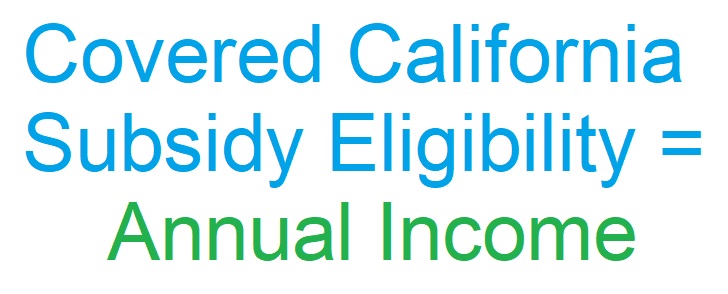

Household income is viewed differently depending on whether the government agency is Medi-Cal or Covered California. Income you report to Covered California for the purposes of receiving the health insurance subsidy may be dismissed by Medi-Cal. The confusion or contradiction regarding legitimate household income is rooted in different rules and human intelligence.

Covered California income for the Advance Premium Tax Credit (APTC) subsidies revolves around IRS definitions of taxable income. The goal of the Covered California system is to advance a health insurance subsidy that correlates to the household’s estimated Modified Adjusted Gross Income. The subsidy must be reconciled on the federal tax return of the primary tax filer in the household.

Covered California Annual Income vs. Medi-Cal Monthly Income

If Covered California advances too much subsidy during the year to reduce the health insurance premiums, the primary tax filer will have to repay the excess subsidy. This repayment would occur if the household underestimates their income on the Covered California application. Conversely, if the household overestimates their income, they will get an additional Premium Tax Credit subsidy when they file their tax return, but that does not help in lowering the health insurance premiums during the year.

Regardless of an overestimate or underestimate, Covered California is focused on taxable income. (The Modified Adjusted Gross Income also includes Social Security retirement and disability income, tax exempt interest, and foreign earned income which may not be taxable.) Covered California does not care how the taxable income is generated. The IRS does not care how the taxable income was received. All that matters is the final annual MAGI.

When you do your taxes, if your taxable income is higher than you estimated on the Covered California application, you must repay some or all of the excess Premium Tax Credit subsidy. Neither Covered California nor the IRS care if you actually possess the income in something like a checking or savings account or you received on a monthly basis or annual distribution. All that matters is the final taxable income amount plus nontaxable Social Security, tax exempt interest, and foreign earned income.

Medi-Cal looks at income differently. Under Medicaid rules for determining eligibility for Medi-Cal health care programs, the default is to calculate monthly household income. Medi-Cal wants to know how much the household receives primarily from wages from a job. County eligibility workers reviewing household income for Medi-Cal eligibility are not focused on annual taxable income. Their task is to verify monthly income amounts.

This is where Medi-Cal and Covered California differ greatly. It is also the pain point when families suddenly find themselves having to deal with Medi-Cal. Households can be reviewed for Medi-Cal eligibility if their income falls below 138 percent of the federal poverty level (FPL) or 266 percent FPL if there are dependents under 19 years of age in the household. This has happened to many families during the Open Enrollment period when Covered California passively renewed their applications for the next year.

Taxable Annual Income Not Accepted By Medi-Cal

At the time of the passive renewal, Covered California compared the existing household income estimate to the new and higher federal poverty income levels. Many families found either the adults or children were referred to Medi-Cal because their income was – at the time of the renewal for the next year – too low for subsidies, but just right for Medi-Cal. Once a possible Medi-Cal eligibility is detected, Covered California sends the household case over to the respective county Medi-Cal office for review.

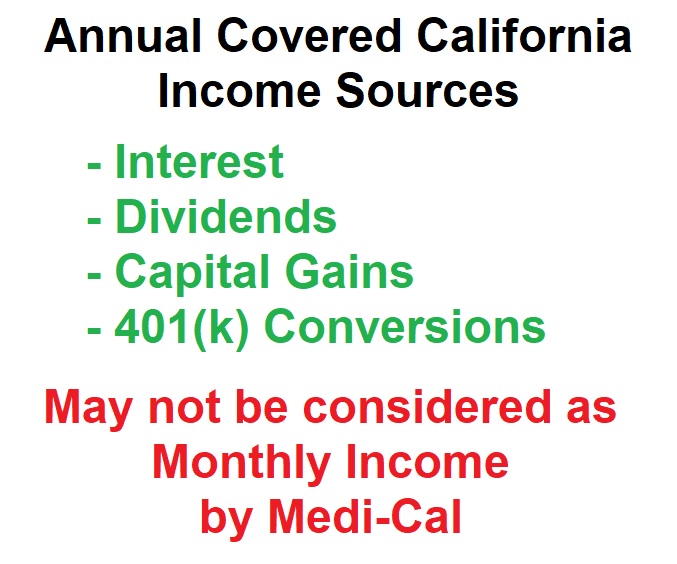

The next problem families face is of a human nature. Whereas Medi-Cal uses essentially the same list of countable sources of income, some of the county eligibility workers don’t understand the nature of the income. For example, a household may have listed interest and dividends they receive as taxable income. However, the interest and income can be distributed at the end of the calendar. There is no proof that the interest and dividends are monthly income.

Capital gains can be a foreign concept to eligibility workers. A tax payer can experience capital gains income streams from selling assets like property or stocks. If the capital gain is generated within a mutual fund and the owner just has the gain reinvested, a very real taxable event occurs, but no proof of monthly income.

There are many people who slowly convert money in a 401(k) into Roth IRA. Each conversion triggers a taxable event. There is no specific monthly income transferred into the owner’s bank account. Interest, dividend, capital gains, and retirement fund conversions must be captured in the Covered California application. If they are not, the consumer has underestimated their income and will need to repay excess subsidies back to the IRS.

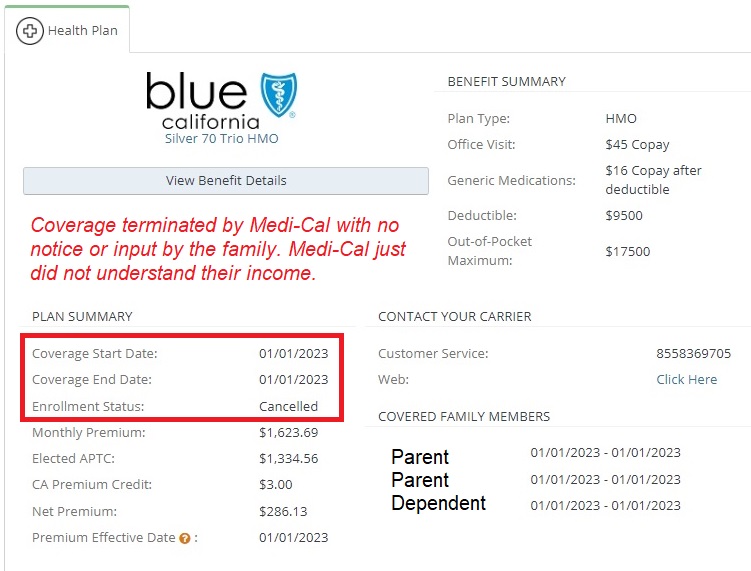

Medi-Cal Cancellation of Health Insurance With No Warning

Because Medi-Cal workers don’t understand or comprehend some of these sources of income, they terminate the Covered California enrollments of adults and children. This creates chaos for these families. An unknown, uninvited, and unauthorized individual accesses a Covered California application and makes an uneducated determination of the household’s income. Then this same elusive individual terminates coverage for individuals and families, some of them undergoing health care treatment with specific providers not in any Medi-Cal HMO network.

How the household income is characterized on the Covered California application can also be confusing for Medi-Cal eligibility workers. Many Covered California applicants will just aggregate all of the household income in one entry. For example, a household with 2 working adults may just list one entry for their income as $60,000 and title it self-employed consulting income on the Covered California application.

In this particular example, there was a child in the household and the annual income was under 266 percent of the FPL at $60,000. Covered California referred the case to Medi-Cal. The parents knew their child would be enrolled in Medi-Cal. They were surprised when Medi-Cal refused to accept their stated income of $60,000, terminated the parent’s health insurance and tossed them into Medi-Cal with their child.

The $60,000 income was estimated on a part-time job for one of the parents, interest, dividends, and 401(k) conversions. All of those income streams were wrapped up into one income estimate. An income estimate that was fully accepted by Covered California in the prior year with no questions asked. This very accurate income estimate by this family, but not meticulously separated into discrete income entries, was rejected by Medi-Cal.

Covered California accepted the income estimate – emphasis on estimate or best, most honest guess – because it was very close to the last filed federal income tax return’s adjusted gross income for the primary tax filer of the family. Because Medi-Cal emphasizes monthly income, many cases with annual income distributions may be ignored.

Closely Monitor Income Estimate and Federal Poverty Income Levels

Medi-Cal will only meddle in a Covered California account if there is already a household member on Medi-Cal or Covered California sends Medi-Cal notification because the income is no longer in the subsidy range. If you are not in Medi-Cal and don’t want to be erroneously determined eligible for Medi-Cal, make sure the household income is above the income trigger points for Medi-Cal eligibility: 138% FPL for adults, 266% FPL for children. Remember, the federal poverty income level creeps up every year. An annual income of $18,000 for a single adult was Covered California eligible in 2022, but in 2023 the Medi-Cal income level increased to $18,755.

While it can be a hassle, separating the different income streams by household member can help reduce confusion when a Medi-Cal county eligibility worker reviews the case. If the worker doesn’t see any income for your spouse, because it is lumped into your income, the Medi-Cal worker assumes your spouse has no income.

Unfortunately, it is the inconsistencies between Covered California and Medi-Cal income accounting, combined with summary terminations of health insurance with no notification, that makes people detest government programs for their arbitrary decisions.