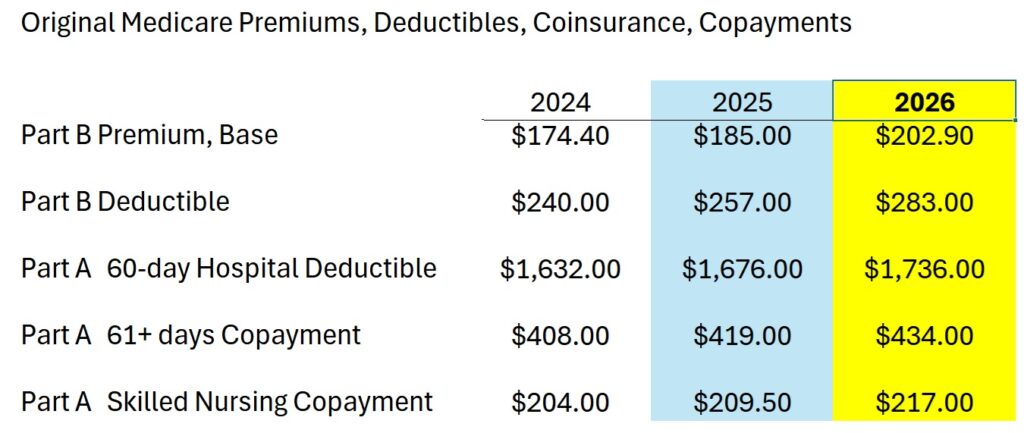

The premiums and cost-sharing of Original Medicare Parts A and B increase modestly for 2026. The income amounts that trigger the Income Related Monthly Adjustment Amounts (IRMAA) also increased.

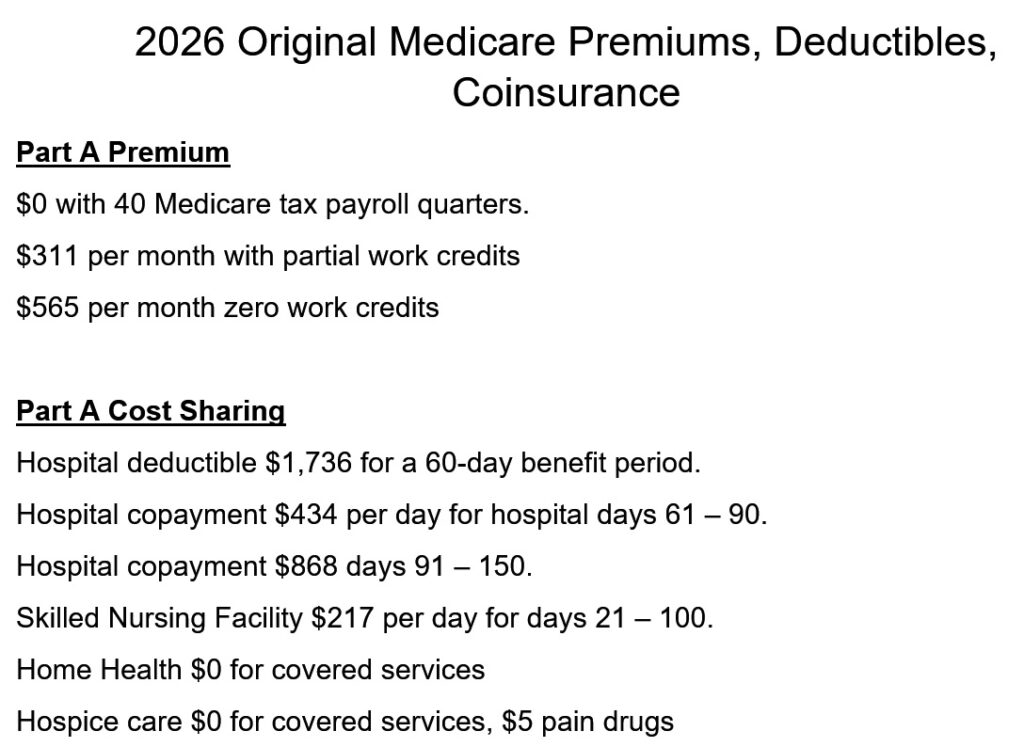

For most people, Part A hospital coverage will be $0 if you have worked for 10 years, 40 quarters, and paid the Medicare taxes. If you have partial work credits, Part A monthly premium is $311. If you have zero work credits, the monthly premium is $565. Remember that an individual who may never have worked, but are or were married to someone who did work, may qualify for $0 Part A.

Under Part A, the first 60 days of a hospital admission will have a deductible of $1,736. This copayment can repeat if you are hospitalized again later in the year. Additional days in the hospital will cost $434 for days 61 through 90. The skilled nursing facility copayment has increased to $217 per day for days 21 through 100.

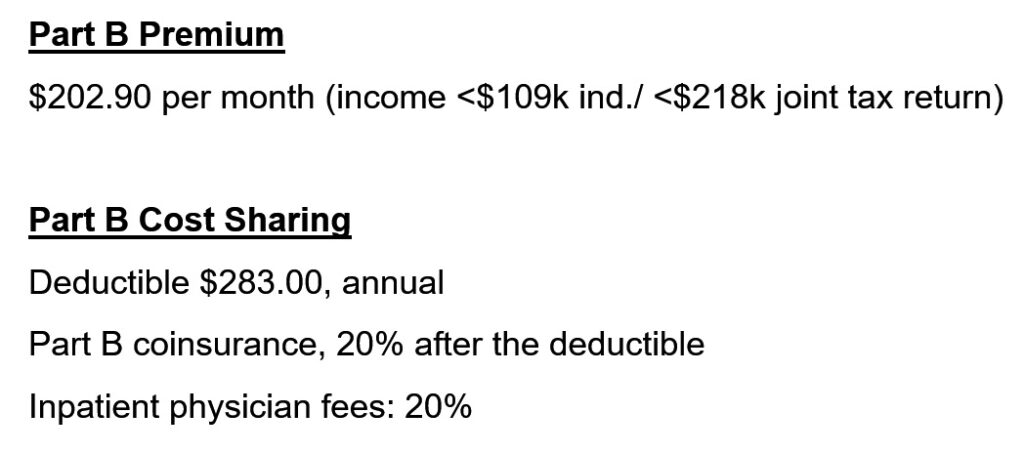

Part B Medicare Premiums for 2026

Your monthly Part B premium will increase to $202.90 per month if your income is less than $109,000 for single adult or less than $218,000 if you file a joint tax return with your spouse. The Part B deductible is $283 for 2026. After the deductible is met, all other covered services and durable medical equipment will be subject to 20 percent coinsurance.

IRMAA Extra Costs

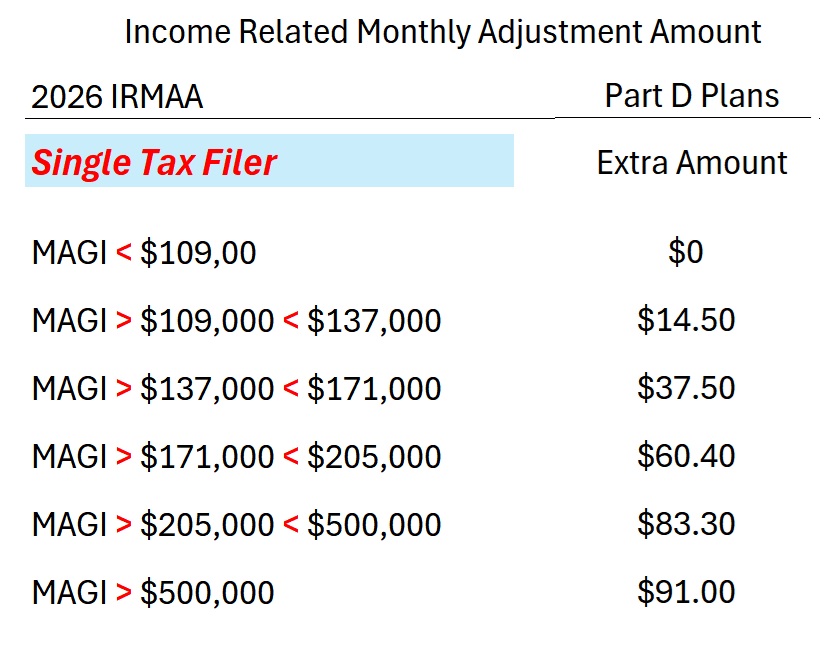

You may have to pay an Income Related Monthly Adjustment Amount (IRMAA) if your income is greater than $109,000 for a single adult or $218,000 for joint tax filers. The income is the Modified Adjusted Gross Income which is comprised of your AGI plus tax exempt interest. The income year is 2 years prior. For 2026, Social Security uses the 2024 tax return to determine if you are subject to the IRMAA.

For example, if your income for 2024 was between $109,000 and $137,000, you will be billed an additional $81.20 per month for Part B. This will make your Part B premium $284.10. This will be deducted from your Social Security deposit or invoiced quarterly.

The IRMAA also applies to Part D prescription drug plans. The extra premiums for Part A, B, and D under the IRMAA are because the federal government subsidizes those health care programs. If your income was between $109,000 and $137,000 in 2024, you will pay an additional $14.50 for Part D. You will continue to pay any Part D plan premium you may have. The Part D IRMAA is invoiced along with the Part B IRMAA, deducted from Social Security or billed quarterly.

The IRMAA extra costs are the same if you file a joint tax return with your spouse, but the income thresholds are higher. For Joint tax filers, the MAGI must be greater than $218,000 for 2024 before the IRMAA is triggered. The IRMAA will apply to the Medicare premiums for you AND your spouse if are both enrolled in Medicare.

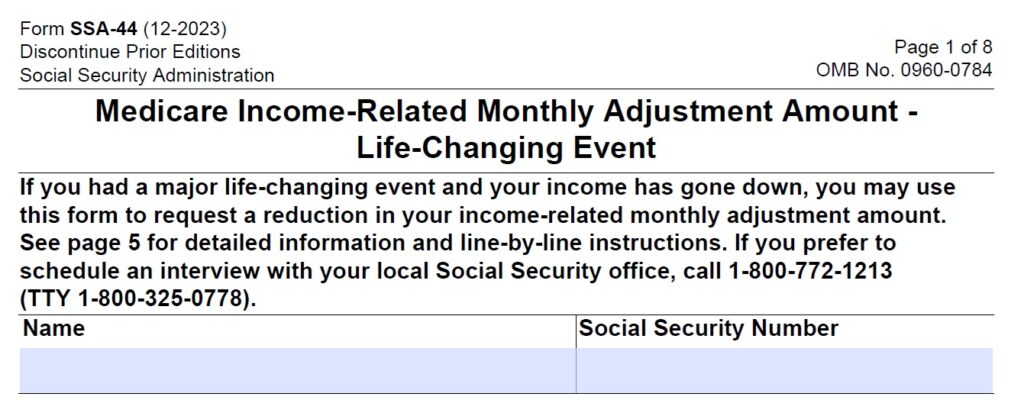

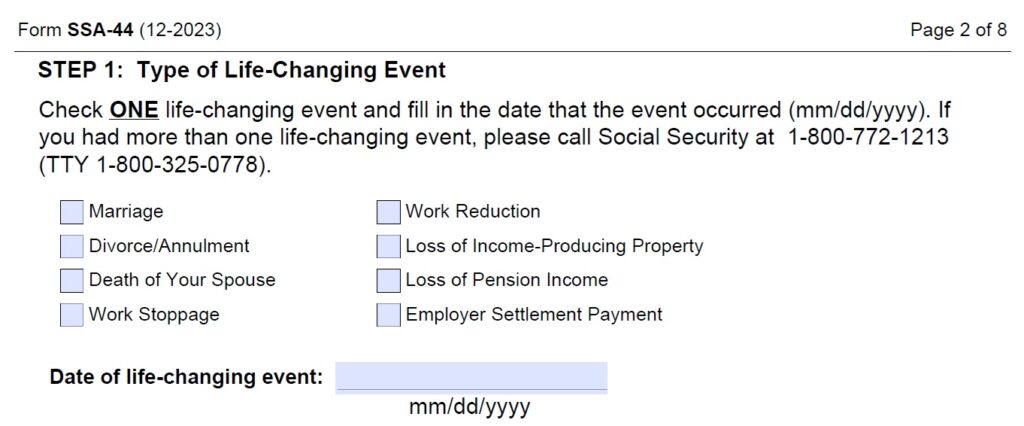

If you believe the IRMAA is in error, you can file a Medicare Income-Related Monthly Adjustment Amount Life-Changing Event appeal (form SSA-44) with the Social Security Administration.

However, the life changing events that can be considered to waive the IRMAA are very narrow.

YouTube video on 2026 Medicare Premiums and Costs.