As the Medicare Annual Enrollment Period opens in the fall of each year, many Medicare beneficiaries will see numerous plans with a very low or $0 monthly premiums. This has led to confusion that the Part B premium Medicare beneficiaries pay each month covers the costs along with their history of paying Medicare taxes. Many people are shocked to learn that the federal government, through Medicare, can pay the Medicare Advantage plans over $1,000 per month for each enrollment per individual.

When a Medicare beneficiary enrolls in a Medicare Advantage plan, usually sponsored by private insurance companies like Blue Cross, Blue Shield, Health Net, Kaiser, UnitedHealthcare, et al, Medicare pays the private insurer a monthly capitation amount to accept the responsibility of all the claims that might be generated by the beneficiary. The amount paid by Medicare is specific to the county of the beneficiary.

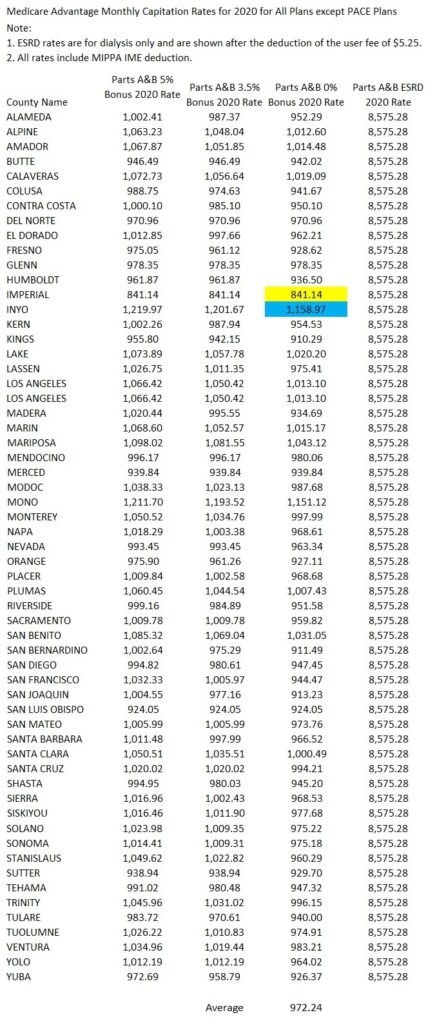

Medicare Advantage California Rates

In California, there are thirteen counties where the Medicare Advantage capitation amount will exceed $1,000 per enrolled member. This does not include any possible bonuses based on quality scores OR for any Part D Prescription drug benefits included in the Medicare Advantage plan. The lowest capitation amount is $841.14 in Imperial County and the highest is $1,158.97 in Inyo County. These figures are from the Medicare RateBook2020 that lists the capitation amounts for all counties in the United States. Download the Ratebook2020 at end of post.

The formulas for determining the county specific monthly capitation rates are complicated. The foundation of the monthly rate is the health care claims Medicare pays for beneficiaries in Original Medicare Fee for Service coverage. In an effort to reduce the growth in spending on Medicare Advantage plans, the Congressional Budget Office (CBO) undertook a review of how the plans are paid and specifically the quality bonuses.

Aside from the CBOs suggestions for lowering costs, their background summary is one of the best descriptions of how the Medicare Advantage plan rates are determined.

Reduce Quality Bonus Payments to Medicare Advantage Plans, December 13, 2018

https://www.cbo.gov/budget-options/2018/54737

Background

Roughly one-third of all Medicare beneficiaries are enrolled in the Medicare Advantage program under which private health insurers assume the responsibility for, and the financial risk of, providing Medicare benefits. Almost all other Medicare beneficiaries receive care in the traditional fee-for-service (FFS) program, which pays providers a separate amount for each service or related set of services covered by Part A (Hospital Insurance) or Part B (Medical Insurance). Payments to Medicare Advantage plans depend in part on bids that the plans submit—indicating the per capita payment they will accept for providing the benefits covered by Parts A and B—and in part on how those bids compare with predetermined benchmarks. Plans that bid below the benchmark receive a portion of the difference between the benchmark and their bid in the form of a rebate, which must be primarily devoted to the following: decreasing premiums for Medicare Part B or Part D (prescription drug coverage); reducing beneficiary cost sharing; or providing additional covered benefits, such as vision or dental coverage. Those additional benefits and reduced cost sharing can make Medicare Advantage plans more attractive to beneficiaries than FFS Medicare. Plans that bid above the benchmark must collect an additional premium from enrollees that reflects the difference between the bid and the benchmark. Payments are further adjusted to reflect differences in expected health care spending that are associated with beneficiaries’ health conditions and other characteristics.

Plans also receive additional payments—referred to as quality bonuses—that are tied to their average quality score. Those quality scores are determined on the basis of a weighted average of ratings that reflect consumer satisfaction and the performance of plans’ providers on a range of measures related to clinical processes and health outcomes. The Centers for Medicare & Medicaid Services (CMS) pays higher-rated plans more in two ways. First, plans that have composite quality scores with at least 4 out of 5 stars are paid on the basis of a benchmark that is 5 percent higher than the standard benchmark. (New plans or plans with low enrollment lack sufficient data for quality scores to be accurately calculated, so they are paid on the basis of a benchmark that is 3.5 percent higher.) Certain urban counties with both low FFS spending and historically high Medicare Advantage enrollment are designated as “double-bonus counties.” The quality bonuses applied to benchmarks in those counties are twice as high as in other counties.

The second way that quality scores impact plan payments is through the size of the rebate that a plan receives when it bids below the benchmark. Plans with 4.5 stars or more retain 70 percent of the difference between the bid and the quality-adjusted benchmark, plans with 3.5 to 4.0 stars retain 65 percent of that difference, and plans with 3 stars or less retain 50 percent of that difference. Recent evidence suggests that quality bonuses have increased Medicare’s payments to plans by 3 percent (Medicare Payment Advisory Commission 2018).

For many people, Medicare Advantage plans are far better than Original Medicare coupled with a Part D prescription drug plan. First, Original Medicare (Parts A and B) have no annual out-of-pocket maximum. Medicare Advantage plans have a cap on what the member must pay each year for health care services. Once the cap is met (anywhere from $3,500 to $6,000), the plan covers the remainder of the claims at 100%. Second, Medicare Advantage plans have set copayments for a variety of health care services such as office visits, labs, imaging, and hospitalization. These set copayment amounts help Medicare beneficiaries’ budget for their medical expenses and reduce uncertainty.

It is up to policy wonks far smarter than me to determine if Medicare Advantage plans are being compensated too much. However, it is important understand that if you enroll in a Medicare Advantage plan, the federal government is making a sizable payment to the plan on your behalf.

Medicare Advantage Rates