Many people will find their Social Security deposit is lower in 2025. The lower monthly deposit is a result of Social Security recipients having their Part D drug plan premiums automatically deducted from the deposit. Many of the Part D drug plan premiums are increasing more than double from their 2024 monthly rates.

Part D Premium Deducted from Social Security Deposit

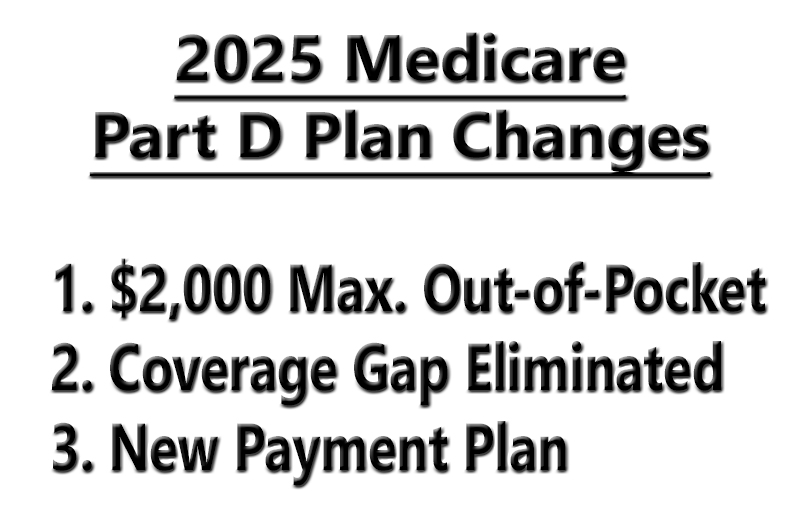

Social Security recipients who have a Part D drug plan need to review their 2025 monthly premium rate. The changes to the Part D drug plans with a lower maximum out-of-pocket amount has forced many Part D plan sponsors to raise their monthly premiums. Rate increases of $30 to $50 per month is not uncommon. The increased monthly premiums were included in the plan sponsors Annual Notice of Change for 2025.

If the Social Security recipient, who has the Part D premium deducted from their retirement deposit, is not aware of the potentially large rate increase, they may get a surprise when they look at their bank account in January. Most people are anticipating a 2.5 percent increase in their Social Security deposit. Unfortunately, the higher Part D plan premiums may swamp the modest monthly increase.

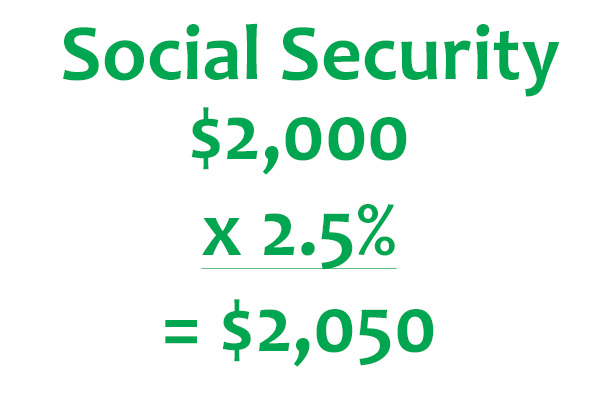

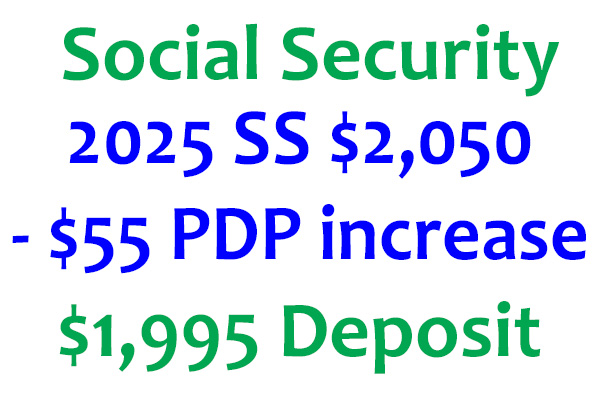

For example, if a Social Security recipient receives $2,000 per month deposit, a 2.5 percent increase would increase the monthly deposit $2,050 per month.

Surprisingly High Part D Premiums for 2025 Plans

For this individual, they were enrolled in a Part D plan with a monthly premium of $30 per month for 2024. The same plan increases the monthly premiums to $85 per month. This is a $55 month increase for the premium.

The increase of the Part D plan premium is larger than the cost-of-living allowance increase of $50. The Social Security recipient will realize a net decrease in their monthly deposit.

This is particularly painful if the individual takes no prescriptions drugs and only has the Part D plan just to avoid the late enrollment penalty. There are many situations where the increased premiums, coupled with the lower maximum out-of-pocket amount of $2,000 is a good deal for the Medicare beneficiary.

However, you will only know if the larger premium increases, and resulting lower Social Security deposit, is worth the extra money by comparing your current Part D drug plan.

YouTube video explaining Social Security Automatic Deposit