Medicare premiums and deductibles will be increasing in 2022. The jump in Part B premiums will be felt most by lower income Medicare beneficiaries who receive no extra help from Medicaid. Even with the modest Medicare cost increases, transitioning from a subsidize Covered California health plan to Medicare could still be shock.

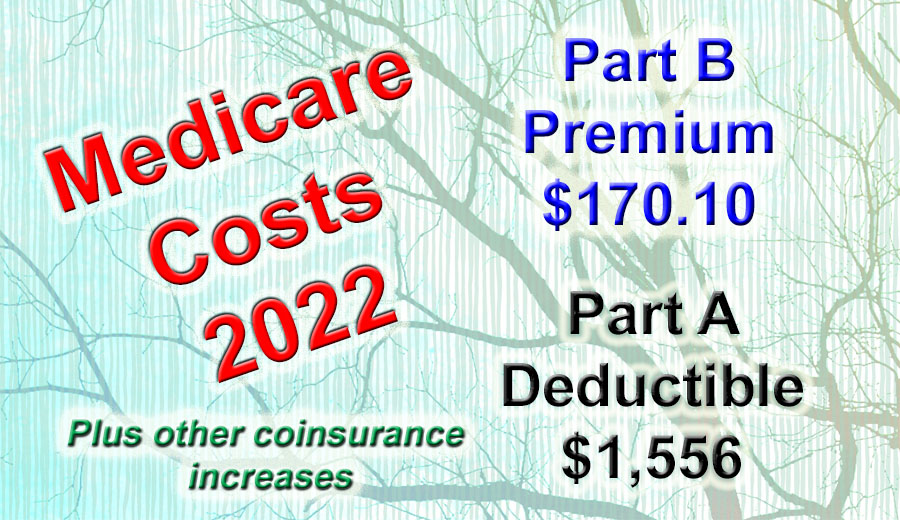

Part B Premium Increases to $170.10 per Month

The Medicare Part B premium for out-patient coverage will increase from $148.50 to $170.10 per month. The new Part B premium is for individuals earning less than $91,000 per year or $182,000 on a joint federal tax return. For incomes over the base, there is an income related adjustment that increases the monthly premium.

The Part B deductible will increase in 2022 to $233 annually, up from $203 in 2021. After the Part B deductible is met, most services covered under Part B (office visits, labs, tests, imaging, etc.), the Medicare beneficiary rolls into 20 percent coinsurance. This means the patient pays 20 percent of the Medicare negotiated rate for the service. If the specialized imaging costs $1,000, the patient would pay $200.

Part A Hospital Deductible up to $1,556

The Part A hospitalization deductible will increase from $1,484 to $1,556. The deductible covers a 60-day benefit period. The daily copayment or coinsurance for extended hospital stays or skilled nursing facility admission will also increase in 2022.

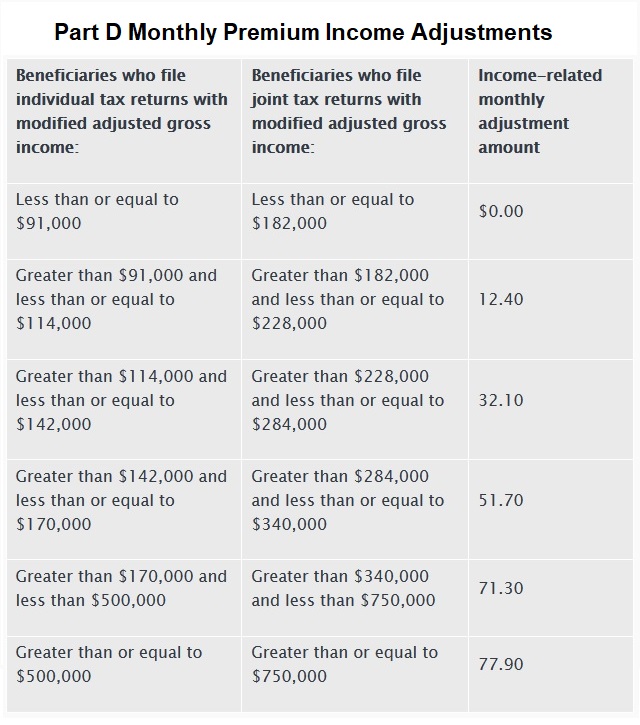

There is no income related adjustment on Part A as most people qualify for $0 cost Part A by virtue of working for 40 quarters and paying the Medicare tax. There is an income related adjustment to the Part D prescription drug plans, similar to Part B.

Medicare Advantage, Supplements, Part D Plan Shopping

There are a couple different ways to structure Medicare coverage. In the absence of any extra help from Medicaid or Social Security for Part D prescription drug coverage, the average Medicare beneficiary will realize the $170.10 for Part B and approximately $35 (national average) for a Part D plan. If the beneficiary adds a Medicare Supplement to cover most of the deductibles, copayments, and coinsurance of Original Medicare, there could be an additional cost of approximately $150 (Plan G in California.) That brings the monthly insurance costs up to $355.

Another way to receive Medicare coverage is through a Medicare Advantage plan. There are usually several plans that will have a $0 monthly premium that includes prescription drug coverage. For those lucky people who have access to a $0 monthly Medicare Advantage plan, they will only be liable for the Part B premium of $170.10. Unfortunately, some California counties only offer a couple of Medicare Advantage plans and their rates can be near $100, making the monthly cost $270.

If the higher Part B premiums are pinching the budget, always apply for extra help through your local social services department and apply for the Social Security Low Income Subsidy (https://www.ssa.gov/benefits/medicare/prescriptionhelp.html) to potentially reduce the cost of the Part D premium and drug costs. If income and assets preclude any extra help, shop for a lower cost Part D plan. There are many Part D prescription drug plans under $15 per month. If you are not taking any high-cost brand name medications, the lower cost Part D plans may save money.

For people receiving health insurance through Covered California with a subsidy, the higher Medicare costs can be a real shock. Original Medicare is pretty good health insurance. The real downside is that it does not have a maximum out-of-pocket amount like a traditional health plan. When you have Medicare coupled with a Medicare Advantage plan or Medicare Supplement with a Part D plan, it is like have a metal tier Gold or Platinum plan.