Many people who are still working when they turn 65 years of age and have their employer health plan, decline enrollment into Part B of Original Medicare. There are specific forms you need to fill out with Social Security in order to enroll in Part B after 65 and to avoid the late enrollment penalty when your employer plan terminates.

Once you leave your job and the health plan, you must enroll in Part B in order to enroll in a Medicare Supplement or Medicare Advantage plan. In this situation, enrollment can be a little confusing.

Start Part B Enrollment with Social Security

The first thing to know is that initial Medicare enrollment goes through Social Security. Social Security is the gatekeeper for Medicare enrollment. They know your work history and if Part A will be $0 premium or if you have to make a monthly premium. Social Security knows your annual income. If you or your spouse (household taxable income) is over a specific dollar amount, you will have to pay an income related monthly adjustment amount over the base Part B premium.

Additionally, Social Security determines if you are subject to a Part B late enrollment penalty. However, if you had creditable health insurance through your employer during the time you were eligible to enroll in Part B, you will not be subject to a late enrollment penalty. This is all accomplished by filing a couple of different forms with Social Security when you are applying for Medicare Part B.

Part B Enrollment Application

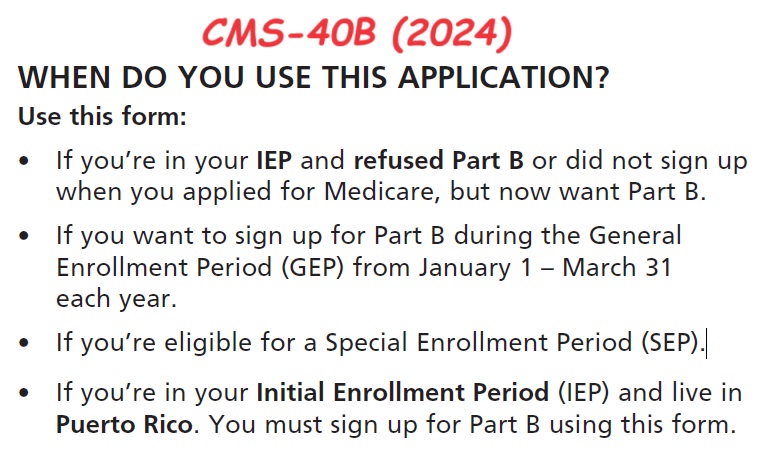

The first form you need to complete is CMS-40B (2024) Application for Enrollment in Medicare Part B. Only use this form IF your Medicare Part A is active, but you do not have Part B. You use CMS-40B If:

- You are in your Initial Coverage Period and refused Part B or did not sign up when you applied for Medicare, but now want Part B.

- You want to sign up for Part B during the General Enrollment Period (GEP) from January 1 – March 31each year.

- You are eligible for a Special Enrollment Period (SEP). A qualifying life event for a SEP is loss of employer sponsored health plan because you leave the job.

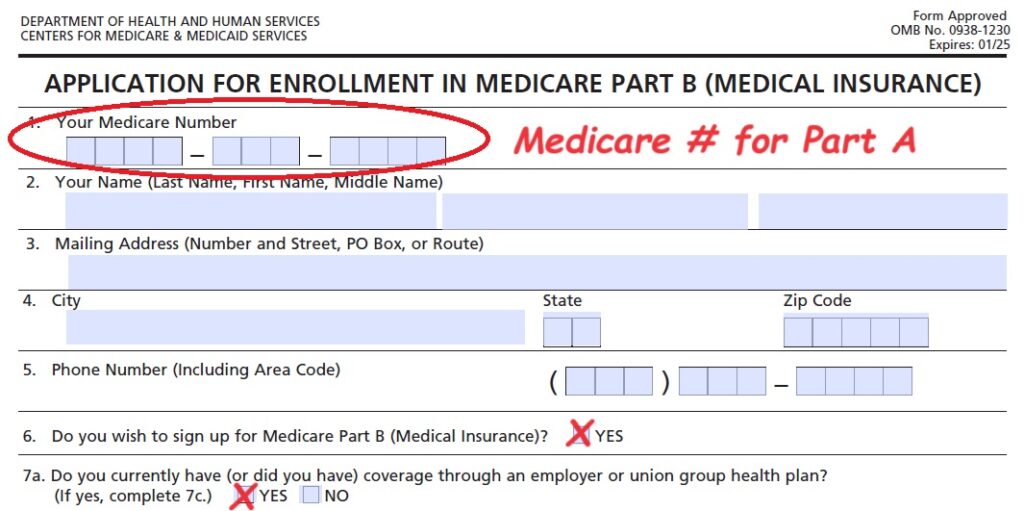

At the top of application, you are asked for your Medicare number. If you are enrolled in Part A, you have a Medicare number and probably a Medicare card showing the effective date of Part A. You also mark that you want Part B and you currently have or had employer group coverage.

You have an eight-month window to enroll in Part B after the group plan terminates. However, you can, and should, start the application process before you leave your employer plan. You can request an effective date up to three months in the future. Starting the application process early helps ensure no gap in coverage. Approval and enrollment are NOT instantaneous. It can take several weeks for the forms to wind their way through the Social Security bureaucracy.

Group Employer Health Plan Verification Form

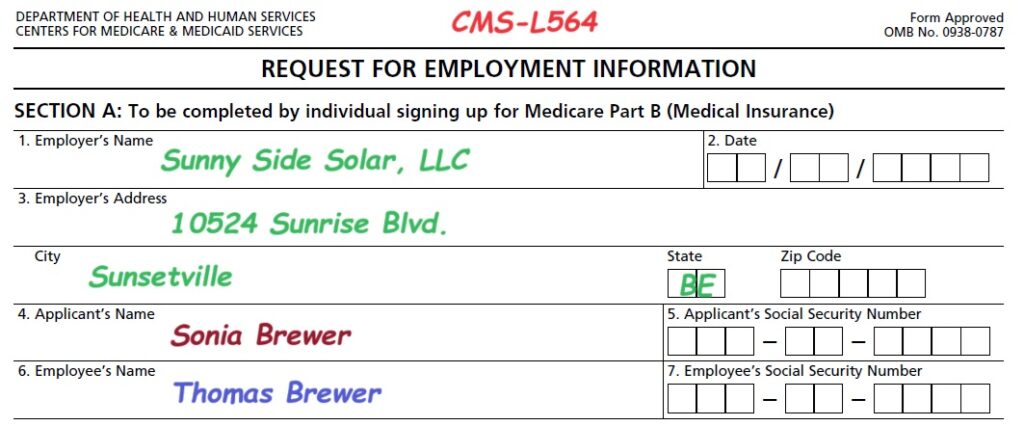

The second form you must file is form CMS-L564 Request for Employment Information. This form documents that you have Special Enrollment Period for Part B. The CMS-L564 form is proof that you had creditable employer sponsored health insurance. Without the form, you cannot document you have a Special Enrollment Period based on the qualifying life event of loss of coverage.

The SEP allows you to enroll in Part B outside of the General Enrollment Period January 1 – March 31. In addition, showing that you have had creditable health coverage, you avoid any late enrollment penalties associated with both Part B and the Part D prescription drug coverage.

The Part B applicant fills out section A. You may not be the employee of the company that provided the employer coverage. The employee may be a spouse. Take note of fields for the applicant’s name and the employee’s name if they are different. You need to submit both CMS-40B and CMS-L564 to the employer.

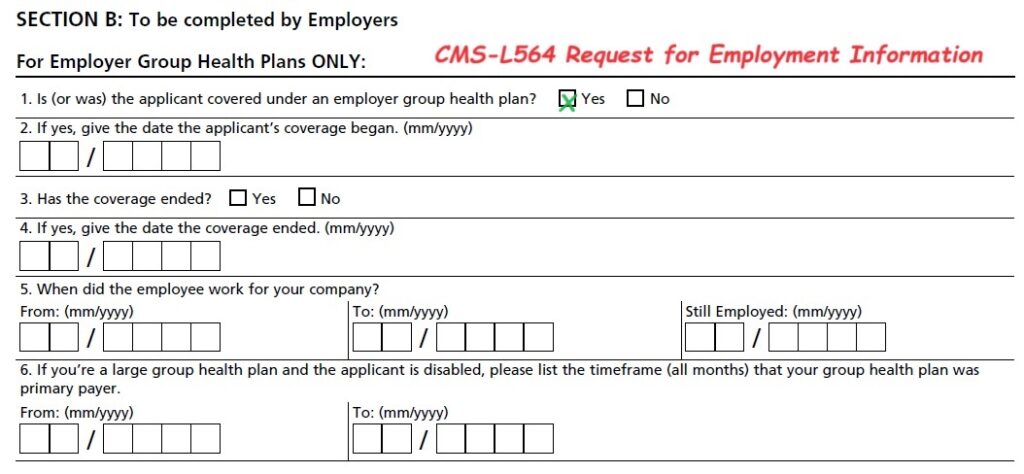

The employer fills out section B of the employment verification form. They will fill in the dates of employment and coverage. The company official signs and dates section B. You can then provide both forms to Social Security.

**COBRA coverage is not considered creditable coverage to waive any late enrollment penalty you may be subject to if you apply after your eight-month Part B Special Enrollment Period.

Example: Enrolling in Part B when Group Health Plan will Terminate

Sonia and Thomas Brewer are a married couple. Thomas is leaving his employment to retire. Thomas is 64 and Sonia is 68. Because Thomas and Sonia were covered by Thomas’ employer health plan, Sonia enrolled in Part A of Original Medicare but declined Part B when she turned 65.

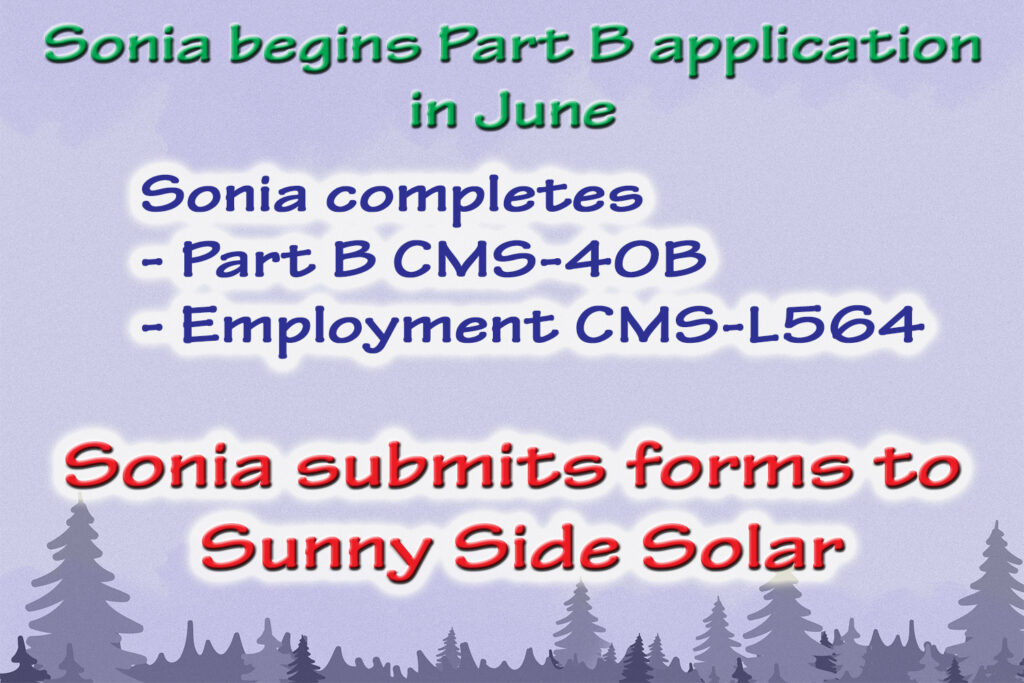

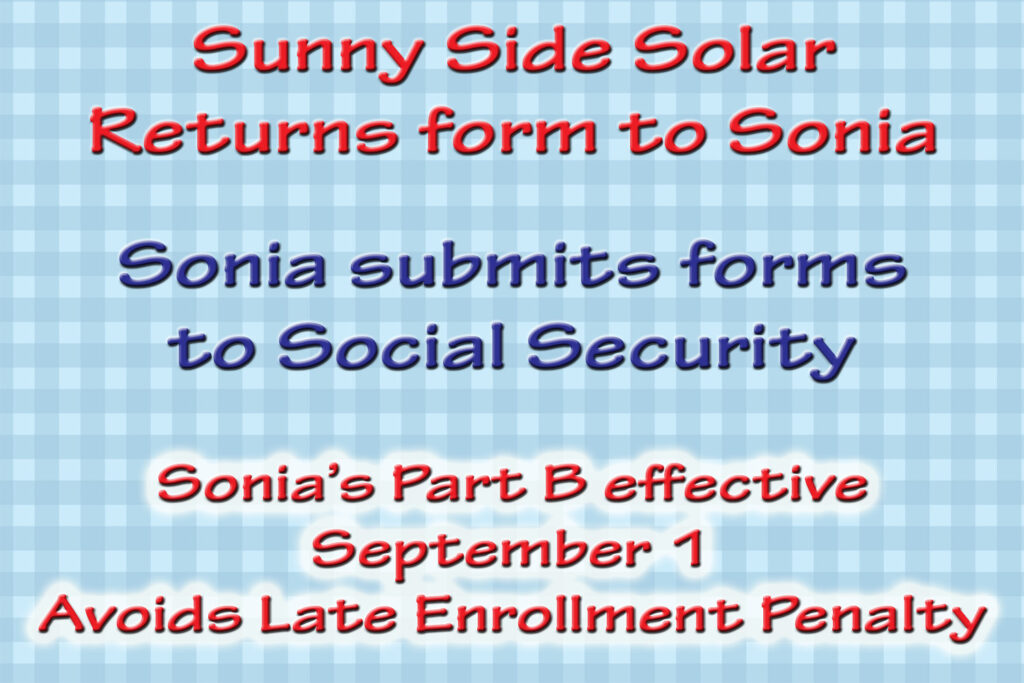

The group health insurance for Thomas and Sonia will end August 31. Sonia begins to apply for enrollment into Medicare Part B in June. She fills out forms CMS-40B and section A of CMS-L564. Sonia then submits the forms to the Human Resources department of Thomas’ company Sunny Side Solar. The company returns the signed CMS-L564 employment information form to Sonia who then submits it to Social Security.

Sonia’s Part B will be effective September 1st. In August she receives notification that Part B will be effective September 1st allowing her to enroll in a Medicare Advantage plan or Medicare Supplement plan with Part D drug plan for September 1st. She will have no gap in coverage from when the employer plan terminates, and her Medicare plans are in place.

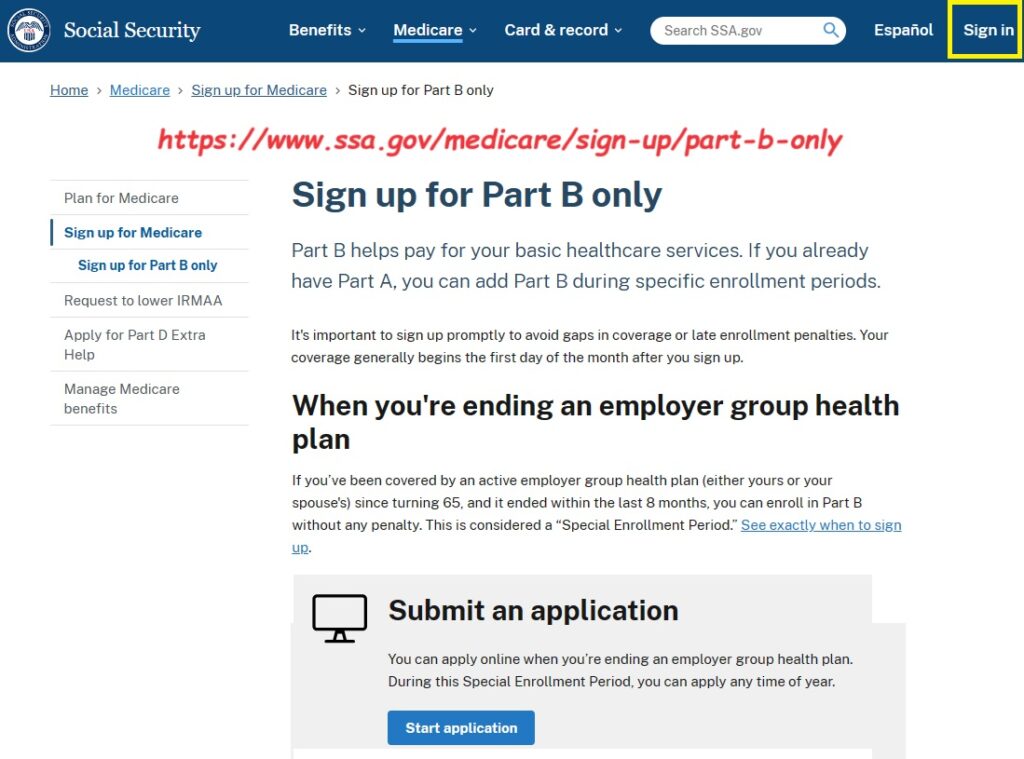

The Social Security website has a link to enroll in Part B only. The necessary forms on the Social Security website.

Part B SEP Forms