The Department of Health Care Services (DHCS) has released the 2020 federal poverty level income guidelines for eligibility into the different Medi-Cal health insurance programs in California. The income levels are higher than those published by Covered California in September of 2019 during the 2020 open enrollment period. The information presented comes from the All County Welfare Directors Letter No.: 20-13.

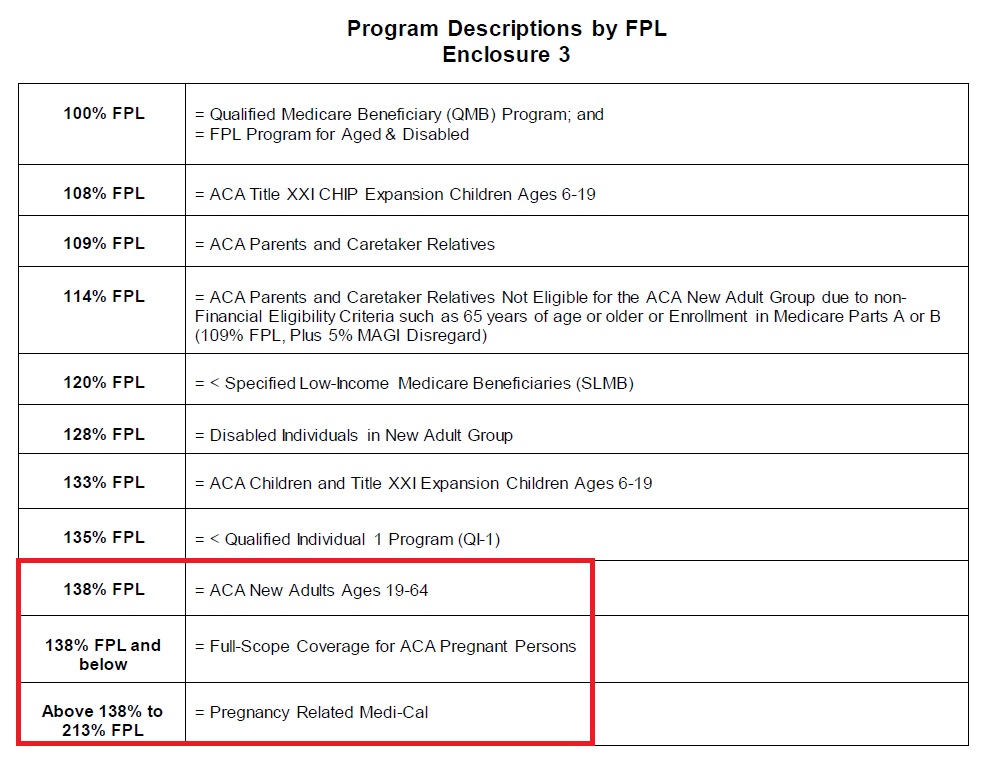

There are a variety of Medi-Cal programs for individuals and families in different situations from low income, blind, disabled, caretakers, Medicare, and MAGI Medi-Cal associated with Covered California. Each of the different programs may have different income eligibility requirements as a percentage of the federal poverty level (FPL) based on household size. Many of the categories are considered conditional and have asset requirements in addition to income limits.

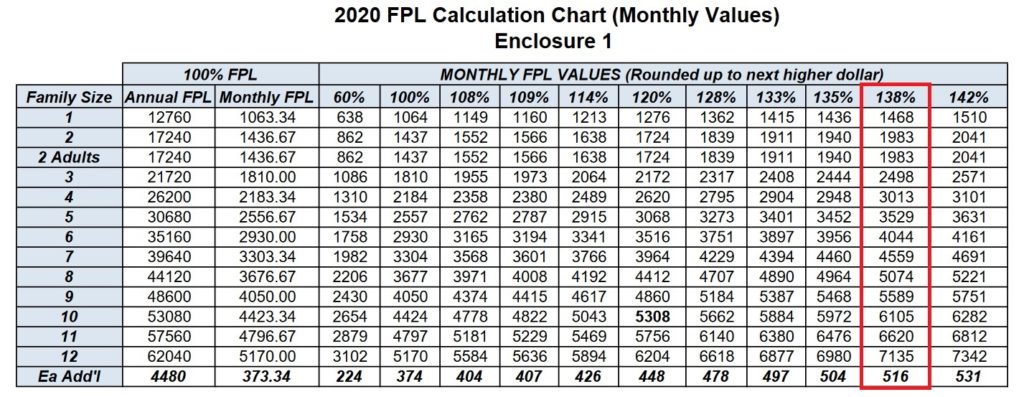

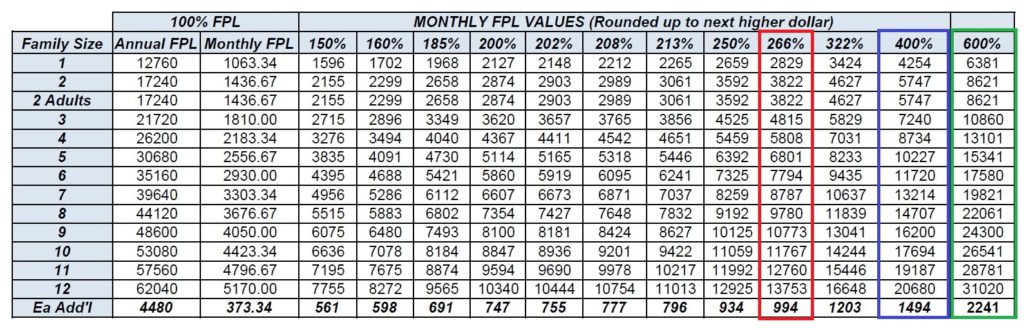

MAGI Medi-Cal is California’s Medicaid expansion for adults and children under the Affordable Care Act and is based solely on income, assets are not counted. (Learn more about MAGI Medi-Cal.) Usually, the monthly income of the household is the primary factor for determining Medi-Cal eligibility, but there can be some latitude for households with fluctuating incomes. However, monthly incomes under 138% of the FPL make adults ages 19 – 64 eligible for Medi-Cal. Dependents, ages 18 and younger, are eligible for Medi-Cal if the household income is below 266% of the FPL.

New Medi-Cal Income Levels Higher Than Covered California

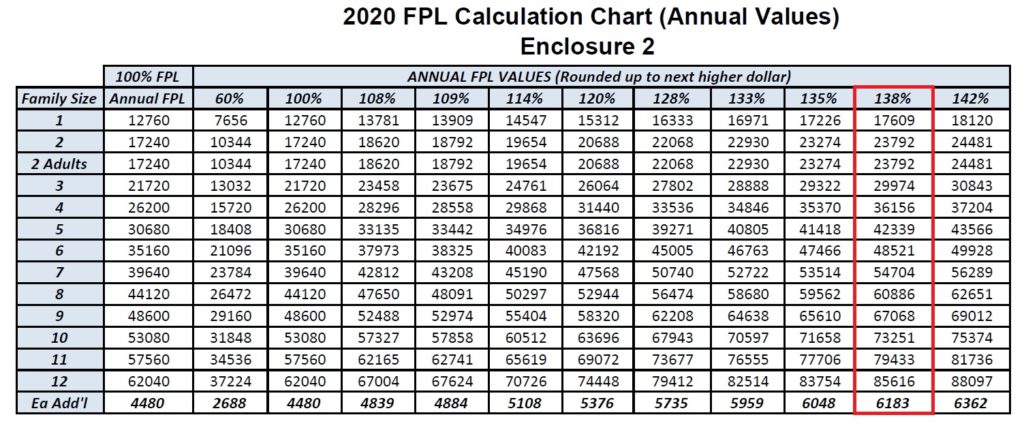

What is interesting is that these 2020 FPL income levels are higher than what Covered California posted in their program eligibility income chart at the start of the 2020 open enrollment period. Covered California listed the single adult Medi-Cal annual income level, 138% of FPL, at $17,237 and for a two-adult household at $23,226. The DHCS 2020 FPL income chart lists a higher amount of $17,609 for a single adult and $23,792 for two adults.

Please note: DHCS is coordinating implementation of the 2020 FPLs in the California Healthcare Eligibility Enrollment and Retention System (CalHEERS) and Statewide Automated Welfare System (SAWS). DHCS anticipates the CalHEERS system and SAWS system will be updated with the annual 2020 FPL amounts in March of 2020.

AWDL 20-13

These slightly higher eligibility income amounts mean that more individuals and children will have access to no cost MAGI Medi-Cal. Of course, for some households right on the edge of MAGI Medi-Cal eligibility, who have a Covered California health plan with the subsidies, under certain circumstances, may be re-determined eligible for MAGI Medi-Cal without any change to their estimated 2020 income.

- Red: 138% adults MAGI Medi-Cal

- Red: 266%: children MAGI Medi-Cal

- Blue: 400% maximum income for federal premium tax credit subsidy

- Green: 600% maximum income for California premium tax credit subsidy

The All County Welfare Directors letter made the following notes regarding individuals who receive the tax credit subsidies through Covered California also known as Advance Premium Tax Credits.

- APTC eligible individuals who are redetermined eligible for Medi-Cal using the 2020 FPLs may be eligible for retroactive Medi-Cal. The county shall only retroactively change eligibility for APTC individuals who did not enroll in a Qualified Health Plan (QHP), did not pay a premium, or who did enroll in a QHP and pay a premium but have Medi-Cal covered medical or dental expenses that were not covered by their QHP during the retroactive period.

- APTC eligible individuals, described above, may be eligible for retroactive Medi-Cal out-of-pocket expense reimbursements (Conlan). Please see Medi-Cal Eligibility Division Information Letter (MEDIL) I 07-02 for additional information about the Conlan process.

One question I have fielded is if an individual or household is determined eligible for Medi-Cal retroactively, when they had private health insurance they were paying for, can they get a refund for those health insurance premiums. The answer seems to be no-

- Note: The Centers for Medicare and Medicaid Services has decided that there will be no reimbursement for premiums paid to Covered California QHPs. The notice sent by DHCS will state that no premium Covered California QHP premium reimbursements will be available. Please see ACWDL 16-08 for instructions on determining retroactive Medi-Cal coverage when an individual is transitioning from Covered California coverage.

However, this may not be the case for children who are determined eligible for Medi-Cal retroactively.

Optional Targeted Low-Income Children’s Program (OTLICP) eligible children

- OTLICP children who are redetermined eligible for free, non-premium OTLICP using the 2020 FPLs may be eligible for premium reimbursements. Please refer to ACWDL 14-43 for guidance on OTLICP premium reimbursements for premiums paid during any months retroactively redetermined eligible for non-premium OTLICP. Below are the 2020 FPL charts for monthly income

Monthly 2020 federal poverty level income chart Medi-Cal

Medi-Cal FPL Income Chart 2020

2020 federal poverty level income chart for Medi-Cal program eligibility.