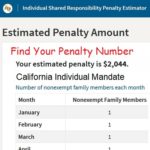

As of November 2020, the only way to apply for an exemption through Covered California was to use an online application that utilizes DocuSign. For individuals who do not own a computer or do not have internet access, this could be challenge. I have not found any paper exemption applications on the Covered California website. That doesn’t mean they are not there or that they won’t be created later.