There is relief for crippling health insurance premiums from employer-based group health plans. Covered California will allow the spouse and dependents offered unaffordable health insurance through a group plan to receive subsidies in 2023. In order to escape the crippling premiums of the group plan, families will have to meet several conditions.

Family Glitch and Crippling Group Health Insurance Premiums

Before a rule change by the IRS in 2022, the spouse and dependents offered group health insurance through a family member’s employment were generally ineligible for the subsidies through Covered California. The problem is that the employer usually only makes a contribution to the employee’s coverage and nothing to the covered spouse and dependents. Consequently, the spouse and children must pay the full premium amount for the health insurance. With an understated moniker, this problem was referred to as the Family Glitch.

Frequently Asked Questions about the Family Glitch Fix

The relief for exorbitant group plan rates through Covered California will focus on the affordability of health insurance for the entire household, not just the employee’s contribution. The employee’s health insurance contribution and affordability will be considered separate from the family.

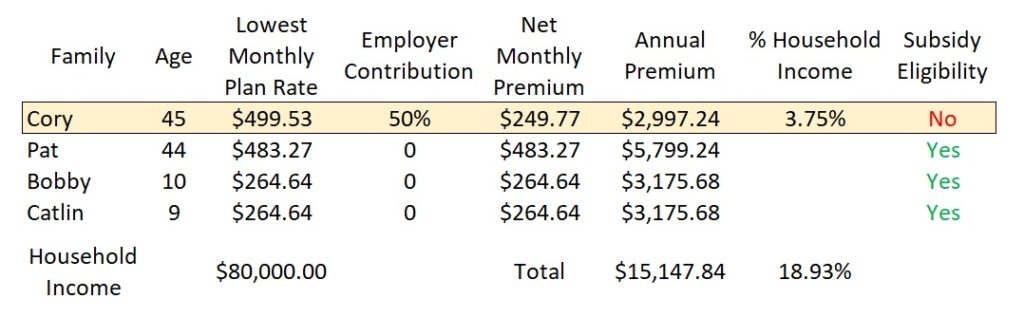

In most situations, the employee’s contribution will still be considered affordable and will remain ineligible for the Covered California subsidies. However, for many families, the group health insurance premium for the spouse and dependents will exceed the affordability percentage and they will be eligible for the Advance Premium Tax Credit subsidies offered through Covered California.

The subsidy benefit for families burdened with crippling employer group health insurance premiums can be enormous. Unfortunately, acquiring the necessary employer information and calculating the affordability percentage can be daunting for some families. However, Covered California has created some worksheets and tools to help in the process.

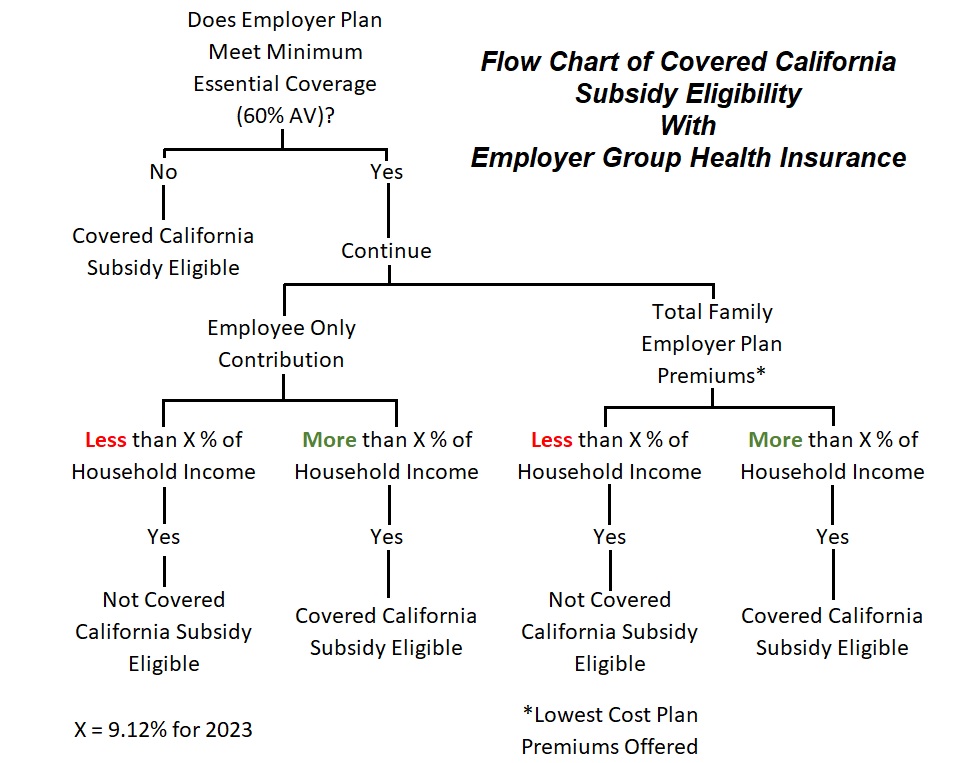

Below is a flow chart of the affordability determination process.

First, does the employer group plan meet Minimum Essential Coverage (MEC.) Most group plans do meet the MEC test. MEC has the health plan’s actuarial value at 60 percent or higher. This is usually noted in the summary of benefits of the health plan. If the group plan does not meet MEC, the employee can opt not to enroll and apply to Covered California during an appropriate enrollment period

Second, is the group plan affordable?

Crucial to the affordability test is the estimated income. The household income is based on the Modified Adjusted Gross Income (MAGI.) The MAGI is the adjusted gross income from the federal tax return plus social security retirement and disability benefits, tax-exempt interest, and foreign earned income.

The health insurance premiums used are for the lowest cost health plan offered that meets MEC. This is not necessarily the health plan the employee or family is enrolled into. For example, the family might be enrolled into a Silver plan. However, the employer may offer a lower cost Bronze plan. It is the Bronze plan premiums that must be used in the calculations.

The premiums for adult children on the health plan, up to age 26, who are not tax dependents of the employee, are not in the affordability calculation. They can remain on the group plan with then employee even if other family members transition to Covered California

Spouses who each have an offer of employer group coverage must be tested separately. In other words, if each adult has employer group coverage, there will be 2 tests for affordability, one for each employer plan offering. If the affordability test, under either of the group plans, yields a result of affordability for the family, then the family is not eligible for the subsidies.

The total family employer group premiums are considered for the affordability test. It’s possible that under Covered California rules, dependents 18 years old and younger will be eligible for Medi-Cal if the household income is under 266 percent of the federal poverty level. Regardless of the children being offered no cost Medi-Cal, their employer group premiums are considered in the affordability test.

Affordability percentage for 2023 is 9.12 percent of the household income and can be adjusted every year by the IRS.

Covered California Employer-Sponsored Coverage Worksheet

Covered California has put together a worksheet for families to use to gather preliminary employer group health insurance costs. The worksheet accounts for the frequency of the employee health premium contributions. For example, an employee may have $900 deducted each pay period for health insurance. If the employee is paid twice per month, the monthly premiums are $1,800.

This is where the data gathering process could stagnate. Employees will be asking the employer or their human resources department to provide them with the necessary information for the affordability test: lowest cost plan premiums for household members possibly not on the health plan. The employer or HR department may not have the time to find all the information. The health insurance company or agent will have less incentive to provide the data.

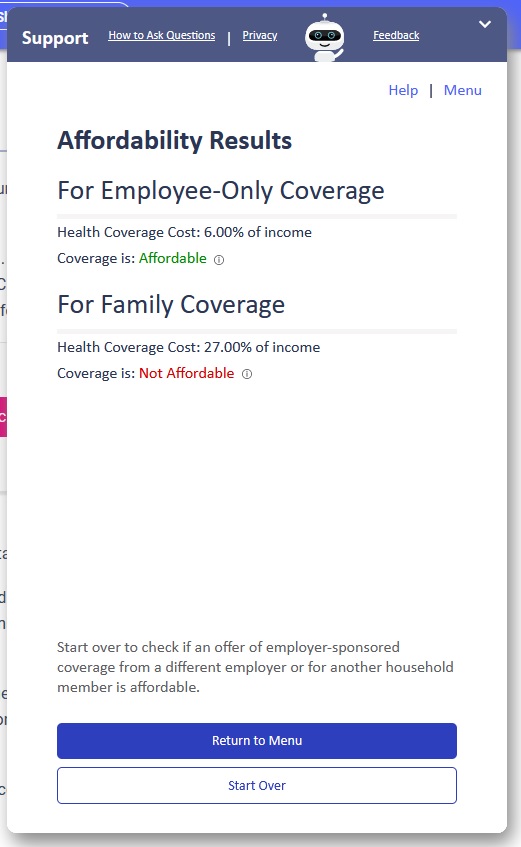

Affordability Calculator

Another tool Covered California has launched is an online affordability calculator. In a 4 step process, the family puts in the estimated income, employer plan premiums, and frequency of employee pay period contributions. The tool then calculates the affordability of the health insurance for the employee and the family.

The affordability calculator is NOT the final determiner for the Covered California subsidies. It is only as good as the information entered into the fields. It can be helpful to determine if it is worth the time and effort to gather the necessary data for the Covered California subsidies.

Finally, Covered California will not be making an official determination if a family qualifies for the health insurance subsidies because the employer group plan premiums are considered unaffordable. The final determination will rest with the primary tax filer and the IRS. If the employer coverage was affordable to the family, the subsidies will have to be repaid. Consequently, it is extremely important to obtain correct information and retain those documents if the IRS challenges the Premium Tax Credit taken by the primary tax filer. Additionally, it will be important to monitor household income, changes in employment, and health plan offerings during the year to reevaluate eligibility for the Covered California subsidies.

Here are a couple potential outcomes from the affordability test

- Employee not eligible for the subsidies, remains with group plan. Spouse and dependents eligible for Covered and the subsidies.

- Neither employee nor spouse (who also has employer coverage) are eligible for the subsidies. Dependents are eligible for the Covered California subsidies.

- Spouse and dependents eligible for Covered California enrollment. However, because household income is below 266 percent of federal poverty level, children are Medi-Cal eligible. Children could remain on employer group plan with employee.

- Spouse and dependents eligible for Covered California. Spouse has Medicare and must remain with that coverage. Dependent children qualify for subsidies through Covered California.

Employer Group Affordability Conditions