The California Department of Health Care Services (DHCS) have a released a document on the variety of changes occurring to Medi-Cal programs beginning in 2026. Some of the changes to eligibility and enrollment are drastic, while other changes will not be implemented until 2028.

DHCS believes that most Medi-Cal members will not see any changes to coverage. Certainly, the most affected group will be low income adults with no children in the MAGI Medi-Cal.

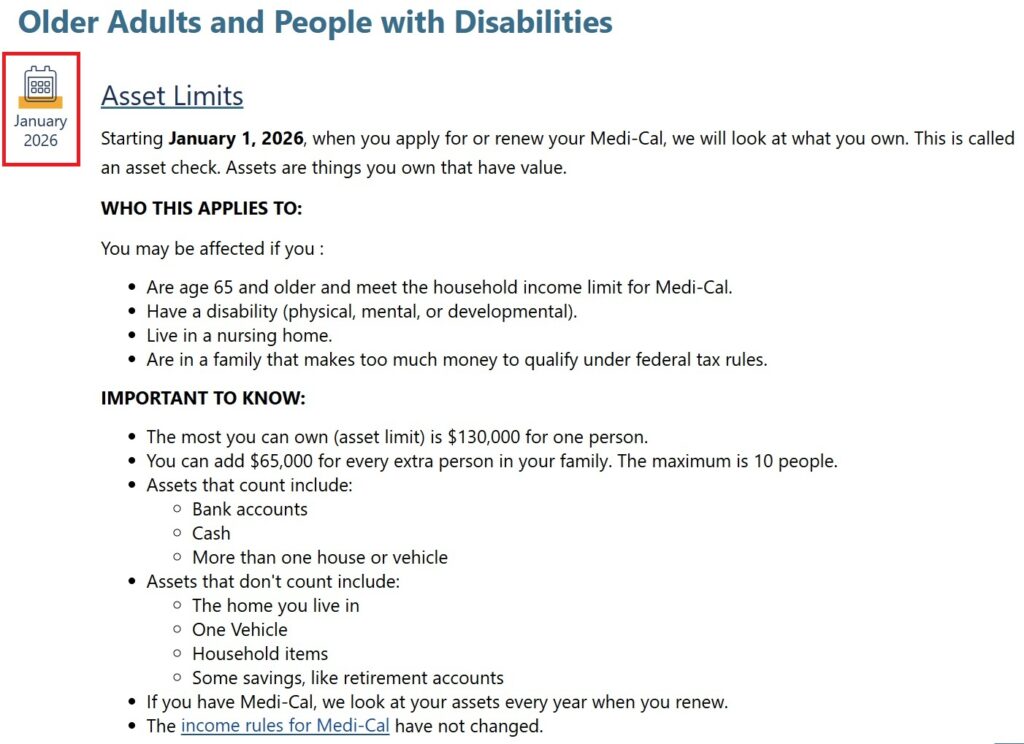

Asset Limits

A big change for Medicare beneficiaries and individuals in skilled nursing facilities will be the return of the asset test. Individuals will be limited to $130,000 in assets in order to be eligible for certain Medi-Cal programs. This will directly affect many people who have both Medicare and Medi-Cal. The asset test goes into effect in January 2026. (See Medi-Cal Asset Back for 2026)

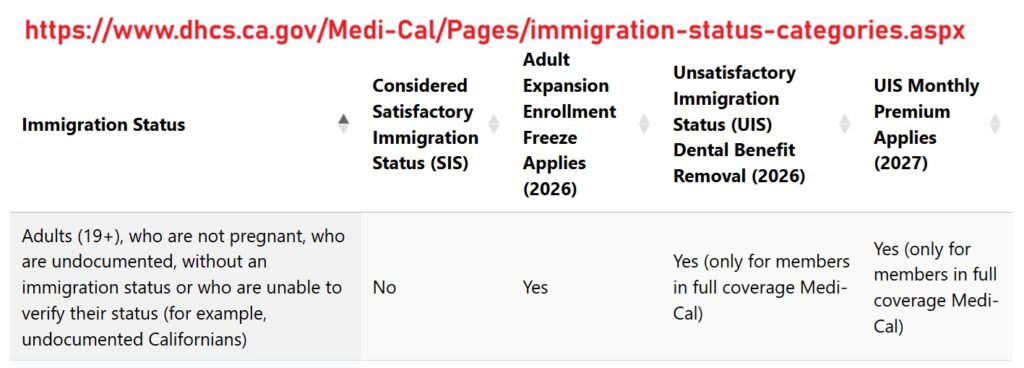

Adult Immigrants

Expanded adult Medi-Cal coverage for undocumented immigrants will be frozen. There will be no new enrollments beginning January 2026. Existing enrollees can keep their coverage as long as they continue to return the renewal forms.

Dental Coverage

Dental Coverage for adults in Medi-Cal will be paired back in July 2026. There will be no more coverage for routine dental services. There will be coverage for adults in Medi-Cal who have urgent of emergency situations such as severe tooth pain, extraction, infection, or are pregnant.

Medi-Cal Health Plan Premiums

Beginning in July 2027, adults in MAGI Medi-Cal will have to make a small premium payment to keep Full-Scope Medi-Cal. If an adult does not pay the premium, but are still eligible for Medi-Cal, they will still have coverage for emergency services, pregnancy related services, and nursing home care.

Work Requirements

The work requirements will go into effect January 2027. Individuals will need to show employment, volunteer services, attendence in school for 80 hours per month to keep Medi-Cal. There are many exemptions to the work requirement rules.

- Children 18 years old and younger

- Over 65 years of age

- Enrolled in Medicare parts A and B

- Parents with children under 13 years of age

- People who are disabled or have serious health conditions

- American Indians and Alaska Natives

- Foster youth or former foster youth under age 26

Covered California

If an individual is terminated from Medi-Cal because they failed to verify the work requirement, they are ineligible for the Advance Premium Tax Credit (APTC). The APTC is the subsidy through Covered California that reduces the monthly premiums of a private health plan.

Six Month Check-Ins

Beginning in January 2027, adult, under 65, Medi-Cal beneficiaries will have to check-in with their county Medi-Cal office to maintain eligibility and enrollment. The check-in will affirm the individual has met the work requirements and supply documentation to satisfy the eligibility requirements.

Shorter Look Back Period

The look back period for Medi-Cal to cover health care expenses will be reduced from 90 days down to either 60 or days.

Copayment

Adult Medi-Cal members under 65 and without Medicare will have to make copayments for health care services. The copayments will not apply in some health care facilities like rural health clinics. In addition, there will be no copayment for emergency services, pregancy related services, mental health and substance use disorders. The total dollar amount for all copayments cannot be greater than 5 percent of the person’s household income. The copayment fees will begin in October 2028.

YouTube video on the Medi-Cal Changes