The Center for Medicare and Medicaid Services publishes a variety of documents outlining how much they reimburse Medicare Advantage and Part D Prescription Drug plans. Below is the monthly reimbursement rate for Medicare Advantage plans known as the capitation rate. This is only for California counties. The capitation amount is only for the medical portion of the Medicare Advantage health plan. There is a separate amount if the plan includes prescription drug coverage.

When you see some Medicare Advantage plans marketing a $0 monthly cost, the Medicare monthly capitation amount to the plan partly explains the low cost. Also remember that you must still pay the Part B premium every month.

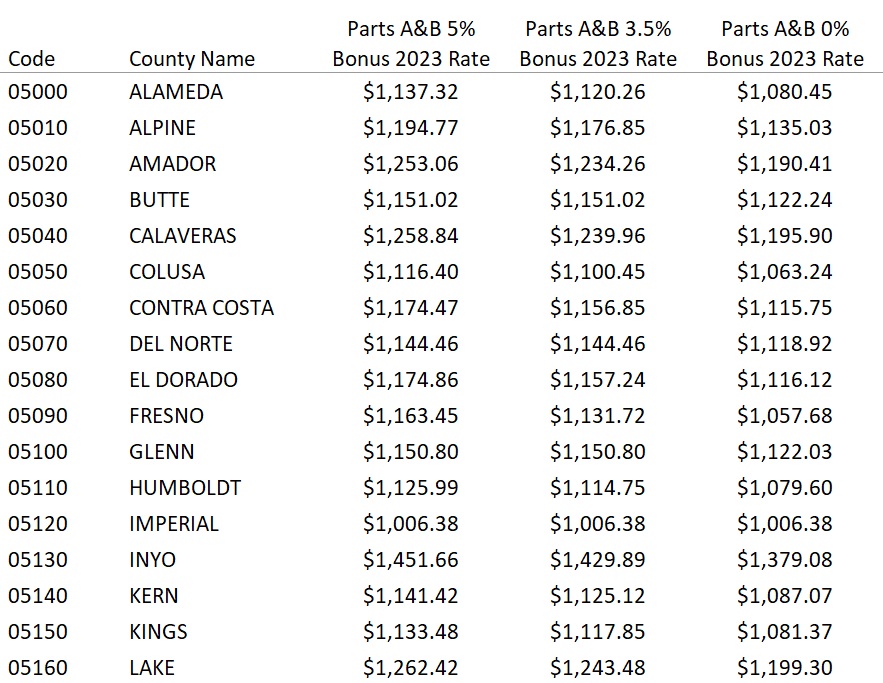

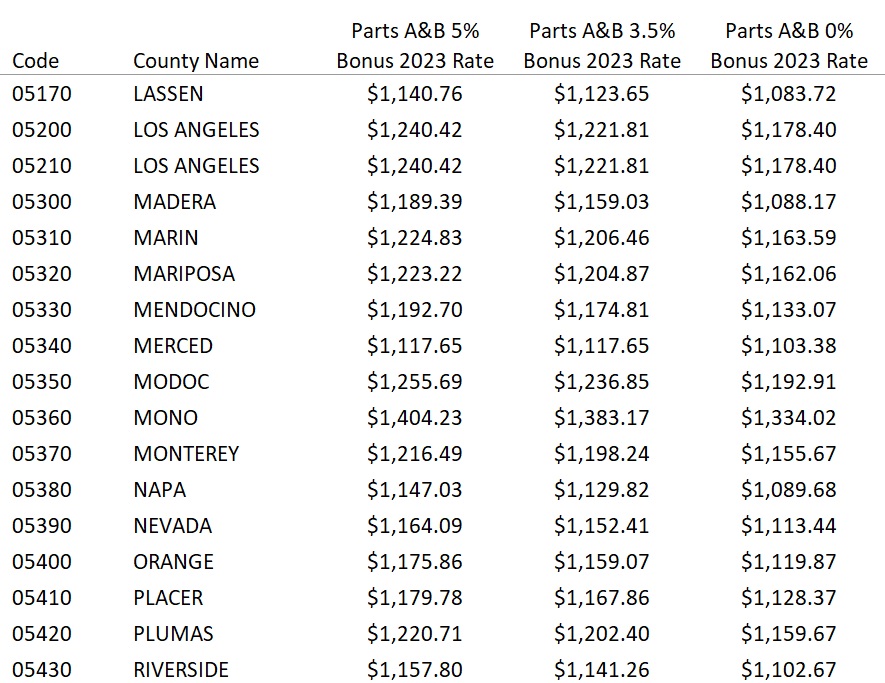

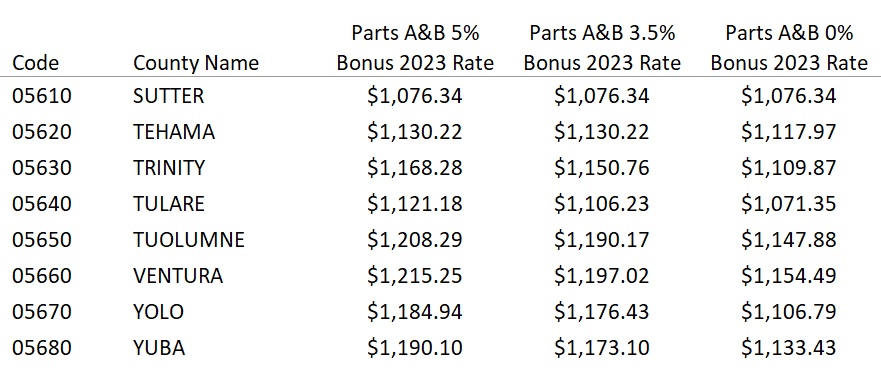

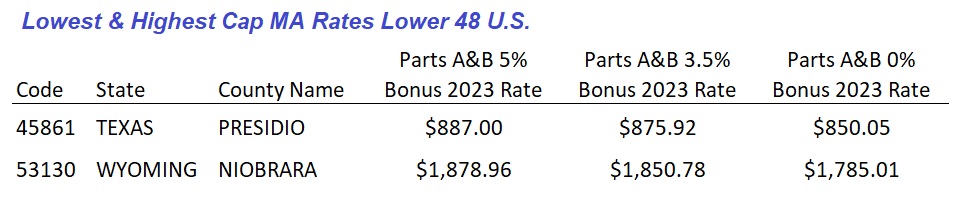

2023 Monthly Medicare Advantage Capitation Rates

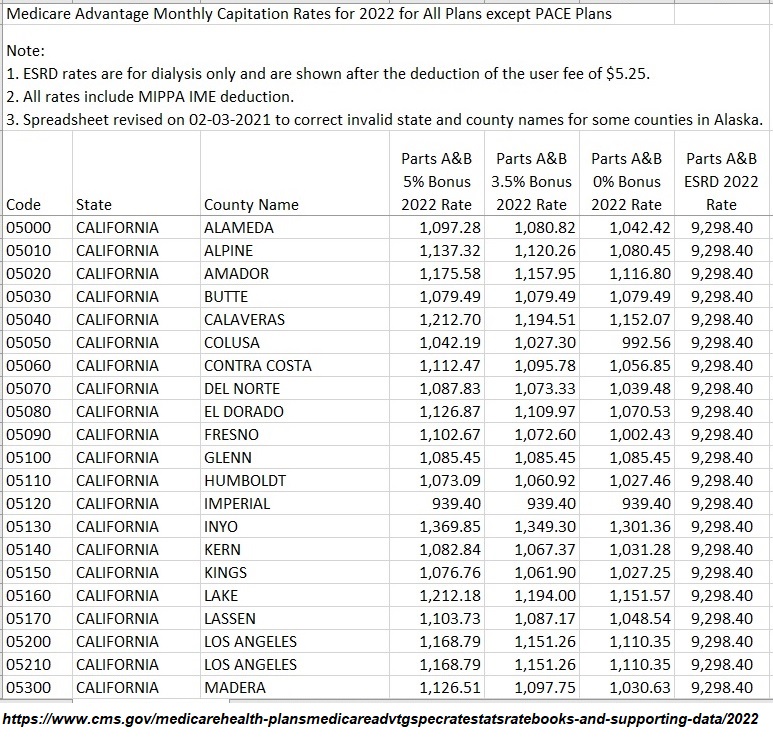

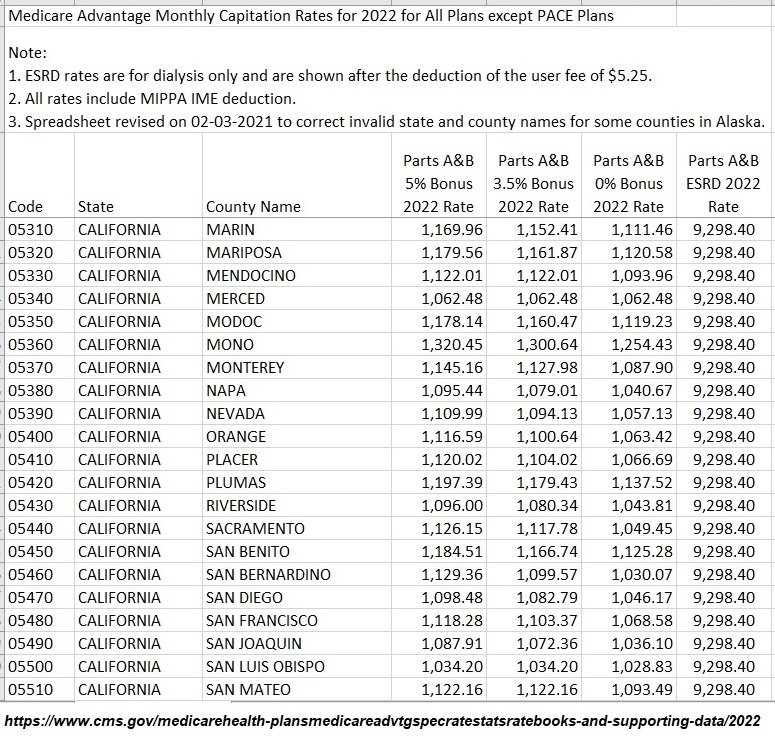

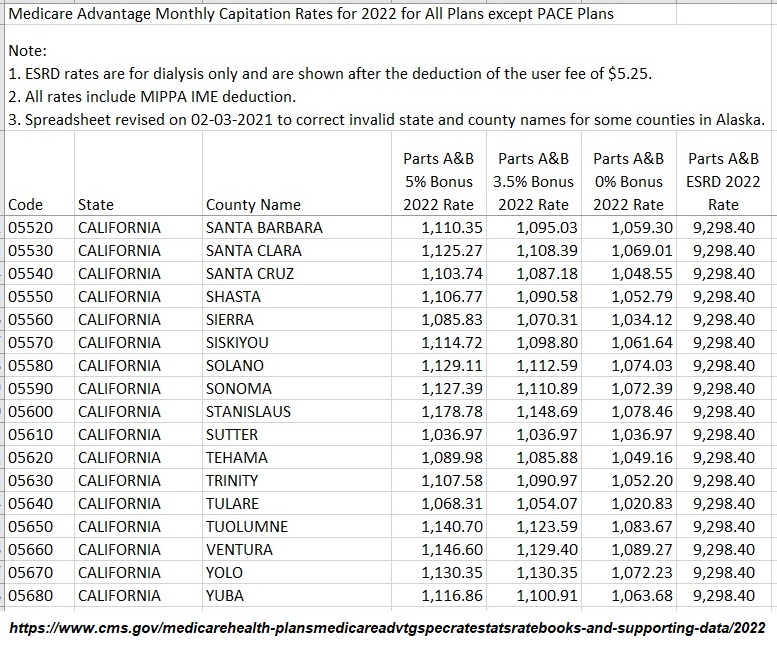

2022 Medicare Capitation Rates California Counties

The monthly capitation rate is the amount Medicare pays Medicare Advantage plans. The rates are based on county per individual enrolled in Medicare Advantage. These rates are only for Parts A and B of original Medicare. If the Part D prescription drug coverage is included in the plan, there is an additional capitation amount. The highest monthly capitation amount is $1,301.36 in Inyo County. The lowest monthly amount is $939.40 for Imperial County. Some plans can receive a higher or bonus amount based quality ratings.

To read more on how the rates are calculated, please visit Medicare Advantage Plans Are Not Free

We all know that the Federal expenditures for Medicare are growing fast and it’s putting a real strain on our budget. $835 billion dollars was spent on Medicare and Medicaid in 2011. That big number doesn’t translate well into an expense per Medicare beneficiary for me. What I wanted to know was, “How much does the Federal government actually pay to the private insurance companies to administer either Medicare Advantage Plans (MA-PD) or Part D Prescription Drug Plans (PDP) on behalf of Medicare beneficiaries?”

I was curious because I wanted to know how it compared to the individual market for health insurance and how large the subsidy was for each Medicare beneficiary. The answers are not easily found on either an Internet search or picking up the phone and calling someone. What I found out was that determining the actual numbers is complicated at best.

Here is the information that I was able to find. I am not claiming this information is perfect and I welcome additional input from folks that have more detailed expertise. From my perspective, until the American public can start to grasp the enormity of the individual expenditure per Medicare beneficiary, we won’t be able to have a meaningful discussion on reform.

First: How does Medicare compare to the private health insurance market?

When a person turns 65, and is fully eligible for all Medicare benefits, their monthly health insurance costs drop dramatically. The premium for a 64 year old individual in small group HMO plan, without employer contribution, $1500 maximum out of pocket, in Sacramento, CA, is approximately $870 per month. A comparable individual plan, standard rate, will run approximately $550 per month.

Once that person turns 65 and enters Medicare their monthly Part B premium is $99.90 per month, with income less than $85,000 per year. If that person enrolls in a Medicare Advantage Plan with a $0 monthly premium which includes the Part D Prescription Drug benefit (MA-PD), their total expenditure would be $99.90 per month. This would generate a net savings of between $300 to $600 per month depending on employer contribution.

Another scenario could have the 65 year old person stay with Original Medicare and purchase a Medicare Supplement Plan and a PDP. In the Sacramento market the combination of the Medicare Supplement and PDP (using a national average of $32 per month for PDP) would create an expenditure of $262.90 per month. (Part B $99.90 + Med. Sup. $130 + PDP $32). The individual might realize a savings of between $100 to $250 per month.

While the new Medicare beneficiary realizes a savings, the cost of the insurance doesn’t go away. Medicare funds a large portion of the insurance cost when they select a Medicare Advantage Plan or a stand alone PDP. There are costs associated with just Original Medicare but my interest was trying to find a hard dollar figures for the MA-PD and PDP plans.

Second: How does the Federal government pay private insurance companies for individuals enrolled in a MA-PD or PDP?

Medicare pays the Medicare Advantage Plan or Part D plan for each beneficiary who enrolls a monthly amount based on a complicated formula. The Centers for Medicare and Medicaid Services takes vast amounts actuarial data, enrollment, local cost numbers and crunches it in a formula to create capitation rates or the average amounts they reimburse plans by county.

Medicare Advantage Monthly Capitation Rates for 2012 for All Plans except PACE Plans showed Medicare Advantage Plans were paid $838 per month in Sacramento and $850 in Placer counties for plans with 4.0 STAR rating. In an effort to reward customer satisfaction and efficiency, reimbursement rates are also adjusted based upon the plan’s STAR rating. There are also other plans and special circumstances that would have CMS paying more per month on behalf of the beneficiary.

On the Part D Prescription Drug plan side similar calculations are involved. However, all companies that wish to participate must submit a bid for monthly reimbursement to CMS.

From: Medicare Part D Prescription Drug Benefit: A Primer

Payments to Plans

CMS makes four types of payments to Part D plans: (1) direct subsidy payments, (2) reinsurance payments, (3) low-income subsidy payments, and (4) risk-sharing payments.

Direct Subsidies

Medicare makes per capita monthly payments to plans for each Part D enrollee. The payment is equal to the plan’s approved standardized bid amount, adjusted by the plan beneficiaries’ health status and risk, and reduced by the base beneficiary premium for the plan.

From: OFFICE OF THE ACTUARY Centers for Medicare and Medicaid Services

The national average monthly bid amount for 2012 is $84.50.

The Part D base beneficiary premium for 2012 is $31.08

Subtracting the premium from the bid we get $53.42 average reimbursement from CMS to the Part D Plans. Just like Medicare Advantage plans, there are circumstances and condition that might make those payments higher or lower.

In the Sacramento region, Medicare beneficiaries are having their MA-PD subsidized by $738 – $750 on average. (Average capitation rate – Part B cost of $99.90). The stand alone PDP are subsidized on average of $53 across the nation. We must also remember that the Federal government picks up the bulk of the prescription drug costs once the beneficiary reaches the Catastrophic level of $4,700 out-of-pocket drug costs.

Medicare is a great program that costs money. With over 47 million million in the Medicare system, 11 million with Medicare Advantage Plans and 17 million with stand alone Part D Plans, anything the government can do to shave a couple of dollars off each reimbursement will mean huge savings down the road.

It is vital that we get Medicare beneficiaries in the conversation about how to reform the program to maintain high quality care and sustainability.

______________________________________________________________________________