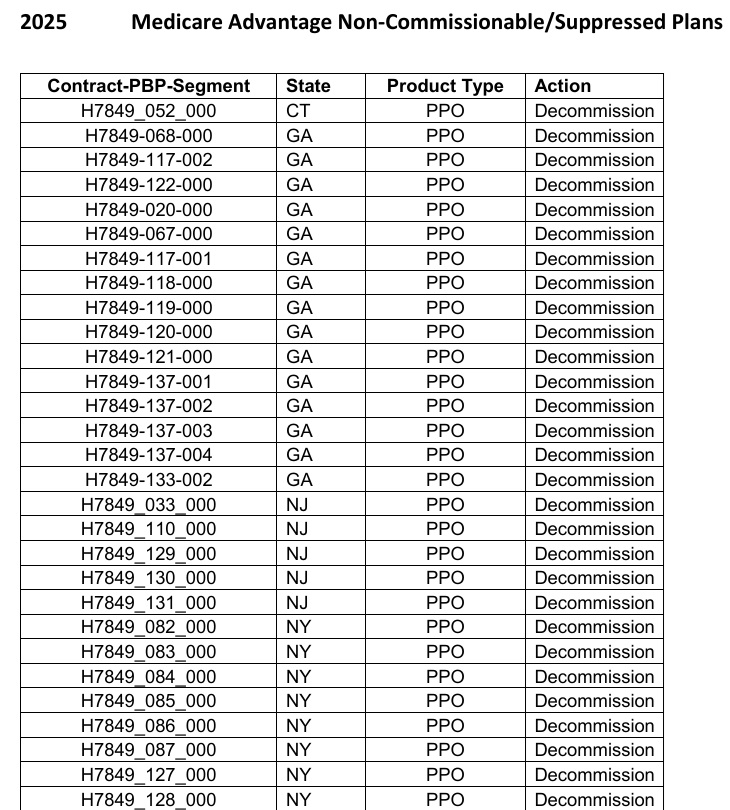

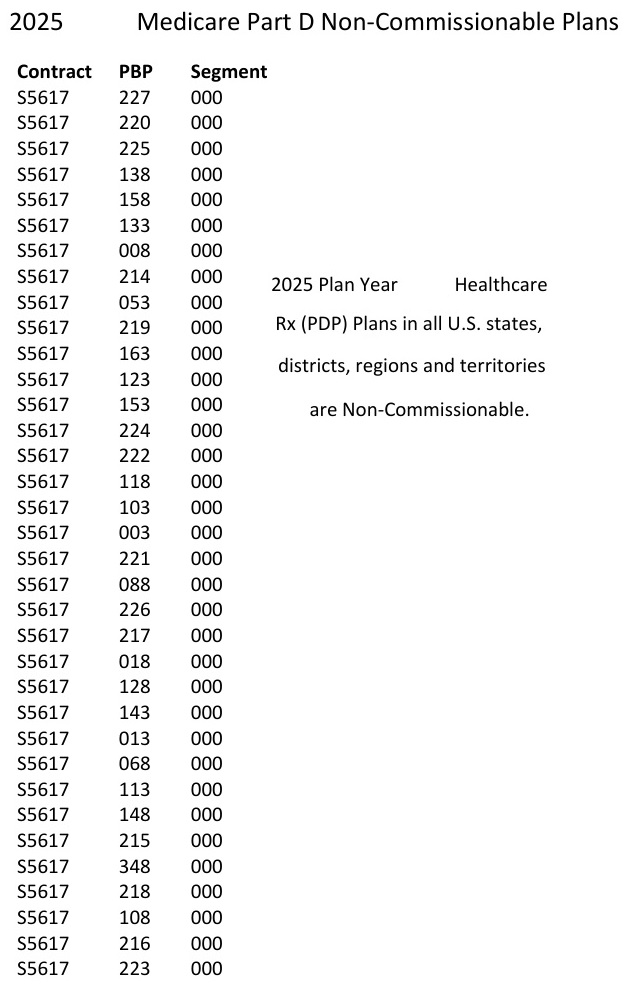

Many Medicare Advantage and Part D prescription drug plans have been flipped to a non-commission status for agents for 2025. After spending hours studying to get Medicare certified, health insurance agents have learned that many plans will not pay them a commission to help Medicare beneficiaries enroll in a Medicare plan. Many agents are pulling back and avoiding costly client encounters because their time will not be compensated.

Agent Training, Time, and Money

Agents learned of the new non-commission status plans AFTER they paid $175 for Medicare training and spent many hours studying to get certified for a variety of Medicare plan sponsors. The plans announced the non-commission plan status at the end of October AFTER the Medicare Annual Enrollment Period had started on October 15.

In order for a licensed insurance agent to represent Medicare Advantage and Part D prescription drug plans, they must first pass a national Medicare training course. This course from the American Health Insurance Plan (AHIP) costs $175. Next, the agent must study to pass a certification course for each plan sponsor they want to represent during the year. The national certification and plan specific certification must be passed before an agent can earn any commissions on any Medicare plan enrollments they perform.

I estimate that as an agent I have spent over 30 hours studying and taking multiple tests to be certified to represent eight different plan sponsors of Medicare Advantage and Part D prescription drug plans. This was after I paid $175 to get my federal Medicare training certificate. Then the rug was pulled out from under me and other agents by the plan sponsors who announced that hundreds of Medicare plans would not pay a commission.

Medicare Plan Enrollment Commissions

Commissions for Part D drug plan are approximately $100 per application. Commissions on Medicare Advantage plans can be as high as $750. The commissions are usually paid once after the enrollment is complete and can be clawed back by the plan sponsor if the beneficiary leaves the plan early. Commissions can also be reduced for partial year enrollment such as the beneficiary only enrolling for the last three months of the year.

Medicare requires agents to disclose to the beneficiary they are compensated for the enrollment. I have not read if Medicare requires agents to disclose the is no commission on an enrollment.

Proper Medicare Enrollment Requires Time to Evaluate Costs and Plans

A proper review of a Medicare beneficiaries health care needs, doctors, and prescription medications requires a certain amount of time regardless of whether the enrollment is for a full or partial year enrollment. A large portion of time is spent entering the beneficiary’s drugs into the quoting system ensuring the brand, type, dosage, packaging, frequency, and preferred pharmacy are correct. Of course, then there is the evaluation of the plans with the beneficiary reviewing the Summary of Benefits along with the member cost sharing to determine which plan is the best fit for the beneficiary.

As an example, I spent a wonderful morning with a couple who requested assistance with evaluating their Part D prescription drug plan options. We checked their prescriptions and determined the monthly cost of the drugs for each of the drug plans. The best plan for each of the Medicare beneficiaries were plans that will not pay a commission for 2025.

I ate two slices of delicious pumpkin bread and had a tasty cup of coffee at the couple’s home. However, after over two hours reviewing plans and then submitting the enrollments, my compensation was the pumpkin bread and coffee.

Some Agents May Hard Sell on Commissionable Plans

The sales and marketing teams of the Medicare Advantage and Part D drug plan sponsors will tell the agents to push the plans that pay an agent a commission. Don’t show the beneficiaries the non-commission plans. Only show the beneficiaries the more expensive plans that have higher monthly premiums. Put the hard sell on and tell the beneficiaries the higher priced plans offer more protection against high drug costs.

There are two problems with the sales department’s recommendations. First, all the training Medicare agents undertake emphasizes enrolling beneficiaries into plans that are best for the individual and not the agent. Second, a higher priced drug plan doesn’t necessarily provide better coverage.

The higher premium drug plans may have lower drug costs. However, all drug plans are capped at a $2,000 maximum out-of-pocket amount. If you hit the maximum out-of-pocket amount in the middle of the year, and the plan has a relatively high premium, you still have to pay the premium even though all the drug costs are covered. If you hit the maximum out-of-pocket with a low-cost plan, then you are paying a monthly premium for the rest of the year, with all your drug costs covered.

The impacts of so many Medicare plans not paying an agent commission will suppress the number agents who are willing to assist enrollments for no compensation. In other words, some Medicare beneficiaries may have a tough time finding local agent help to evaluate their Medicare plan options.

YouTube Video of Medicare Enrollment Challenges for Consumers