The incredibly high health insurance premiums that individual and families are facing for 2019 has spawned many conversations between my clients and me over a single payer health care system. While I am not necessarily opposed to a single payer system, it works well for Medicare beneficiaries, the fundamental economics of our current system preclude any reasonable single payer system from being implemented. Specifically, hospitals and medical groups would realize a significant drop in revenue jeopardizing their budgets and potentially their solvency.

Regardless of whether you feel the health insurance companies are gouging their health plan members with high premiums, the rates, in large measure, reflect the costs of paying claims. The cost of paying health care claims is tied to the negotiated rates the health insurance companies negotiate with providers such as hospitals, physician medical groups, labs, and prescription drug costs through Pharmacy Benefit Managers.

Health insurance companies employee a cadre of people to do nothing but estimate the total cost of health care claims they will have to pay in a given geographical region based on the rates they have negotiated for a variety of different health services, products, and drugs. Aside from a major catastrophe such as a major fire or earthquake, the health insurance companies have a reasonably good estimate of how many different types of health care services will be rendered given the demographics of the region.

Single Payer Will Have Lower Average Hospital Reimbursement Rates

The estimated cost of the health care claims is directly related to the negotiated rates for those services among their network providers. The health insurance rates in Southern California are approximately 20% lower than Northern California. This is not because Southern California residents are healthier and use less health care services. The differential primarily reflects the lower costs negotiated with the hospitals and medical groups in Southern California.

This raises the question as to why the health care costs in Northern California are higher than in Southern California. I have not read a detailed study that points to a definitive reason that health care costs are higher in Northern California. One hypothesis is that the management of many hospitals in Northern California is concentrated in fewer owners than in Southern California. This may lead to more negotiating leverage on the part of the hospital chains for higher reimbursement rates for their services.

Single Payer Will Disrupt The Budgets Of Hospital And Medical Groups

Regardless of the reason why the health care costs are higher, each hospital and medical group has a budget. The budget is at the heart of why a single payer system will be so very difficult to construct. Like the health insurance companies, a hospital estimates how many different health care services they will provide. This is the cost of doing business. They have the cost of the facility and maintenance, wages for nurses and administration, and any contracts for doctors if they have emergency room facilities. (California laws prohibit hospitals from hiring doctors on staff. Emergency Room doctors are usually under contract through a separate medical group. That’s why you always get a separate bill: one from the hospital and another for the physician services.)

Most of a hospital’s revenue is dictated by the negotiated rates with the health insurance plans. Even if the patient is responsible for most of the invoice for health care services because of a large health plan deductible and coinsurance, the cost of the service is set by the health plan contract. If the total charges amount to $5,000 under the contract, the hospital doesn’t care who pays it, they just know that the $5,000 is all they will receive in compensation for the services.

Different Plans, Different Rates For Same Services

This may be a big surprise, but the hospital has agreed to accept different reimbursement rates from the different types of health plans for the exact same services. In general order from lowest to higher reimbursement rates are Medi-Cal, Medicare, individual & family plans, small group plans, large employer group plans. For the exact same patient service such as an X-ray, the hospital may receive a higher rate if the patient has a small employer group plan than if the patient had Medi-Cal.

The big complaint for families in Covered California is the small network of doctors they can see in EPO and PPO plans. This is because many hospitals and medical groups refuse to accept the lower reimbursement rates offered by individual and family plans. This is also the case for many HMO plans.

Are the hospitals and medical groups just being greedy? I would argue that while greed may be a factor, the bigger reality is the organization’s budget considerations. Not only do hospitals have a pretty good estimate of the number and types of services they will provide in the next year, they also have an excellent grasp of the types of health plans that will be paying for those services. They know that a certain percentage of their revenue will come from Medi-Cal, Medicare, individual & family plans, small employer groups and large employer group health plans.

Under a single payer plan, in order to make it affordable, the reimbursement rates must be lower than private health plans. Some people contend the reimbursement rates for services will approach Medicare or even the lower Medi-Cal level. This sort of seismic shift in revenue over a relatively short period of time will blow up the budgets of hospitals that have hard fix costs from construction loans to union contracts. This will lead many hospitals not to participate in a single payer plan.

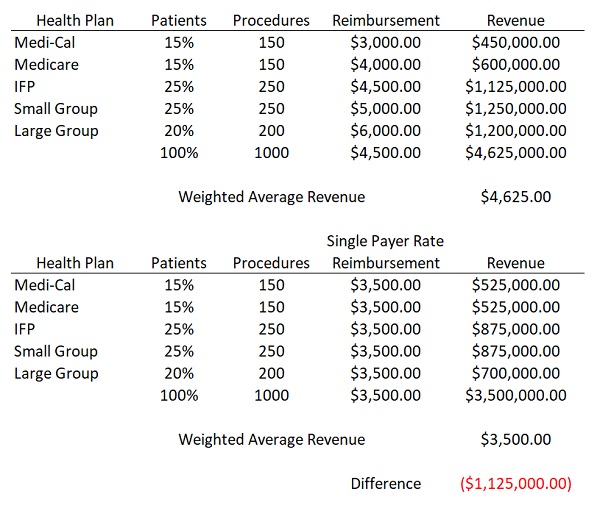

To illustrate the budget dilemma faced by hospitals let’s look at a hypothetical scenario. Golden State Hospital performs 1,000 outpatient knee surgeries every year. Of the 1,000 patients who have the procedure there are five different health plans that each reimburse the Golden State Hospital at a different rate for the exact same service. The hospital knows the relative percentage of each health plan type and the reimbursement rate. They estimate at the end of their fiscal year they will have generated $4,625,000 in revenue for an average weighted reimbursement rate of $4,625 per procedure. Golden State has built their budget around this estimated revenue for the year.

Under a single payer proposal, all of the outpatient knee surgeries will receive a reimbursement rate less than their weighted average. The reimbursement rate is set low to keep the costs of administering the single payer low. If the rate is set somewhere between Medi-Cal and Medicare, $3,500, the revenue to Golden State drops by $1,125,000 for the year. How is a hospital supposed to adapt to such a loss in revenue when their expenses remain the same? The same shortfall of revenue occurs if there is an increased demand for the outpatient knee surgery because more people want the operation performed by Golden State because of their excellent reputation for health care. The revenue will increase, but so will the fixed expenses that have not been decreased.

The budget busting hospital scenario also applies to medical groups, labs, and imaging centers. You can’t ask health care providers to suddenly accept lower reimbursement rates from a single payer plan while there is no mechanism for lowering their expenses. Hospitals and doctors will simply refuse to participate in a single payer plan.

Sutter Hospital And Doctors Only In A Few Health Plans

Real world evidence of hospitals and medical groups opting out of health plans with low reimbursement rates exists today. In Northern California, if you purchase your health insurance through the individual and family market (such as Covered California), and you want to visit Sutter Health doctors and hospitals, you have two options: Blue Shield PPO and Sutter Health Plus HMO. Only the Blue Shield PPO plans are offered through Covered California with the tax credit subsidy. Both the Blue Shield PPO and Sutter Health Plus HMO plans are expensive compared to the other options of Western Health Advantage, Kaiser, Chinese Community Health Plan, or Valley Health Plan.

Part of the reason Blue Shield PPO plans are more expensive is that they have the Sutter Health hospitals and medical groups in-network and those organizations command higher reimbursement rates than other comparable hospitals and physician groups. Blue Shield recognizes that many of their members will gravitate toward Sutter Health, which means they will have more claims for health care services at a higher cost than if the plan member received services from a different medical group or hospital. Hence, one of the reasons for the Blue Shield PPO plans being more expensive is the higher cost of claims of plan members.

Most Health Plans Have Dropped Stanford Health Care

If someone wants Stanford Healthcare physicians and hospital in-network in an individual and family plan the only option is the Health Net full network PPO plan. The Health Net PPO is the most expensive health plan available. It is not offered through Covered California so there are no subsidies to reduce the premiums. Similar to the Blue Shield/Sutter situation, Health Net must price its health plan accordingly to reflect the higher reimbursements rates for services they pay to Stanford. These are rates that no other health plan wants in their individual and family plan portfolio because it will drive costs through the roof. Consequently, no other individual and family plan has Stanford in-network.

Behavioral economics informs us that if all the costs are the same, the consumer will select a product with what they perceive is the best value. Stanford and Sutter, through hard work and good marketing, are viewed in the market place as providing exceptional health care services. If the cost is the same, consumers will gravitate toward those providers. In short, if Stanford and Sutter hospitals were forced into a single payer system, their patient load would easily increase 11/2 to 2 times. They would be treating more patients and generating less revenue. This would ultimately lead to rationing of care and possibly a collapse of the hospital system itself.

There are other indicators that hospitals and medical groups are reducing their exposure to low reimbursement rates. UC Davis Health System pulled out of Western Health Advantage HMO plans. UC Davis is a founding member of Western Health Advantage. HMO plans pay a monthly capitation rate to the medical group in lieu of paying on specific services rendered such as a routine office visit. UC Davis will still accept Blue Shield PPO individual and family plans, which has a negotiated rate reimbursement for a variety of health care services rendered to each plan member. By avoiding the HMO reimbursement structure, UC Davis can realize higher reimbursement rates for all of their services.

Sutter Health will not accept new Medicare beneficiaries. I had heard this several months ago, but a client told me that Sutter Health informed her they were not accepting any new patients with Original Medicare. They would accept Medicare health insurance if the person was an existing patient and transitioned to Medicare or if the person enrolled in a Medicare Advantage plan that had Sutter doctors in-network. We could only speculate that Sutter wanted to limit the number of patients for whom Medicare services are reimbursed at a lower rate.

California can push through some sort of single payer plan, but if the reimbursement rates are far below the average that many doctors and hospitals have built their budgets around, they won’t participate. The other scenario is the reimbursement rates are relatively decent, attracting most of the hospitals and doctors to participate, but certain facilities and providers will become swamped by new patients. Everyone will want to go to Cedars-Sinai, Stanford, or Sutter hospitals. They won’t be able to handle the volume. The increased revenue won’t necessarily cover the increased costs for providing the care.

The single payer proposals I have read deal mainly with the consumer side regarding access to care and reduced patient costs. What seems to be missing is recognition that medical groups and hospital have built their budgets around the existing health insurance plan reimbursement rates. There is no mechanism in the single payer proposals to limit the costs such as the cost of labor (nurses) which is a significant financial element for hospitals. Until we get a handle on the cost of health care, health insurance rates will continue to rise and a viable single payer proposal, where you have more than one or two hospitals participating, will only be a dream.

Podcast