With the Covered California Silver Plan Rate spike for 2018, some Gold and Platinum plans are less expensive.

In an effort guarantee that the enhanced Silver plans 73, 87, and 94 with reduced member cost-sharing will continue for 2018, Covered California had the health plans raise their Silver plan rates to generate the money to fund the reduced cost-sharing subsidies of the enhanced Silver plans. The rate increase, applied only to Silver plans, has translated into some Gold and Platinum plans being cheaper than the lower benefit Silver 70 plans. This is sure to lead to confusion for some consumers and potentially disrupt the health insurance market place.

Enhanced Silver Plan Subsidies

Adults with household incomes between 138% and 250% of the federal poverty level qualify for enhanced Silver plans. The enhanced Silver plan have reduced member cost-sharing such as lower deductibles, copayments, coinsurance, and maximum out-of-pocket amounts. These plans are only available through Covered California. The money to reduce the health plan members share of cost for the enhanced Silver plans comes from the federal government and is in addition to the monthly tax credit subsidy to lower the health insurance premium.

President Trump threatened to cut off the funding for the cost-sharing reductions (CSRs) earlier in 2017. But the ACA mandates that the exchanges like Covered California offer the plans. Because the federal government had taken no action to guarantee the CSR funding by early October, Covered California implemented their plan to fund the enhanced Silver plans by having the health plans increase their rates.

Gold And Platinum Plans Cheaper Than Silver Plans

But because the rate increase only applies to the Silver plans, an average increase of at least 12%, there are Gold and Platinum plans that cost less than the Silver plans. This means that some people can move into a higher benefit health plan for less money than a Silver plan, even before any monthly tax credit has been applied.

However, if the household income is low enough and allows the family to enroll in an enhanced Silver plan, they should strongly consider it. All of the metal tier plans have a little number after their name: Bronze 60, Silver 70, Gold 80, and Platinum 90. Those numbers represent the actuarial value of the plan. The actuarial value is a percentage of the health care costs that the health plan will cover on average of all the members. For instance, a Silver 70 plan means that, on average, all the people with the Silver 70 plan will have 70% of their health care costs covered by the health plan during the year.

The enhanced Silver plans, because they have lower cost sharing requirements will cover a greater percentage of the health care costs of the members. Silver 73 = 73%, Silver 87 = 87% and Silver 94 = 94%. If you have a Silver 87 plan that is like having an above average Gold 80 plan. A Silver 94 plan is better than a Platinum 90 plan.

Silver 70 Plans Less Expensive Off-Exchange

Unfortunately, there are many individuals and families who do not qualify for an enhanced Silver plan. They can only enroll in a Silver 70 plan. For these folks they should to consider potentially moving up to a Gold or Platinum plan if those health plans have the doctors and hospitals they want to use as providers.

Another odd twist to the financial story is that by Covered California spiking the Silver plan rates, they also forced an increase in the monthly tax credit subsidy for all individuals and households eligible for the premium tax credits. This is because the Advance Premium Tax Credits (monthly subsidy) is based on the Second Lowest Cost Silver Plan. Since all the Silver plans went up, the monthly APTC subsidy went up. What were not artificially inflated were the Bronze, Gold, and Platinum plans. This means that all those plans became effectively less expensive by the factor increase of the Second Lowest Cost Silver Plan.

In particular, Bronze plans may now look very attractive with the lower price after any APTC is applied. Both the standard Bronze 60 plan and the Silver 70 plan each have a maximum in-network calendar year amount of $7,000 for 2018. Once all of an individual’s deductibles, copayments, and coinsurance for both medical services and pharmacy drugs reach $7,000 ($14,000 for a family) then most all the health plan covered services are paid 100% by the health plan.

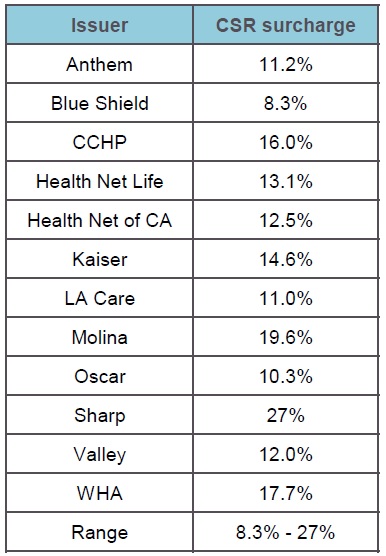

Percentage increase of Covered California Silver plans by carrier to cover the CSR funding.

Health Insurance As Asset Protection

If the primary purpose of health insurance for an individual or family is asset protection, then a Bronze plan would be the better financial decision. This is especially true if the inflated subsidy is disproportionately deflating the cost of the Bronze plan.

Some regions of California will benefit more from the inflated subsidy via the inflated Silver plans because not all the carriers raised their Silver plans by the same percentage. They calculated the increase of their Silver plans in order to generate enough money to fund the enhanced Silver plan benefits. The Second Lowest Cost Silver Plan (SLCSP) in one region may have only increased 10%, whereas another region, with a different SLCSP may have increased 15%.

What has not been explained was if the increased Silver plan rates were based on existing Silver plan enrollments or projected enrollments. For those individuals and families who receive very little or no APTC the off-exchange Silver 70 plans will be 8.3% to 27% less expensive. People will naturally enroll in off-exchange Silver plans to save money. There will also be people who downgrade their plans from Silver to Bronze to save money, or, enroll in a Gold or Platinum plan for more benefits at an equal or lower cost of a Silver plan through Covered California. Either way, people will exit Covered California Silver plans in 2018. And since only the Covered California Silver plans have the increased rates, will that generate enough money to subsidize those people left in the enhanced Silver plans?

Covered California Is Income Protection

The increased Silver plan rates in order to guarantee the enhanced Silver plans, which is good and a necessary thing, adds more complications and confusion for individuals and families looking at health insurance for 2018. If you leave Covered California, you lose the income protection it provides. In other words, if you buy a plan off-exchange and your household income suddenly drops because of a loss of a job, that loss of income is NOT a qualifying event for enrolling through Covered California to receive the tax credits. So people enrolling in Silver plans off-exchange lose the benefit of reducing their health insurance premiums because of a reduction of income.

Before you make any decision, carefully weigh the pros and cons of leaving Covered California or switching to a Bronze plan that has higher out-of-pocket costs for routine out-patient care. Covered California Keeps Premiums Stable by Adding Cost-Sharing Reduction Surcharge Only to Silver Plans to Limit Consumer Impact

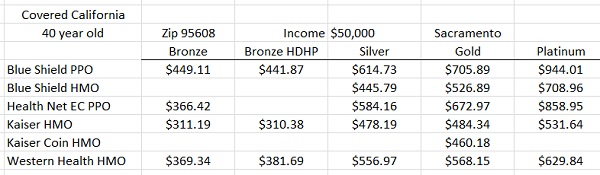

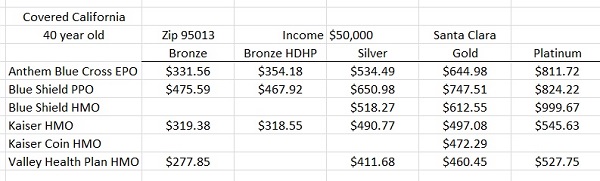

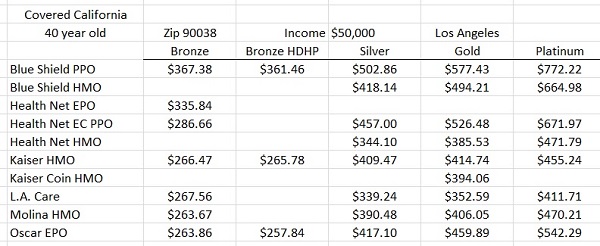

Comparing the rates of a 40 year old in Los Angeles, Santa Clara, and Sacramento counties. These are the full premium rates without any monthly subsidy deducted.