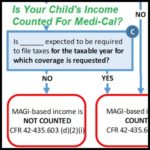

The benchmark 100% federal poverty level income for a single adult increased 3% from $12,140 in 2018 to $12,490 for 2019. The all important Covered California premium tax credit eligibility income (138% of the FPL) for a single adult increased from $16,754 for 2018 to $17,237 in 2019. This means a single adult now has to have an annual Modified Adjusted Gross Income (MAGI) of $17,237 to be eligible for Covered California if they apply for health insurance in 2019.