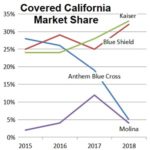

Anthem Blue Cross started out as carrier with the largest enrollments in 2014 and 2015. They dropped to 26% market share in 2016. They dropped again 2017 down to 19%. Part of the drop, from my perspective, was related to the cost of the health plan versus their EPO network. People didn’t see the value of the smaller network and no out of network coverage relative to other alternatives. Then in 2018 Blue Cross pulled out of most of California. They offered plans only in region 1 (Northern California), region 7 (Santa Clara County) and region 10 (Central Valley counties). This dropped their market share down to 5%.