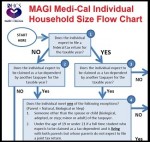

There are many good reasons to include qualifying adults such as parents and stepparents within a Covered California household. There can also be unintended consequences such as making the entire household eligible for Medi-Cal and ineligible for the Covered California subsidies. The best approach is to understand all of the IRS rules regarding a qualifying relative and how the inclusion of the parent or stepparent will modify the eligibility of the household for the subsidies and Medi-Cal.