2019 income and asset levels for eligibility for help paying for Medicare health care expenses and prescription drug costs.

There are two programs that help Medicare beneficiaries with financial assistance to help pay for their health care and prescription drug costs. The Medicare Savings Program works with Medi-Cal to help cover some premiums of Original Medicare and related costs of health care expenses. Social Security administer the Extra Help program to provide assistance for prescription drugs.

The Social Security Extra Help program has higher income and asset levels for eligibility. This means a Medicare individual or household may qualify for help for prescription drug cost but not Medi-Cal assistance. If you qualify for Medi-Cal assistance based in income and assets, then you would qualify for the Social Security Extra Help Program.

Financial Help Paying For Medicare Costs

The Medicare Savings Program has four different levels of eligibility and each covers different costs associated with Medicare, either the premiums or cost-sharing.

Medicare Saving Program

Qualified Medicare Beneficiary QMB

Pays for:

- Part A premiums

- Part B premiums

- Health care and durable medical equipment deductibles, coinsurance, copayments

Specified Low-Income Medicare Beneficiary SLMB

Pays for:

- Part B premiums only

Qualifying Individual QI

You must apply every year for QI Benefits. QI applications are granted on a first-come, first-served basis, with priority given to people who got QI benefits the previous year. (You can’t get QI benefits if you qualify for Medicaid).

Pay for:

- Part B premiums only

Qualified Disabled and Working Individuals QDWI

- Working disabled person under 65

- Lost premium-free Part A when you went back to work

- Are not getting medical assistance from home state

- Meet income and resource limits of the state

Pay for:

- Part A premiums only (Generally Part A is premium free if you have enough work quarters. Younger adults may not have enough work quarters to make Part A premium-free)

Medicare Savings Program Countable Assets include

- Money in checking or savings accounts, Stocks, bonds

- Not included in asset calculation

- Home, one care, burial plot, up to $1500 in burial expenses savings, furniture, other household and personal items.

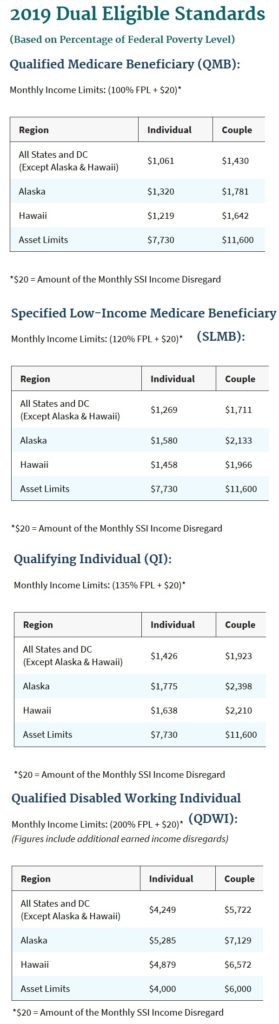

2019 Medicare Medi-Cal income and asset levels for Medicare Savings Program.

Social Security Extra Help With Medicare Prescription Drug Plan Costs

Pays for:

- Monthly Part D Prescription Drug Plan (PDP) premiums

- Annual PDP Deductibles

- Prescription Copayments

Eligibility

- You have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance); and

- You live in one of the 50 States or the District of Columbia

Assets

Your combined savings, investments, and real estate are not worth more than $28,720*, if you are married and living with your spouse, or $14,390* if you are not currently married or not living with your spouse. (Do NOT count your home, vehicles, personal possessions, life insurance, burial plots, irrevocable burial contracts or back payments from Social Security or SSI.) If you have more than those amounts, you may not qualify for the extra help. However, you can still enroll in an approved Medicare prescription drug plan for coverage.

Income

Your annual income must be limited to $18,210* for an individual or $24,690* for a married couple living together. Even if your annual income is higher, you still may be able to get some help. Some examples where you may have higher income and still qualify for Extra Help include if you or your spouse: Support other family members who live with you; Have earnings from work; or Live in Alaska or Hawaii.

*2018

EXCEPTION: Even if you meet these conditions, DO NOT complete this application if you have Medicare and Supplemental Security Income (SSI) or Medicare and Medicaid because you automatically will get the extra help.

You must apply for the Medicare Savings Program through your local Medi-Cal county office. You apply for the Social Security Extra Help program directly with Social Security. If you are determined eligible for the Medicare Savings Program you will be considered a Dual Eligible: eligible for both Medicare and Medi-Cal. Your eligibility can change throughout the year based on income but is usually re-evaluated on a yearly basis. Whenever you eligibility changes, you are eligible for a Special Enrollment Period to change or enter into different Medicare Advantage or Medicare Prescription Drug Plans.