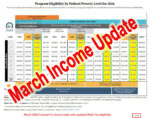

Covered California has revised their income table to reflect the higher federal poverty levels. The higher dollar amount numbers are effective March 2026. The revision only applies to Medi-Cal programs. When reviewing any income table update, make sure the date in the lower right-hand corner is 3/2026. That is the revised table from the 10/2025 […]