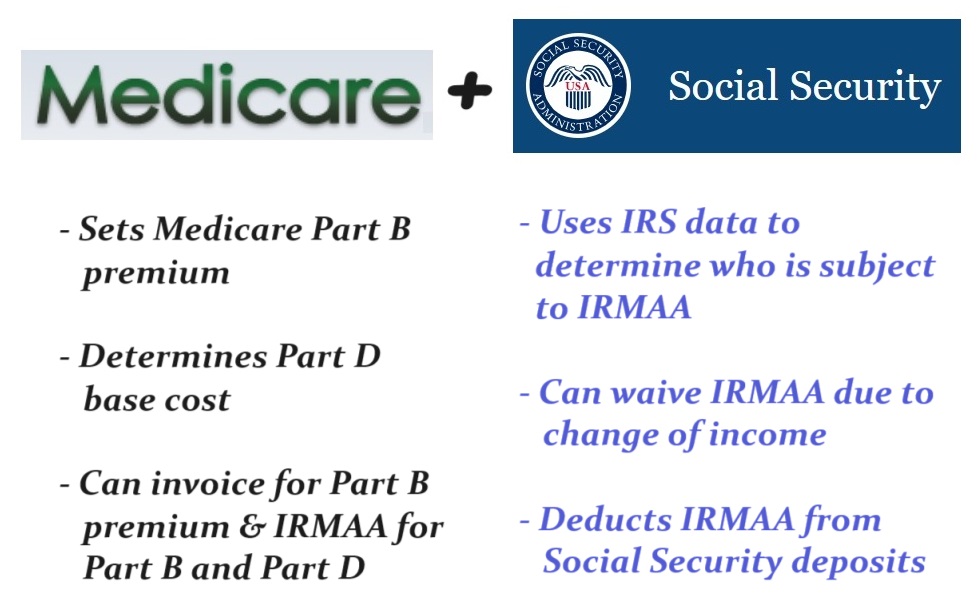

Many people, when they are researching their costs for Medicare, assume they will pay the advertised rate for their Part B enrollment. Then they get the bill and learn Medicare is billing them an extra amount for Part B and Part D. The extra amount is either a late enrollment penalty, an Income Related Monthly Adjustment Amount (IRMAA), or both. If the extra amount is several hundred dollars per month, it is usually the IRMAA based on a high modified adjusted gross income from the last file federal income tax return.

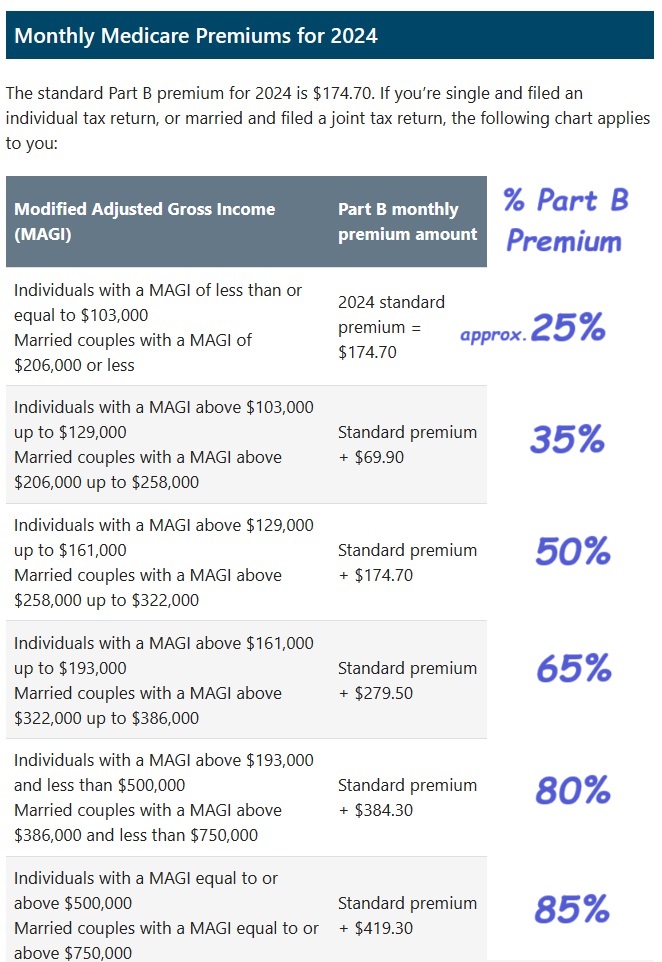

The Part B premium for Medicare outpatient health care services is a set amount that everyone is liable for when they enroll into Medicare. Most people pay $0 for Part A (hospital coverage) if they have necessary work credits. According to the Social Security Administration, the Part B premium paid by Medicare beneficiaries represents approximately 25 percent of the cost of the outpatient insurance. However, when an individual reports an income higher than a set dollar amount, they will be subject to paying more for their Part B premium through the IRMAA calculation.

Explanation of the Medicare Income Related Monthly Adjustment Amount

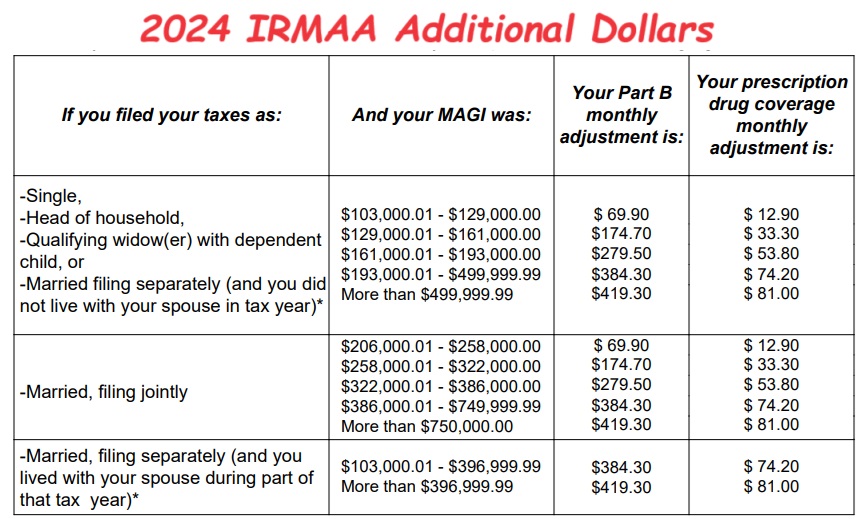

Every year, the Part B premium and the income thresholds are adjusted for inflation. For 2024, if an individual’s last filed modified adjusted gross income (MAGI*) is less than $103,000 ($206,000 for married couples), then the individual pays the base Part B premium of $174.70. As the income increases, the Medicare beneficiary must pay a higher percentage of the Part B premium. There are five income levels that equate to higher percentages of the beneficiary responsibility for the full Part B premium: 35%, 50%, 65%, 80%, and 85%.

For example, if a single tax filer reported an modified adjusted gross income between $103,000 and $129,000, they would have an additional $69.90 added to their monthly Part B premium as the IRMAA

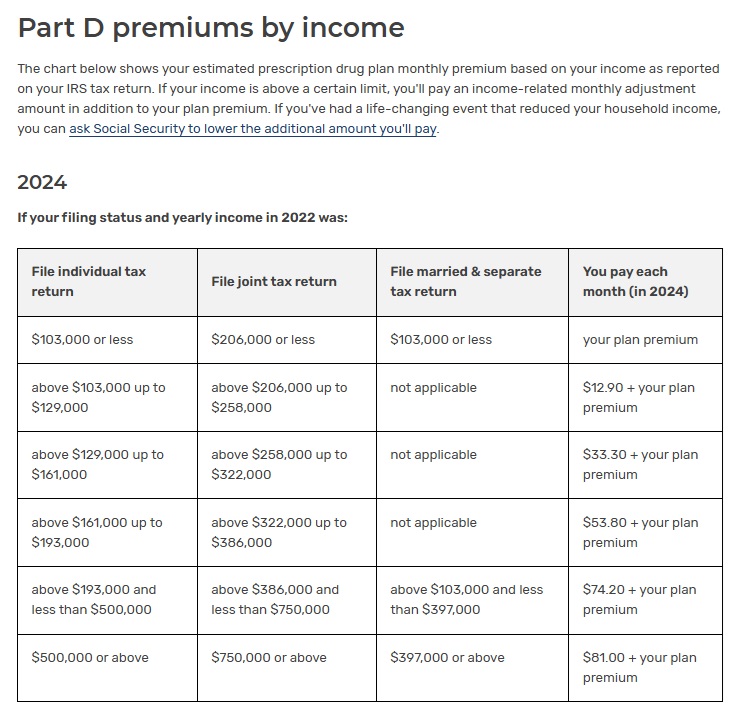

Medicare Part D drug plan premiums are also subsidized by the federal government. Because the Part D premiums are set by the insurer offering the coverage, there is not a set benchmark dollar amount like there is with the Part B premium. Consequently, a base plan premium is calculated by Medicare for the Part D plans to determine the Income Related Monthly Adjustment Amount. The income amounts and tax filing status are the same as the Part B IRMAA.

For a single tax filer who reported an modified adjusted gross income between $129,000 and $161,000, they would invoiced $33.30 every month by Medicare for the IRMAA. The extra amount is not paid to the Part D insurance plan.

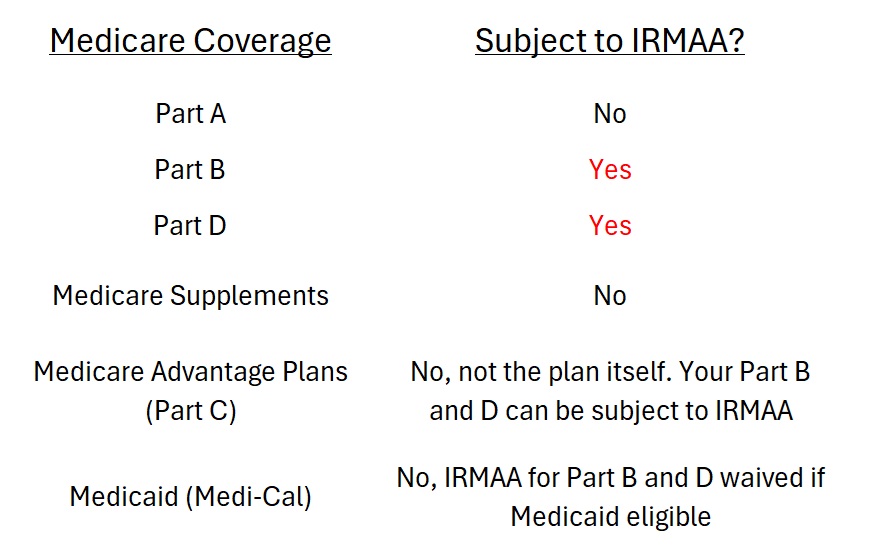

There is no IRMAA related to Medicare Supplement plans. It only applies to the federally subsidized Part B and Part D coverage. If you are enrolled in a Medicare Advantage plan, you must have Part B. Most Medicare Advantage plans include Part D drug coverage.

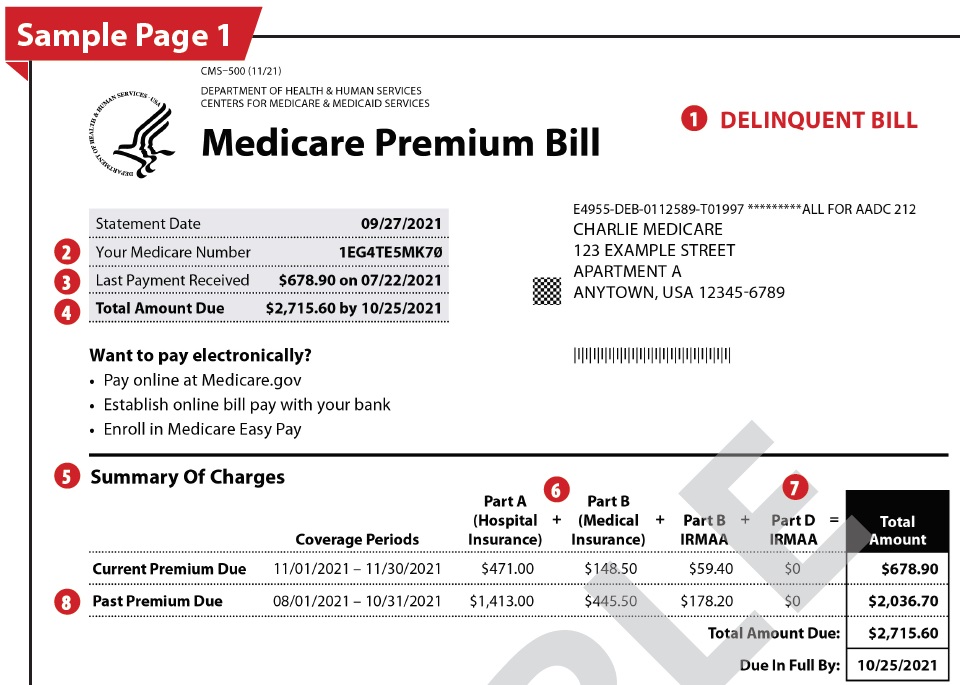

The IRMAA will not be invoiced by either the Medicare Advantage plan or a standalone Part D drug plan. If you are not receiving Social Security income, Medicare or The Railroad Retirement Board will send you an invoice for the Part B premium and any IRMAA. If you are receiving Social Security income, the Part B and IRMAAs will be deducted from the monthly deposits.

Social Security, IRS, and Medicare IRMAA

The Social Security Administration and Medicare work together to make the IRMAA happen. First, Social Security queries the Internal Revenue Service about the reported modified adjusted gross income of Medicare beneficiaries. Second, if the income is within the range for an IRMAA, Social Security will send a letter to the beneficiary notifying them if they are subject to the additional cost for Part B and/or Part D. Some people enroll in Part B, but not a Part D prescription drug plan because they have other coverage such as Veterans Administration benefits.

The modified adjusted gross income is captured from the last filed federal tax return. This means that the IRMAA application can be over a year old. For instance, 2024 IRMAAs were based on 2022 tax returns because 2023 tax returns are not filed until after 2024 has begun. If the 2022 modified adjusted gross income (MAGI) is under the IRMAA threshold, but 2023 MAGI is higher and triggers an IRMAA, you will get a letter from the Social Security Administration.

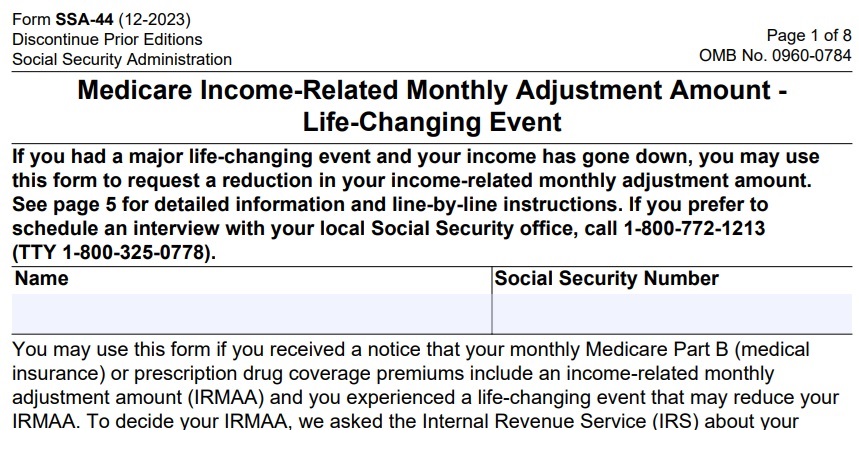

Life Changes, Income Decrease, IRMAA Waiver

If the Medicare beneficiary qualifies for the Medicare Savings Program, extra help from Medicaid (Medi-Cal) based on low household income, the IRMAA is removed. There are other life changes that affect income adversely and should be communicated to Social Security.

- You married, divorced, or your spouse died.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy, or reorganization.

If your household income drops because of any of the above mentioned life qualifying events, you can file a request with the Social Security Administration to remove the IRMAA, form SSA-44.

There are times when unfortunate good events occur that lead to the IRMAA. In preparation for retirement, some people sell property or homes that spike their adjusted gross income up for one year. If that specific year, where the adjusted gross income is over the IRMAA threshold, the additional cost is triggered. Fortunately, the IRMAA will be removed after the Social Security Administration gets the next tax return information and verifies your AGI is below any IRMAA trigger.

Pat, Don, and IRMAA

Pat and Don are a married couple. Pat is age 67 and Don is age 64. Pat retires from work and leaves the employer group plan. Pat activates Part B of Medicare. For the last filed tax year, the modified adjusted gross income for Pat and Don was $350,000. Pat will be subject to an Income Related Monthly Adjustment Amount for the Part B and Part D.

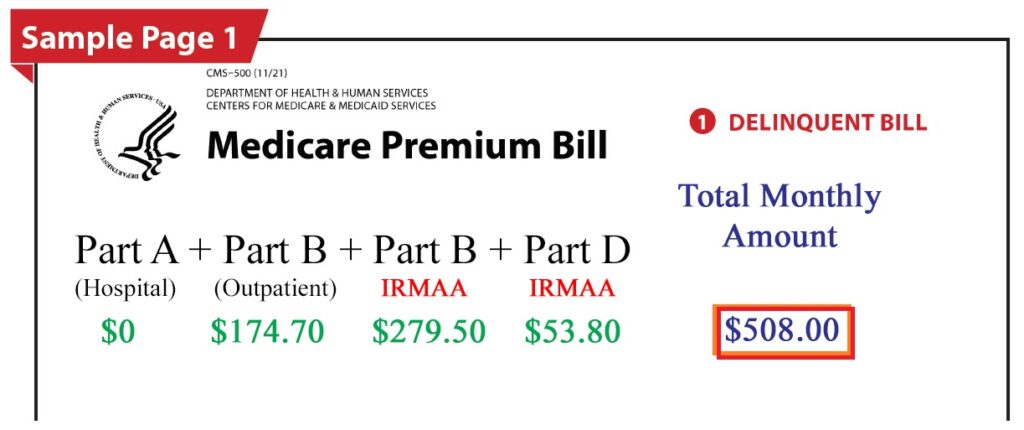

Because Pat is not taking Social Security retirement benefits, Medicare will send an invoice. The is no premium Part A. For 2024, the base Part B premium is $174.70. The Part B IRMAA is $279.50 based on the household income for a married couple filing a joint tax return. The Part D IRMAA is $53.80. Pat must pay Medicare $508.00 every month in addition to Medicare Advantage plan premium or Medicare Supplement plan and Part D drug plan premium.

If the couple’s household income is still above the IRMAA threshold when Don turns 65 and enrolls in Medicare, Don will also be subject to the extra IRMAA costs.

*MAGI, modified adjusted gross income is the adjusted gross income from form 1040 plus tax exempt interest. https://www.ssa.gov/benefits/medicare/medicare-premiums.html