, the agent or the consumer can upload requested documents into the consumer’s Covered California account to be reviewed by the county Medi-Cal case worker. Individuals and families can also create online accounts specific to each county and report changes that way as well.

Your Benefits Now is only for Los Angeles County residents

MyBenefits CalWin is used by Alameda, Contra Costa, Fresno, Orange, Placer, Sacramento, San Diego, San Francisco, San Luis San Mateo, Santa Barbara, Santa Clara, Santa Cruz, Solano, Sonoma, Tulare, Ventura, and Yolo counties. https://www.mybenefitscalwin.org/

C4Yourself is used by Alpine, Amador, Butte, Calaveras, Colusa, Del Norte, El Dorado, Glenn, Humboldt, Imperial, Inyo, Kern, Kings, Lake, Lassen, Madera, Marin, Mariposa, Mendocino, Merced, Modoc, Mono, Monterey, Napa, Nevada, Plumas, Riverside, San Benito, San Bernardino, San Joaquin, Shasta, Sierra, Siskiyou, Sutter, Tehama, Trinity, Tuolumne, and Yuba.

The Soft Pause Of Covered California

What is Soft Pause and how does an agent identify when an application is in Soft Pause?

When there is a report of change in a MAGI Medi-Cal eligible household that changes a member of the household’s eligibility from Medi-Cal to Covered California, a consumer’s case may be placed in Soft Pause. Department of Health Care Services regulations require this review to protect certain consumers who have been identified as Medi-Cal eligible, and when changes are reported that affect the consumer’s eligibility.

Soft Pause is applied to households with:

- Children

- Pregnant women

- Parents/Caretaker relatives

- Individuals aged 65 and older

- Individuals that are blind or disabled

Soft Pause is intended to review eligibility for Non-MAGI Medi-Cal programs.

When a case is in Soft Pause, the consumer’s eligibility in CalHEERS will continue to reflect Medi-Cal eligible despite changes made in CalHEERS. The Agent or CEC assisting the consumer, nor the consumer, will not be able to complete Covered California plan selection until the review is complete and the Covered California plan selection functionality is enabled by the County Eligibility Worker. The consumer, or their Medi-Cal Authorized Representative can contact the county and request the completion of eligibility updates and Soft Pause review.

In other words, as long as an individual on the Covered California application is in Soft Pause mode they will not be offered the opportunity to enroll in a Covered California with the tax credit subsidy.

How does an agent complete a Covered California plan selection on a Mixed Household if the case is being reviewed by the county?

Consumers or their Medi-Cal Authorized Representatives must contact the County Eligibility Worker and request the completion of eligibility updates and Soft Pause review to allow plan selection functionality to be restored for Covered CA eligible individuals on the case.

What about the phrases “release my application from the county” or “remove soft pause?”

Previously, the phrases “release my application” or “remove soft pause” were used to request completion of county updates. However, these are inaccurate, and should not be used. The term “soft pause” is a technical phrase, and refers to a multi-step process of evaluating eligibility for Non-MAGI Medi-Cal. A Covered California plan cannot be selected for the individuals in Soft Pause until the Soft Pause review is completed.

The best way to request action from the county is to ask for eligibility updates to be completed. If a consumer is certain that they do not want to be evaluated for Non-MAGI Medi-Cal, they can communicate that request to the County Eligibility Worker.

How can an agent assist a consumer transitioning from Medi-Cal to Covered California?

The county will send a Notice of Action (NOA) no less than 10 days before the last day of Medi-Cal coverage. In addition, Covered California will send a notice (NOD01) indicating they qualify for Covered California and need to select a plan by the end of the month and pay the premium by the due date in order for coverage to begin. If the consumer has not yet selected an APTC plan and paid their premium, it is important that they do so as soon as possible in order to avoid a gap in coverage.

Loss of Medi-Cal is considered the same as loss of Minimum of Essential Coverage (MEC). Agents and CECs can use this loss of coverage as a Qualifying Life Event (QLE) for the Special Enrollment Period (SEP).

When an individual or family is released from Medi-Cal eligibility the switch is flipped inside Covered California to let them enroll in a plan. The Medi-Cal termination will note the last day of coverage at the end of the month. The consumer has until that last day of the month to select a plan. If they don’t, they will have at least one month without coverage.

SAWS:

SAWS is the Statewide Automated Welfare System that is used by the counties to determine Medi-Cal program eligibility in California. This system supports the eligibility and benefit determination, enrollment, and case maintenance functions at the county level for the state’s major health and human services programs, including Medi-Cal.

The Covered California enrollment system, also known as CalHEERS, works in conjunction with SAWS to transmit enrollment and eligibility information. When a consumer is determined eligible for Medi-Cal in CalHEERS, the determination is sent to the county and stored in SAWS. The county will use this information to complete Medi-Cal enrollment in SAWS. Conversely, when a consumer is determined eligible for Covered California by the county, the eligibility information is transmitted to CalHEERS.

Caution! There are known data miss-match issues between SAWS and Covered California CalHEERS software. When a consumer is released from Medi-Cal it is necessary to scrub the application and look for missing or inaccurate data and conditions. The missing data could prevent the individual or family from getting the subsidy. It could be as simple as the application no longer indicating that the consumer will file taxes. This is simply fixed by checking Yes, the consumer will file taxes. Both Covered California and Medi-Cal are working to resolve this issue.

Mixed Household:

Mixed households have at least one member eligible for a Covered California Health Plan with Premium Assistance (Advanced Premium Tax Credit or APTC) and at least one member eligible for Medi-Cal (MAGI and/or non-MAGI).

Medi-Cal Managed Care Plan:

A Medi-Cal Managed Care Plan contracts with specific doctors, clinics, specialists, pharmacies, and hospitals. These providers make up the health plan’s “network.” Some eligible consumers may be automatically enrolled into a Medi-Cal Managed Care Plan if they reside in a County Organized Health System (COHS.) A COHS is a local agency created by a county board of supervisors to contract with the Medi-Cal program.

Information about the plans available in each county can be found at: http://www.dhcs.ca.gov/individuals/Pages/MMCDHealthPlanDir.aspx. For questions about enrollment into Medi-Cal Managed Care plans, please contact Health Care Options at (800) 430-4263.

For questions about Medi-Cal eligibility, contact the local county social services office, and for questions about Medi-Cal Managed Care Plan expedited enrollments, contact the Medi-Cal Managed Care Office of the Ombudsman at (888) 452-8609.