Some family members on Medicare are being included in Covered California renewals for 2018.

Some Covered California consumers are learning that their 2018 renewal rates have skyrocketed. The new rates are far above the expected increases for age and inflation. Before you panic you should carefully review your Covered California account to make sure all the information is correct. Some families have found that a Medicare household member has been included on the health plan. In addition, the fine print on Medi-Cal Estate Recovery has also added some confusion to the 2018 renewal process.

The Covered California application is a complicated program that looks at many different household conditions to determine eligibility for the Advance Premium Tax Credits or the monthly subsidy to lower the cost of health insurance. Every year Covered California makes minor modifications to the CalHEERS program to make it run smoother. A major change was made in September that completely redesigned the look and feel of the web pages that consumers and agents work with. It seems that within this major update some information that was previously captured in a consumer’s original application is either missing or needs to be confirmed.

Covered California Includes Medicare Family Members In Renewals

One of my clients received a letter from Covered California notifying her that her monthly premium would jump from $63.64 to $993.45 per month. The letter casually stated that the premium increase was 147.2%. The client is a household of two people one eligible for Covered California and the spouse is on Medicare. When I went through the renewal procedure on the updated Covered California website, I had to re-confirm that the spouse was on Medicare. The final eligibility results were that the Medicare spouse could select a plan at the full premium amount while the primary applicant could select a plan with the monthly subsidies.

In the previous version of the Covered California application and eligibility results, a family member Medicare eligible wasn’t even offered enrollment. I selected a plan only for the Covered California subsidy eligible household member. The final monthly premium will be approximately $49 per month. These is a far lower monthly premium than included in the Covered California form scare letter of early October and lower than the current 2017 rate of $63.64.

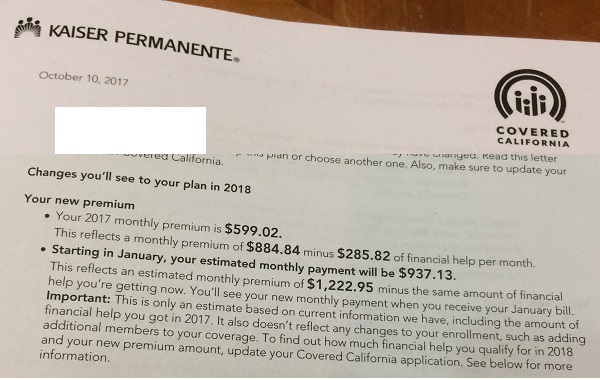

Kaiser Rate Scare Letter

So far, all of the households who have received the letter indicating an ineligible Covered California household member’s monthly rate would be included in the new premium amount have come from Kaiser Permanente with the Covered California logo prominently displayed.

Some families are receiving Kaiser Permanente letters that are erroneously adding in the rate for household members ineligible for Covered California because they are on Medicare or have employer sponsored health insurance.

The erroneous rate letters have been including household members that are either Medicare or have employer sponsored health insurance. The letters are adding the full premium amount for the individual because they are not eligible for the Covered California subsidy. If you get an astronomically high rate increase, you need to carefully review the application for incorrect or missing data. We have also seen similar abhorrent rate results when a household or family member is released from Medi-Cal. It seems as if all the information is not transferred properly to the CalHEERS program creating erroneous results of no subsidy eligibility.

The new and improved Covered California renew program will also ask you to confirm if anyone is American Indian or Alaska Native. This was clearly indicated on the consumer’s original application but is does not seem to be transferring over to the new program. The program will also ask if anyone is pregnant. This seems to be happening even if all the household members are male. In any event, make sure you highlight the square that says Nobody if that is the correct selection, and then click confirm.

One condition of receiving the monthly subsidy is filing the previous year’s tax return. If you filed late with an extension, Covered California may not know that you filed your taxes. If they have no record of your tax filing, you won’t receive any subsidy in 2018. If you have filed your taxes you can attest to through a link at the bottom of your home page. Similarly, if your consent for verification expired in 2017, you may need to grant Covered California for another year, up to 5 years. Without the consent for verification, you can’t get the tax credit subsidy.

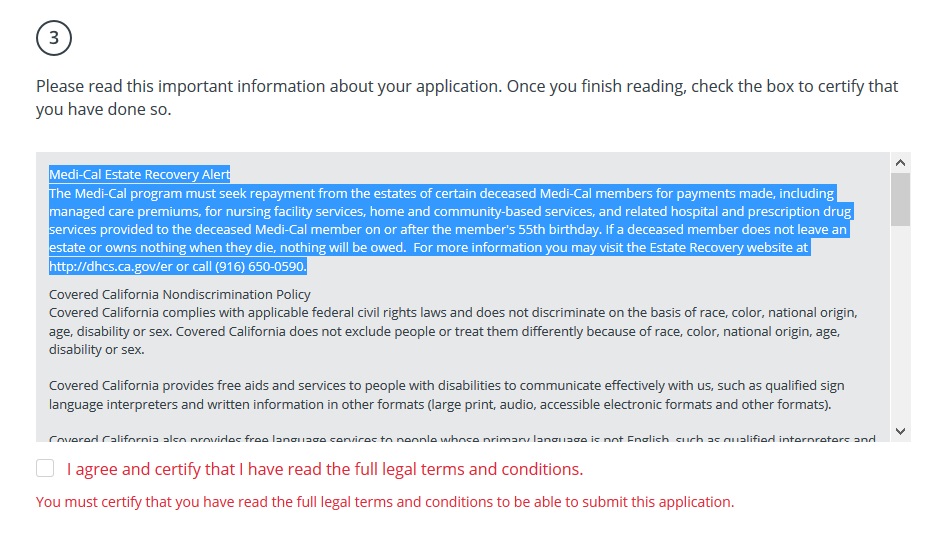

Medi-Cal Estate Recovery Alert

Finally, there is a new notice you must scroll through (i.e. read through) before you submit your application for renewal. You can’t check mark the box that you have read the legal fine print until you scroll through the notice. Oddly, the first paragraph discusses the rules for Medi-Cal Estate Recovery, which generally doesn’t apply to Covered California consumers. Unfortunately, the text used in the full legal terms and conditions is somewhat confusing.

The Medi-Cal program must seek repayment from the estates of certain deceased Medi-Cal members for payments made, including managed care premiums, for nursing facilities, home and community-based services, and related hospital and prescription drug services provided to the deceased Medi-Cal member on or after the member’s 55th birthday.

Medi-Cal Estate Recovery no longer applies to MAGI Medi-Cal individuals enrolling through Covered California.

But if you read the notice pertaining to the new Medi-Cal Estate Recovery rules effective January 1, 2017, the conditions for the estate recovery are much narrower.

For Medi-Cal members who pass on or after January 1, 2017*, DHCS will only pursue repayment if the following apply:

The Medi-Cal member received nursing facility services and/or home- and community-based services on or after his/her 55th birthday**; and

The Medi-Cal member has real or personal property and/or other assets, as of their date of death that will be part of their estate subject to probate

** The State may collect from Medi-Cal members of any age who have been determined “permanently institutionalized.” An individual is determined to be “permanently institutionalized” when they are an inpatient in a nursing facility, are not expected to return home, and have had the opportunity for a hearing regarding their “permanently institutionalized” status.

Basically, a person must be in a skilled nursing facility AND on Medi-Cal before the estate recovery applies. Persons in a skilled nursing facility are most likely not eligible for MAGI (Modified Adjusted Gross Income) Medi-Cal. They would be determined eligible for conditional Medi-Cal based on their illness or impairment.

In other words, Medi-Cal is not going to come are the parents of children who are enrolled in Medi-Cal based on the household income. But the lack of clarity in the Covered California Medi-Cal Estate Recovery Alert is unnecessarily scaring people. Medi-Cal won’t even attempt to recovery any money from adults, over 55, who are MAGI Medi-Cal eligible and not in a skilled nursing facility.