Parents can be shocked when their children are placed into Medi-Cal through Covered California because of the family income.

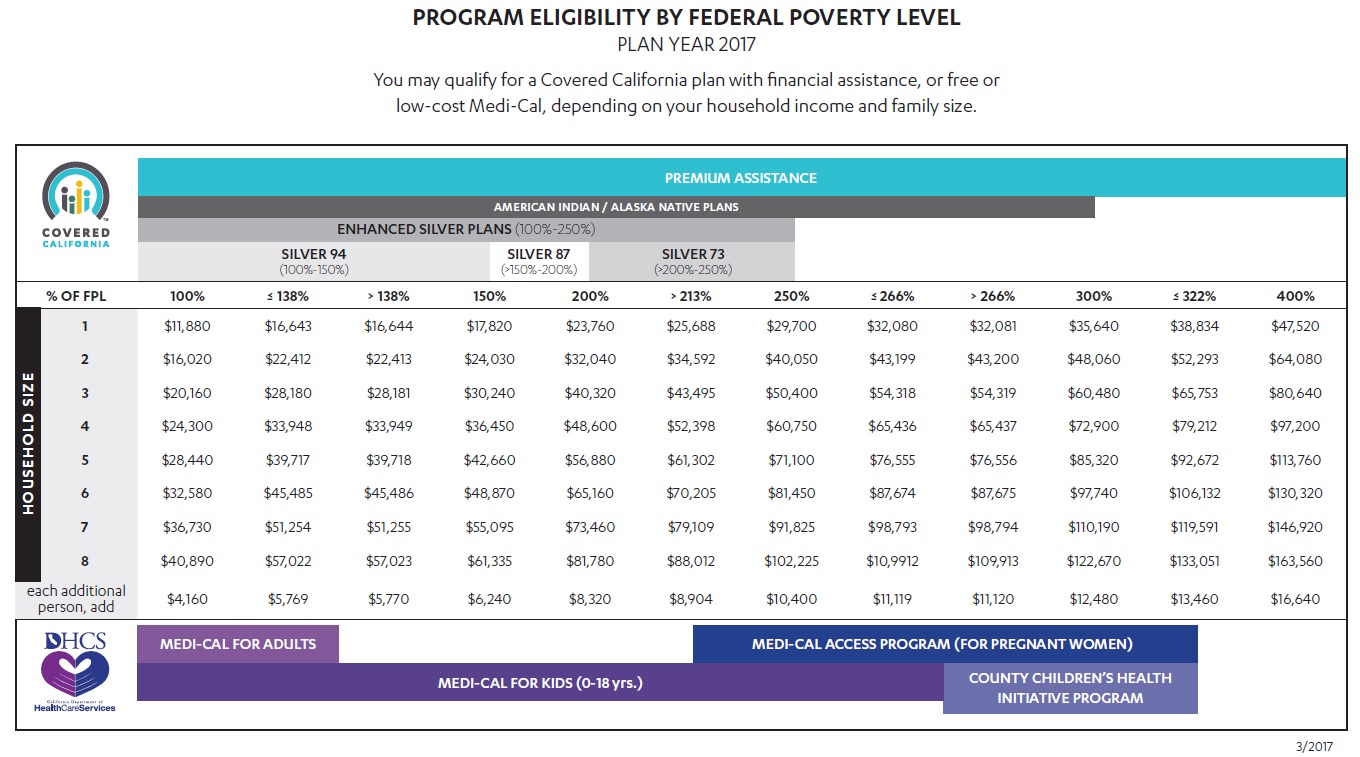

Many parents are surprised to learn that their children are placed in Medi-Cal after completing the Covered California health insurance application. Medi-Cal eligibility is determined by the monthly household income, not the annual Modified Adjusted Gross Income. If the monthly household income is below 266% of the federal poverty level (FPL), but above 138% of the FPL, children in the household will automatically be put into Med-Cal. The parents will receive tax credits to purchase a private plan when the MAGI falls in the above income range.

Covered California Shop & Compare Tool

The 2017 Shop and Compare on the Covered California website may not accurately reflect if you dependents under 18 years old are Medi-Cal eligible. With household income ranges between 138% of the FPL and 266% FPL, children are shown as part of the household members receiving premium assistance. In reality, the children will be Medi-Cal eligible and not eligible for premium assistance and a private health plan. See: Covered California Shop and Compare Tool is broken.

[wpfilebase tag=file id=1933 /]

Medi-Cal is monthly income

Eligibility for the Affordable Care Act health insurance Premium Tax Credits are determined by the households’ annual Modified Adjusted Gross Income (MAGI). But when it comes to Medi-Cal in California the monthly household MAGI takes precedence. This can be confusing and is not necessarily explained very well on the Covered California website. Even if a family calculates that their annual MAGI will be above 266% of the FPL they may still find their children deemed Medi-Cal and ineligible for the Advance Premium Tax Credits to be included in the family’s private health plan.

Bay Area counties have higher income limits

The counties of San Mateo, San Francisco, and Santa Clara have higher income eligibility limits for Medi-Cal kids program. Where other counties use 266% of the federal poverty level (FPL), these Bay Area counties will determine children eligible for Medi-Cal when the household income is up to 322% of the FPL. At the end of March 2016, children in these counties where the household income is below 322% of the FPL will be kicked off the parent’s health plan with premium assistance. The parents must either pay the full premium amount for the children’s health insurance or allow them to be placed into the Medi-Cal system. For more information and to review the notices being sent out to Covered California consumers please see: Medi-Cal set to snatch Bay Area kids from parent’s plan.

Prior income doesn’t count

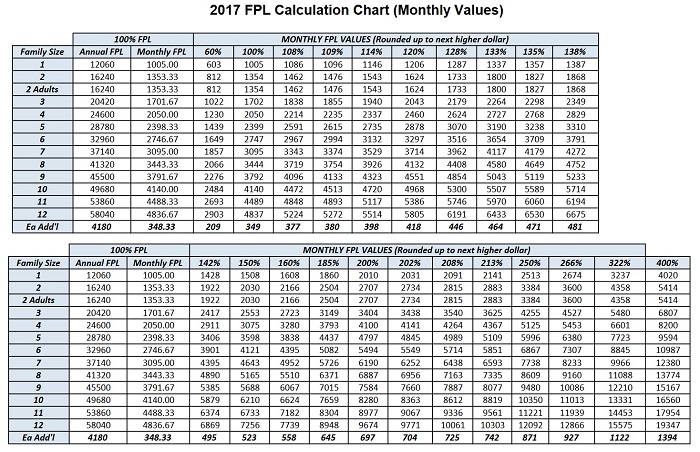

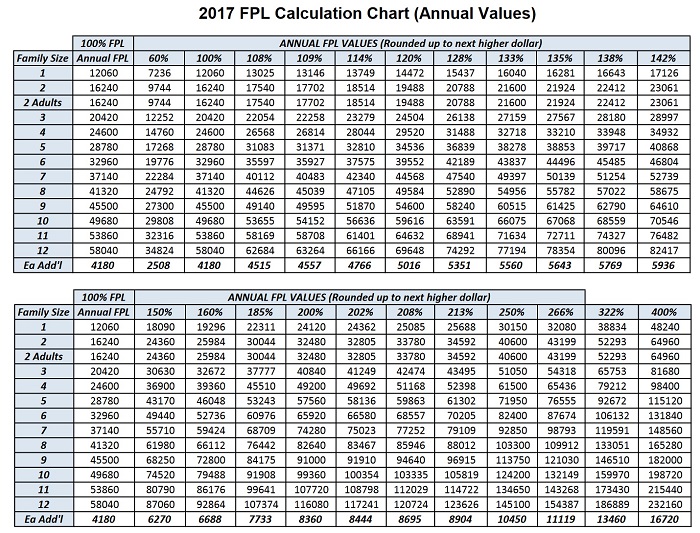

For example, let’s say a family of four (two adults and two children) are enrolled in one of the parent’s group health insurance plans. The family has a MAGI of $6,000 per month. Six months into the year the parent with the health insurance leaves his or her job to accept a position that offers no health insurance and takes a cut in pay. The new MAGI is $5,000. On paper, the household MAGI would be $66,000. Under the 2014-2015 Covered California Income Table this family of four qualifies for all the household members to receive tax credits because the annual income is above 266% of the FPL.

Note: families in San Mateo, Santa Clara and San Francisco counties have a higher income level of the federal poverty level, 322%, that make children eligible for Medi-Cal.

Monthly income safety net

But the Covered California CalHEERS enrollment system focuses on the monthly income, not the annual income. The new $5,000 MAGI (calculated as $60,000) puts the children under 19 years of age into Medi-Cal. The basic rational for basing eligibility on monthly and not annual income is an effort to always make the health insurance premiums, which are made on a monthly basis, affordable for the family. A family could have earned in excess of 400% of the FPL making them ineligible for any tax credits, but as soon as the household income drops to zero because of the loss of a job, all the household members would be put into Medi-Cal.

Income must be verified

There are creative ways to adjust the household income when applying for Covered California. However, families enrolling through Covered California will ultimately have to prove they have the income they stated. There is also the issue that consumers agree to notify Covered California of any income change within 30 days so it can be accurately reflected in the system.

To see a break down of the various programs by FPL percentage, please visit: https://calhealthnews.com/2017-medi-cal-monthly-and-annual-income-charts/