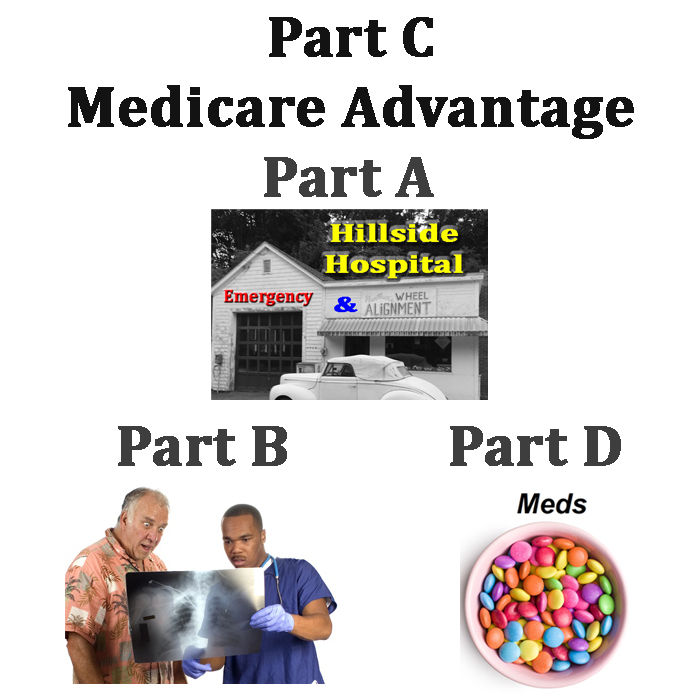

Medicare Advantage plans are private health insurance plans that covers all of the Medicare benefits of Original Medicare Parts A and B. Many Medicare Advantage plans also include prescription drug coverage. Medicare Advantage plans are not the same as Medicare Supplement or Medi-Gap plans.

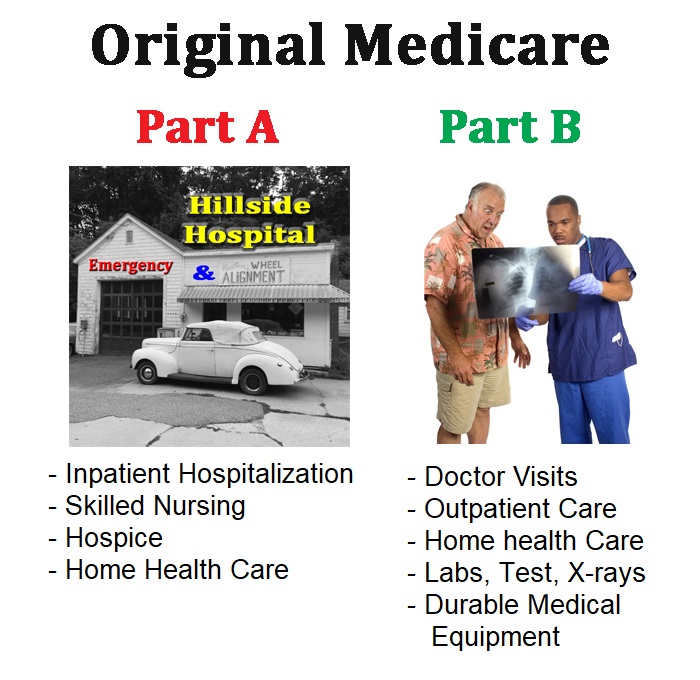

Original Medicare is pretty good health insurance, but it has some serious deficiencies. For example, there is no maximum out-of-pocket cap on either Part A or Part B of Original Medicare. In addition, Original Medicare has no coverage for prescription medications you receive from your local pharmacy.

Part D prescription drug plans were developed to cover medications purchased at your local retail pharmacy.

Medicare Advantage plans include Part A, B, and D and are designated as Part C.

Medicare Advantage Plans More Like A Traditional Health Plan

Medicare Advantage plans more closely resemble a traditional health insurance plan you may have had from your employer or individual and family plan. They have predictable copayments for many routine health care services such as office visits, labs, tests, and x-rays. Most Medicare Advantage plans include the Part D prescription drug coverage within the plan. For medical services, Medicare Advantage plans have a maximum out-of-pocket amount. Once the dollar amount is met, the Medicare Advantage plan covers all future medical services at zero cost to the plan member.

The plan sponsors or insurance companies who offer Medicare Advantage plans contract with the Center for Medicare and Medicaid Services to offer their plans in specific counties. The Medicare Advantage plans assume all the risks and liabilities of providing covered benefits to the enrolled Medicare beneficiaries. Medicare pays the Medicare Advantage plans a set amount every month – anywhere from $600 to several thousand dollars – to administer the health plans and assume the financial liability.

When you enroll in a Medicare Advantage plan you don’t loose Original Medicare. You will always have Original Medicare. It’s just that the Medicare Advantage plan is handling all of your health care service claims and prescription drug benefits, if included in the plan. Every year during the Annual Enrollment Period (October 15 – December 7) you can change Medicare Advantage plans or drop your plan and return to Original Medicare.

Original Medicare is a giant PPO. You can see any provider who accepts Medicare assignment anywhere in the United States. Many Medicare Advantage plans have provider networks. If you go outside of the network, the plan may not cover any of the service costs. Many Medicare Advantage plans are HMOs (Health Maintenance Organizations) that require you select a Primary Care Physician (PCP.) The PCP must make a referral for certain services or to see a specialist. Emergency room care for a serious life-threatening condition does not need a referral.

There are several different types of Medicare Advantage plans that have smaller or larger networks. Not every type of plan will be offered in the county or region where you reside.

List of types

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS)

- Special Needs Plans (SNP)

- HMO Point-of-Service (HMOPOS)

- Medical Savings Account (MSA)

- Medicare Cost Plan

Carefully read how each plan works so you don’t have any surprises. However, the first filters for narrowing down your plan selection are your doctors and hospitals. Each Medicare Advantage plan maintains an online list of their contracted providers and hospitals. Once you have plans that include your providers, you will want to check the drug formulary if the Part D prescription drug benefit is included in the plan. Some Medicare Advantage may not include your preferred prescription medication. Or, it may be on the formulary, but at a higher drug tier and cost than another Medicare Advantage plan.

Medicare Advantage plans can also include benefits and services that Original Medicare does not cover such as dental, vision, podiatry, or hearing aid benefits. Just like checking for your medical doctors, you will want to research if your preferred dentist or optometrist participates with the Medicare Advantage ancillary benefits package.

A quick search on Medicare.gov for Medicare Advantage plans offered in your county will show you the available plans and their monthly premiums, if they have one. Medicare Advantage plans don’t work with Medicare Supplement or Medi-Gap plans. It is a waste of money to have both because if you are enrolled in a Medicare Advantage plan, you must receive all your health care services through that plan.

Medicare Advantage Pros and Cons

Potential Positives for Medicare Advantage Plans

- All of your doctors and hospitals may be in-network

- Annual cap on your out-of-pocket expenses for health care services

- Guarantee issue, no waiting period or exclusions for pre-existing conditions

- Predictable copayments for most routine services

- You deal directly with the insurance company and not a federal bureaucracy

- Can include prescription drug benefits

- May include extra benefits not covered by Original Medicare such as dentistry and optometry

- Overall costs can be lower than Original Medicare plus Medicare Supplement and Part D prescription drug plan

- Some Special Needs Plans can help coordinate care for people with chronic conditions

Potential Drawbacks of Medicare Advantage Plans

- Network of providers may not include your preferred doctors or hospitals

- Some plans require a Primary Care Physician for referrals

- You may not be able to get routine medical care if you take extended vacations and you are out of the network region

- Provider networks can change from year to year

Medicare Advantage plans work well for some people and can be a disaster for other folks. The great thing about Medicare is you always have options every year to change plans or go back to Original Medicare if you want.