The rallying cry in the 2020 presidential primaries is Medicare For All. But Original Medicare is the sort of health insurance that the Affordable Care Act set out to ban from the market place. Original Medicare has no annual caps on the maximum out-of-pocket a consumer must pay for either hospitalization or outpatient services. People can incur multiple Part A hospitalization deductibles during the year. The 20 percent coinsurance for medical services can mean some tests, imaging, and procedures can cost the consumer hundreds of dollars. Plus, there is no prescription drug coverage.

Medicare A Poor Substitute For Family Health Insurance

Medicare was developed in the 1960s when our health care delivery system and costs were very different. What seemed simple and comprehensive then, has now become complicated and slightly antiquated. The most insidious aspect of Original Medicare (Parts A & B) is that there are no maximum out-of-pocket caps for the Medicare beneficiary. In other words, there is no maximum dollar amount liability that when the beneficiary meets a maximum patient responsibility, Medicare pays the rest of the costs. This maximum out-of-pocket amount is now routine with most creditable health insurance plans under the ACA.

No Maximum Out-of-Pocket Cap

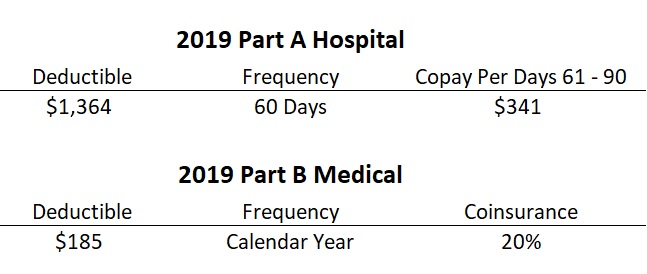

While the Part A hospitalization deductible is reasonable at $1,364, for 2019, it is based on a 60-day benefit period. If the beneficiary must be hospitalized again after 60-days, they incur another Part A deductible in most cases. After 60 days of hospitalization, the Medicare beneficiary is on the hook for $341 per day for the next 30 days.

Similarly, the Part B medical insurance (office visits, labs, tests, imaging, outpatient surgery, durable medical equipment) has a modest $185 deductible. After the deductible is met, the beneficiary pays 20 percent coinsurance. 20 percent coinsurance on a $100 office visit is not onerous. But if a person has multiple office visits, expensive labs, X-rays, MRI scans, outpatient surgery, coupled with physical therapy, that individual is looking at thousands of dollars in health care costs. Again, there is no maximum out-of-pocket cap on the Part B patient responsibility.

No Prescription Drug Coverage

It wasn’t until 2006 that prescription drug coverage was added to Medicare. The Part D Prescription Drug plans cover medications prescribed by doctor and obtained from a retail or mail order pharmacy. Most Part D plans will have a deductible that must be met before the member starts paying a copayment or coinsurance for medications. While there is not a maximum out-of-pocket amount on the Part D plans, there is a catastrophic level dollar amount that, once met, drastically reduces the costs of generic and brand name medications.

If Medicare Parts A and B were packaged for either the individual and family market or employer groups, it would never be approved as a health plan today. Even with the addition of Part D Prescription drug plan, most health plans, such as offered by Covered California, offer more comprehensive coverage with better consumer protections.

Even though the federal individual mandate or penalty, levied on people who did not have creditable health insurance coverage, was essentially dropped for 2019, Medicare still has a stick to get people to enroll. Both Part B and Part D have late enrollment penalties if an eligible Medicare beneficiary does not enroll. This penalty, in most instances, is applied to the premiums for Part B and D for the life of the beneficiary. No such penalty exists in the individual and family or employer group markets.

In short, Medicare doesn’t really resemble the comprehensive health insurance plans that most individuals and families are enrolled into. And I doubt that most people would select a Medicare plan, even with the Part D Prescription drug coverage tacked on, over one of the standard plans in the market place. For low income individuals, they may qualify for Medicaid, Medi-Cal in California, that can pick up all the costs that Medicare does not cover. There is also the Social Security low income subsidy to help with the costs of the prescription drug plans.

For Medicare individuals who are not low income, and can’t qualify for extra help from Medi-Cal or Social Security, they can enroll in a Medicare Supplement plan or a Part C Medicare Advantage plan. Medicare Supplement plans, sometimes referred to as Medi-Gap plans, will cover some or all of the health care costs Medicare doesn’t cover. These plans range from $50 to $150 per month for people turning 65 years old and eligible for Medicare. This is in addition to the monthly Part B premium. Medicare Supplements don’t cover prescription drugs, so an individual with Original Medicare (Parts A & B), must also enroll in a Part D Plan.

Medicare Advantage Plans

Part C Medicare Advantage plans are closer to the health insurance that most people have today. A private company manages all of the covered Medicare benefits. They usually have set copayments for hospitalization, office visits, labs, imaging, etc. Medicare Advantage plans also have a maximum out-of-pocket amount, which Original Medicare does not have. Many Medicare Advantage plans also include prescription drug coverage. But to keep down the costs, Medicare Advantage plans are usually HMOs, as opposed to the giant PPO plan nature of Original Medicare. While some Medicare Advantage plans have no monthly premium, others charge a modest monthly premium. And the beneficiary must still pay the Part B premium unless it is covered by Medi-Cal.

The Medicare Advantage plans are able to create a health benefits coverage package because the federal government pays them a monthly capitation amount on behalf of the beneficiary. The private organization is paying for all the health care costs of the enrolled Medicare beneficiary, minus the member’s copayments or coinsurance responsibility. Medicare is no longer paying for the beneficiaries health care services. Everything goes through the Medicare Advantage plans. These Medicare Advantage plans are offered by a variety of carriers including Anthem Blue Cross, Blue Shield, Health Net, Kaiser, and many more.

When the politicians say Medicare For All, I don’t know if they mean Original Medicare Parts A, B and D, or if they mean Medicare Advantage plans. I’m not sure if they really know what they are talking about. All I do know is that Original Medicare will not work for low and moderate income people. Those folks are better served with a comprehensive health plan with the ACA subsidies and the Enhanced Silver plans with lower deductibles, copayments, and coinsurance.

I am not opposed to Medicare For All. I am opposed to politicians throwing around feel good catch phrases without the specific details of how Medicare would be modified to work as real creditable health insurance. From my perspective, the Affordable Care Act has created comprehensive health plans that are reasonably priced for many Americans. The ACA needs improvement on many different fronts such as increasing the income range eligible for the subsidy. A federally subsidized individual and family plan through Covered California looks very similar to a federally subsidized Medicare Advantage plan. Perhaps the politicians really mean to say Medicare Advantage Plans For All.

Podcast of Blog Post