If you are awarded money through a settlement because of an injury or accident you were involved with and you received health care services from a Medi-Cal provider, you will have to pay for that health care from the proceeds of the award. Medi-Cal will file a lien to recover the cost of the health care services.

Repaying Medi-Cal For Health Care Services

If you applied for MAGI Medi-Cal through Covered California, you may have seen the question about whether a household member is involved in a lawsuit because of injury or accident? This question only pops-up if the application determines an adult or child may be eligible for MAGI Medi-Cal based on the estimated income. The purpose of the question is to alert Medi-Cal that if one of the individuals receives health care services from a Medi-Cal provider and receives a settlement because of injury or accident, Medi-Cal can get repaid for those health care services.

DHCS Places Lien on You for Reimbursement

Technically, it is not the county Medi-Cal office who seeks repayment for health care services from a settlement. The Department of Health Care Services, the California state agency that manages Medi-Cal, has the Personal Injury Program that is tasked with seeking the reimbursement for Medi-Cal services. The process for reimbursement is triggered when Medi-Cal is notified that a beneficiary is involved in an action that may result in a settlement from a third-party as compensation for an injury or accident.

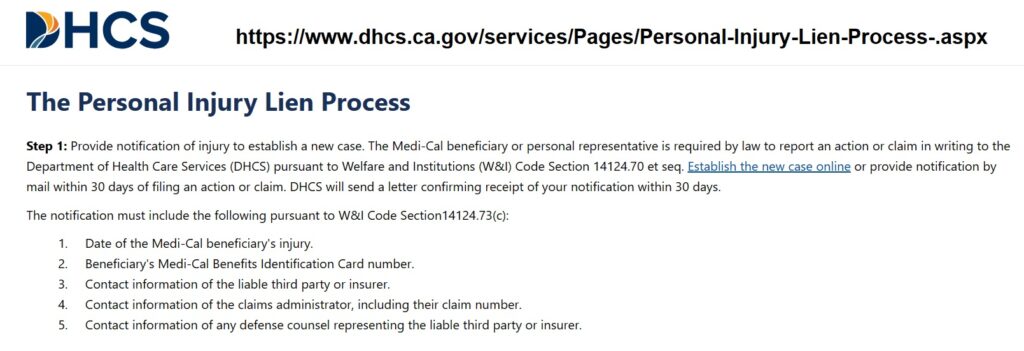

State and federal law require Medi-Cal to seek the reimbursement for health care services from any settlement that results from a personal injury or accident paid by a third-party such as an insurance company that covered the responsible party for liability. If you are represented by an attorney, they must inform Medi-Cal of the proceedings. You or your representative must notify the Department of Health Care Services (DHCS) within 30 days of commencing an action on your behalf.

Personal Injury Program Lien Process

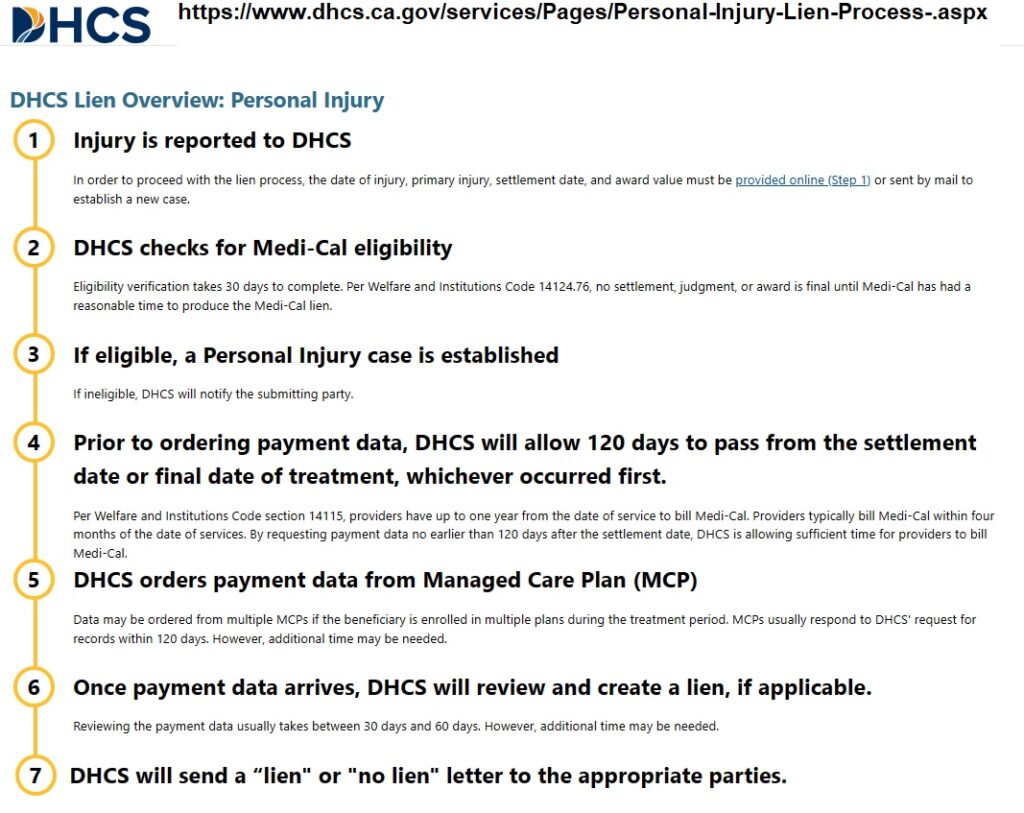

Notification of the legal action to DHCS begins a process of review that can result in a lien on you. The lien will cover all health care services provided that addressed the medical issues as a result of the injury. The process can take over 4 month, 120 days, as DHCS must give time to the health care providers to submit claims either to your county or to your Medi-Cal HMO plan.

There are several scenarios that can complicate the process and require you to review all the health care bills that may be subject to the lien.

- In reference to the Covered California application about injury or accident, a household member may have been receiving health care under an employer health plan for the injury. Once the member transitions from the group plan to Medi-Cal eligibility, the continued treatment could be subject to the DHCS lien. However, you don’t want the DHCS lien to recover payments made by the employer plan.

- A household member may be receiving health care for a condition completely unrelated to the injury or accident. You don’t want claims for the pre-existing condition treatment to be included in the DHCS lien.

Because the DHCS lien will most likely be paid out of any settlement you receive, you don’t want it inadvertently lowered for claims by another insurance plan or for treatment that is unrelated to the injury or accident. While DHCS can provide assistance with filing the notification about the legal action for an injury or accident, you are on your own update the case and monitor the claims subject to recovery from the Personal Injury Program lien process.