Under the Affordable Care Act, individual and family plans (IFPs) will have coverage benefits very much like an employer sponsored small group plan. Another way in which the new IFP plans will mirror a group plan are enrollment restrictions. Individuals and families will only be able to enroll into the new IFP plans outside of open enrollment if there is a “qualifying event”.

Curbing adverse selection

In an effort to curb “adverse selection” or allowing a person to enroll in a health plan anytime during the year if they become ill, all IPF plans, inside and outside of the state exchanges like Covered California, will only allow new membership during open enrollment or if a life changing event occurs within the household outside of open enrollment.

Qualifying event overrides open enrollment restrictions

In other words, if you don’t purchase a health plan during the initial enrollment period ending March 31, 2014, you won’t have another chance until open enrollment October 15th – December 7th, 2014, for the 2015 year. You won’t be able to buy health insurance outside of open enrollment when you get sick and need it the most. Consequently, you will be totally on the hook for all the expenses associated with any illness, accident or disease. However, if you lose your coverage or in some cases even if you don’t have health insurance but your circumstances change you can enroll outside of open enrollment. These special circumstances are known as “qualifying events” because they qualify you to purchase a health plan outside of open enrollment.

What are the triggers for a qualifying event?

A qualifying event in the household will trigger a special enrollment period allowing the purchase, addition or subtraction of insurance for individuals.

Special enrollment periods due to a qualifying event include the following:

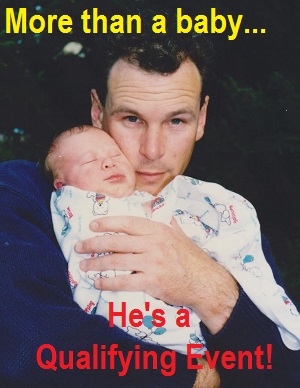

- Gains a dependent or becomes a dependent through birth or adoption

- Getting married

- Applicant or dependent lost minimum essential coverage due to termination or change in employment status

- Cessation of an employer’s contribution toward an employee or dependents coverage

- Death of the person through whom the applicant was covered

- Entitlement of benefits of the subscriber under Title XVIII of the Social Security Act (Medicare), resulting loss of coverage to the dependents

- Dependent child’s loss of dependent status under the applicable requirements of a group plan, such as reaching age 26

- Loss of minimum essential coverage excluding the loss of termination due to failure to pay premiums or situations allowing rescission

- Gains a dependent or becomes a dependent through marriage or partnership

- Dependent is mandated to be covered pursuant to a valid state or federal court order

- Legal separation or divorce through whom the applicant was covered as a dependent

- Loss of coverage under the Access for Infants and Mother’s Program and Medicaid share of cost program

- Loss of HMO coverage benefits as the individual no longer resides, lives or works in the HMO service area

- Applicant became a permanent resident of California during a month outside of open enrollment period

- Applicant returns from active military duty

- Applicant is release from incarceration

These are the most common qualifying events, but their may be others such as a change in household income making the applicant and family no longer eligible for Medi-Cal.

Documentation of qualifying events

Application for coverage outside of open enrollment should be submitted 60 days before one of the qualifying events listed above. Documentation will be necessary to verify the qualifying event and should be sent with the application. Typical documents might include

Loss of minimum coverage

- COBRA FMLA or Cal-Cobra Election Forms

- HIPAA certificate or Certificate of Credible Coverage

- Letter from employer confirming loss of coverage due to reduced hours

Enrollment in Medicare resulting in loss of coverage for dependents

- Copy of Medicare Card*

- Approval letter of entitlement from Social Security Office

*This will have your Social Security number on it so make sure you send it to the correct address.

Gains a dependent: birth of baby, adoption, marriage, etc.

- Birth certificate from hospital, county or state issue only

- Medical authorization form

- Evidence of enrollee’s right to control the health care of the child

- Relinquishment form (such as from the birth parent)

Applicant becomes permanent resident

- Current utility billing statement confirming California address

- Lease or renter’s agreement

- Monthly mortgage statement

*This might actually in apply in California that has 19 different rating regions and not all carriers and health plans are offered in all regions. If the member moves from Southern California where they are enrolled in a health plan from L.A. Care to Northern California where the plan is not offered, that would be a qualifying event to enroll in a new health plan.

Plan transfers

An individual can only transfer to another health plan during open enrollment or during a special enrollment period triggered by qualifying event.

[wpdm_file id=131 title=”true” desc=”true” template=”bluebox ” ]