Medicare Advantage and Part D prescription drug plans are complicated. As an agent, I have always struggled to properly analyze the Medicare options for my clients so they can enroll in a Medicare plan that best fits their situation at the lowest cost. I recently started using a customer relationship management (CRM) application from FairStreet to assists me in presenting the best options to my Medicare clients.

The various permutations and combinations offered to a Medicare beneficiary for their health care services and prescription drugs can be overwhelming; a tsunami of information overload. Consequently, it is important to put the person at the center of the universe and see what Medicare options align with the individual’s lifestyle, budget, health care and drug needs.

FairStreet Software To Narrow Medicare Advantage Plan Choices

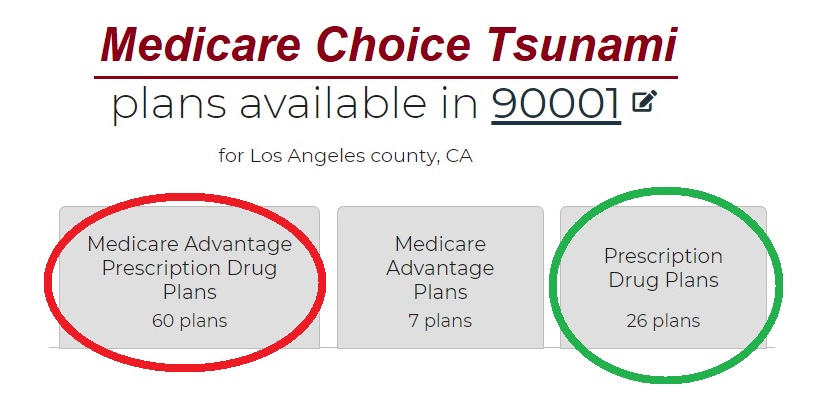

In Los Angeles County a Medicare beneficiary has over 60 Medicare Advantage plans and 26 different prescription drug plans to choose from. It is no small task to filter all the different plans to find the Medicare Advantage or prescription drug plan that fits the beneficiary. The FairStreet CRM application is helping agents like me analyze the various Medicare options for individuals who come to us seeking guidance in the Medicare landscape.

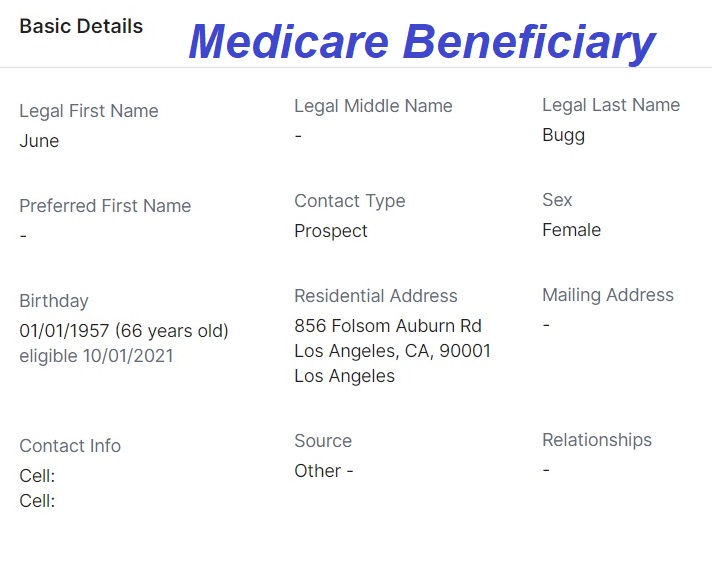

The start of the process is just the basic details: address, birthdate, contact, etc. However, the basics are crucial because the Medicare Advantage plans are county based. Many people will see an advertisement on the TV for a Medicare Advantage plan that sounds great, but it may not be offered in the county where the individual resides.

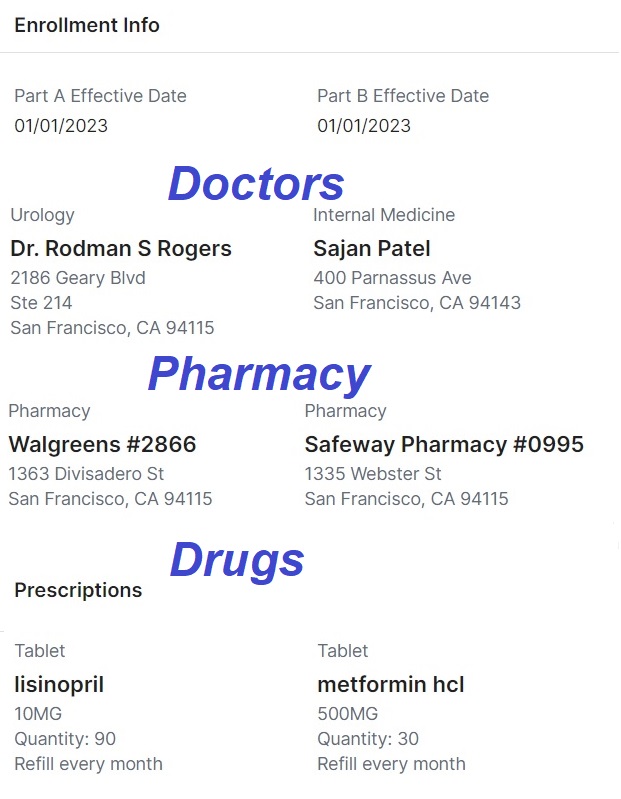

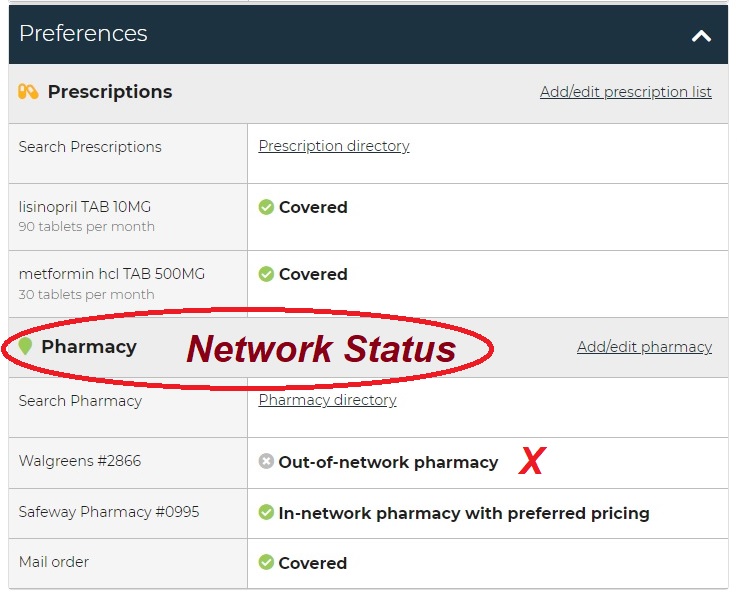

We then capture the specifics of doctors, pharmacies, and prescription drugs.

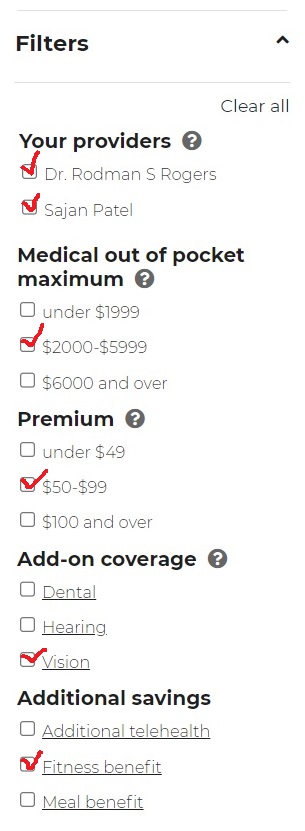

When we go to view the available plans, we can filter the search results for different criteria such as providers, cost, and if various additional elements such as dental and fitness benefits are important.

Medicare Plan Review, Analysis Based on Beneficiary Criteria

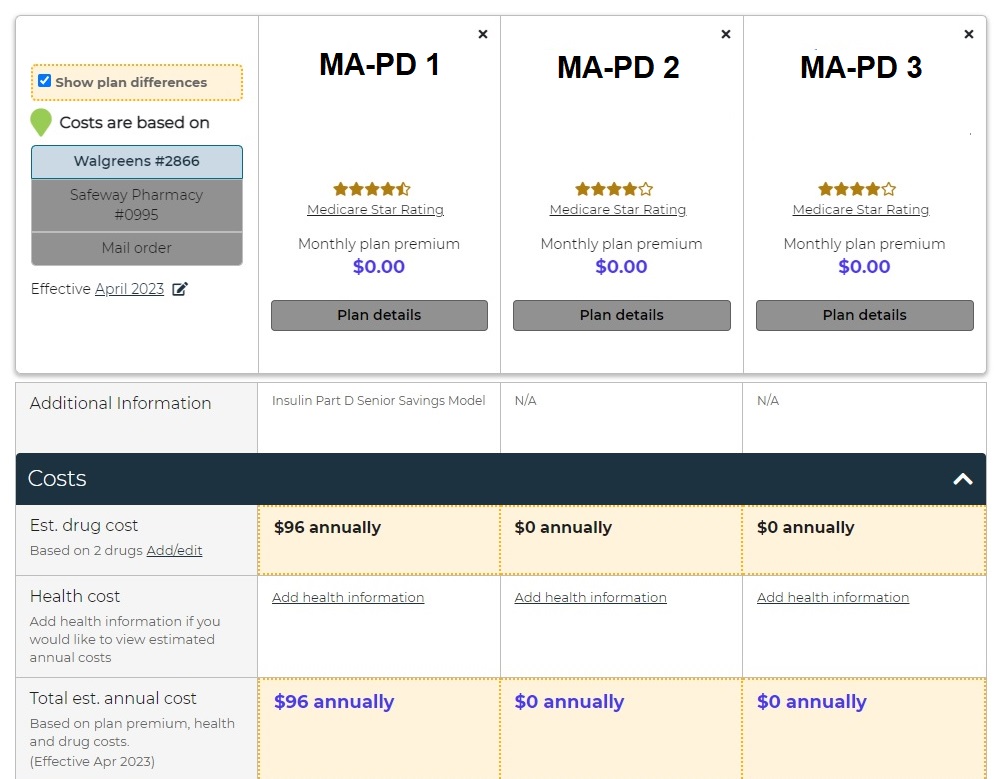

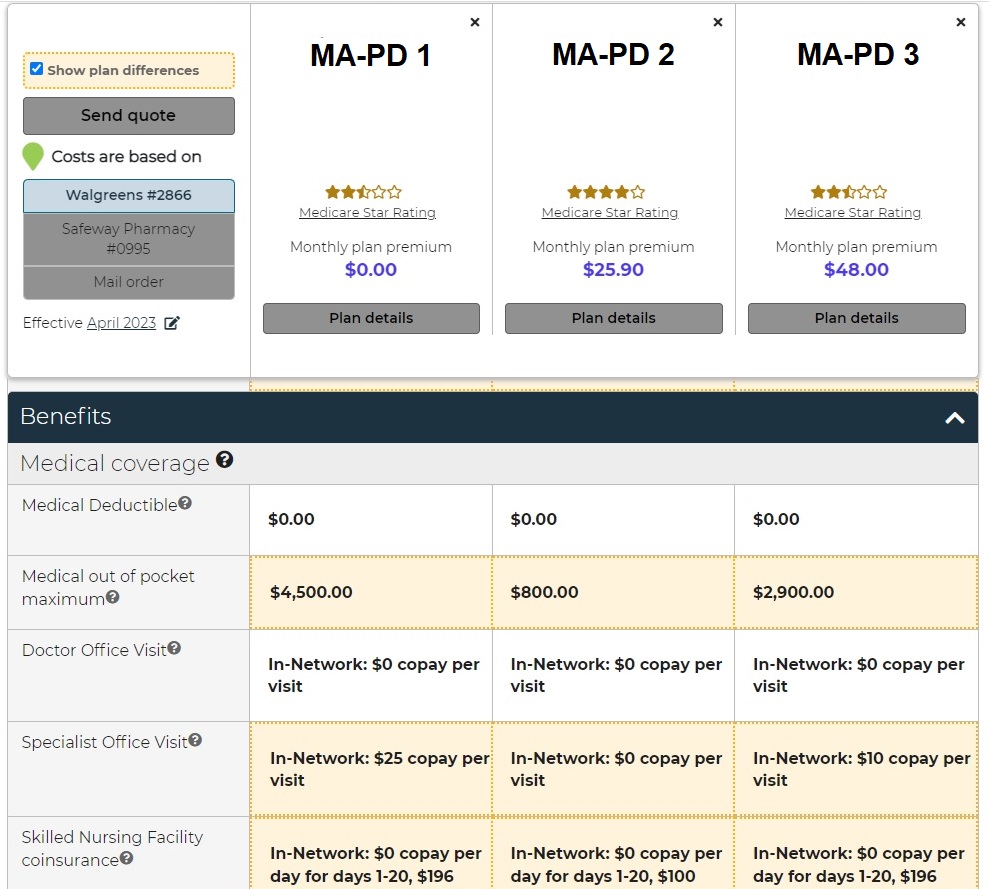

We can then compare those plans that meet the search criteria. The FairStreet application will give us estimated costs of the Medicare Advantage plans based on monthly premium and prescription drug costs.

However, the fixed costs or premiums and drugs is only part of the analysis. Each plan can have slightly different cost-sharing for health care services. FairStreet allows us to compare a variety of health care services and the cost to the beneficiary. Some people know they will be using a lot of health care services so they might give a preference to Medicare Advantage plans that have a low maximum out-of-pocket annual amount.

Prescription Drug Plan Analysis

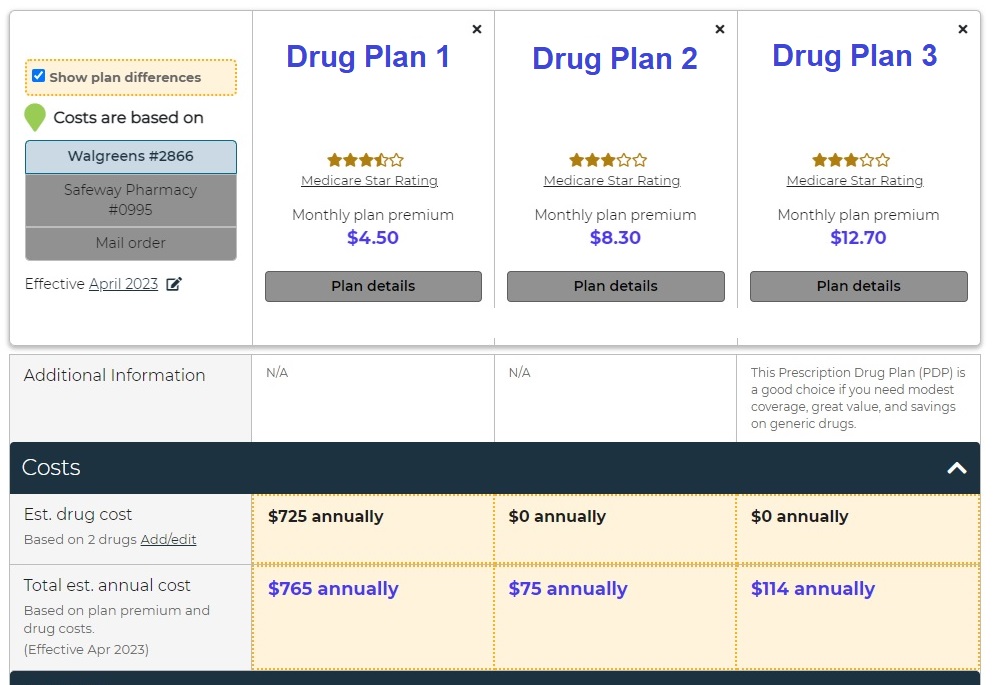

Of course, not everyone wants a Medicare Advantage plan. Some people want to stay in Original Medicare and add a Medicare Supplement plan and a prescription drug plan. Prescription drug plans are some of the most complicated and shifty Medicare insurance products ever designed.

With FairStreet, it takes the entered prescription drug information for the beneficiary and taps into a huge database of drugs to display the annual and monthly anticipated beneficiary drug costs. This is also where the consumer’s favorite pharmacy comes into play. Some pharmacies are NOT in a drug plan’s preferred network. If you patronize a pharmacy not in the preferred network for your drug plan, you’ll pay higher prices.

With the captured prescription drugs for the beneficiary, FairStreet will give us the projected monthly cost of the medications. Some plans have no copay for generic drugs, other plans require you move through a deductible before the lower cost copayments are applied. If the cost of prescription medications is a big monthly budget item for you, this is where carefully scrutinizing the Medicare Advantage and prescription drug plans carefully can save money.

As an agent, I am subject to a variety of different Medicare marketing rules. FairStreet helps me stay compliant and not trip over myself. Medicare now requires all Medicare Advantage and prescription drug plan conversations be recorded. Medicare Supplement conversations are not subject to the recording rules. With FairStreet, I can initiate recorded phone calls right through my computer so I stay within the lane of Medicare marketing dictates.

The team at FairStreet had to overcome my built-in skepticism. One aspect of their company that they inadvertently revealed to me was that they were not a sales company. They had a different approach and perspective. The emphasis was on providing clear information for appropriate analysis of Medicare options. This is what we need in the senior Medicare market. We need less emphasis on sales and more focus on education, information, and beneficiary compatibility with the Medicare plans.

If you are working with an agent, or plan to do so, make sure they are using a CRM like FairStreet so you can view all of your available options. Only a gigantic overhaul to the Medicare Advantage system will make it less complicated for beneficiaries. Until that happens, FairStreet is helping me filter out Medicare plans that make no sense for my clients.

FairStreet does not pay me and I don’t pay them for the use of their CRM application. I was not paid to write this blog post. To learn more about FairStreet, you can visit their introductory video https://www.youtube.com/watch?v=ew1IHERjUbg