In 2026, Medi-Cal will begin to screen Medicare beneficiaries for the extra help through the Medicare Savings Program based on an individual’s assets. Medi-Cal will request a statement of the Medicare beneficiary’s assets to determine if they are eligible for the extra help.

The asset test only applies to Non-Modified Adjusted Gross Income applicants. In general, those individuals who have Original Medicare Parts A and B and not eligible for Covered California.

Reporting Your Assets to Medi-Cal

With the reinstatement of the asset test, your county Med-Cal office will mail you a screening packet. The screening packet will include

- Cover letter

- Income and Property Supplement form

- Non-MAGI Medi-Cal brochure

- Medi-Cal General Property limitations notice

- Standard for Medi-Cal eligibility

- Notice regarding transfer of a home for both married and unmarried applicant/beneficiary

- Covered California brochure

The screening packet does not replace the original application. The income and property supplement form will be sent in 2026 when the beneficiary reports a change in circumstances, annual renewal, and when the individual turns 65 and can be evaluated for Non-MAGI Medi-Cal.

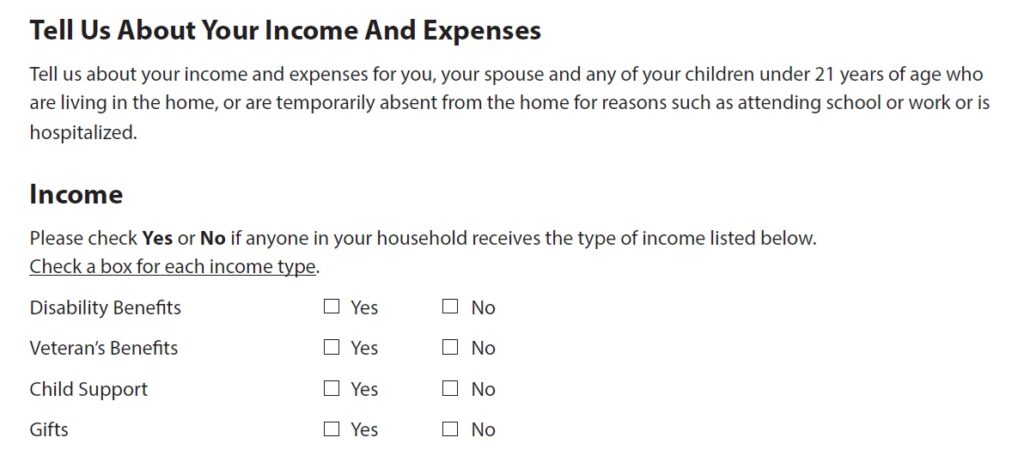

For income information, Medi-Cal will first try to verify monthly income through electronic online sources. You may be income eligible for extra help through Medi-Cal for Medicare based on the initial review. However, you do need to provide any additional sources of income and report that on the supplemental form.

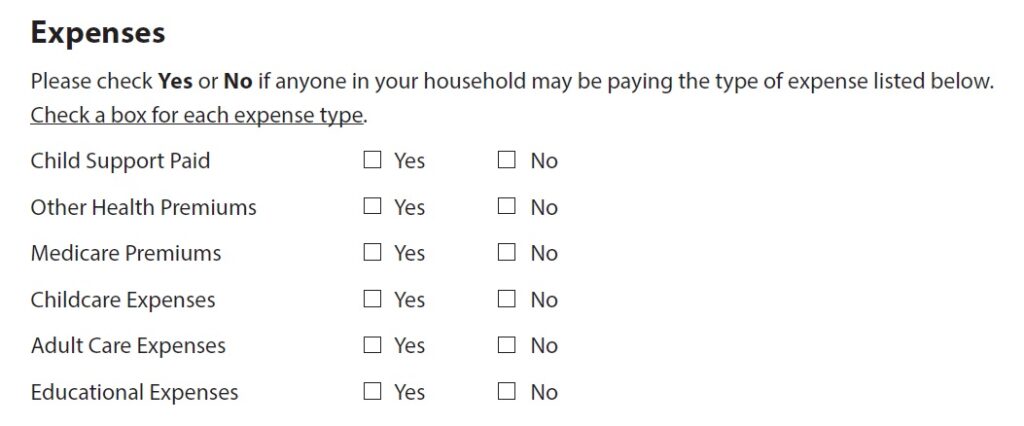

Certain Expenses Reduce Your Income

Because the income and asset limits are based on household size, you will be asked to list the income for you, your spouse, and children under the age of 21. The supplemental form also captures expenses that may be reduce your total income such as Medicare premiums.

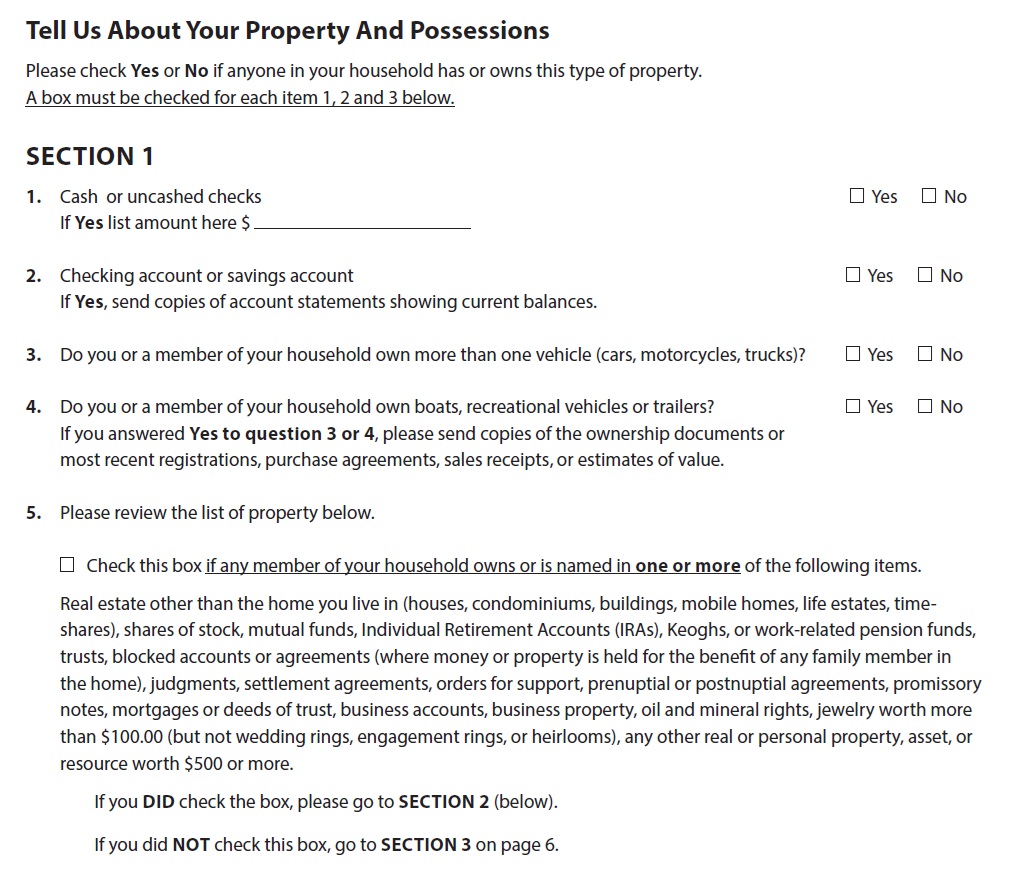

The next section focuses on your property or assets. There is long list of potential assets that may be included. Some of the assets, like your primary residence, are excluded from asset calculation.

The supplemental questionnaire will ask if you own any

- Stocks or mutual funds

- Individual Retirement Accounts, pension funds

- Annuities or life insurance

- Blue plots, trusts, burial insurance

- Individual or family trusts

- Judgements

- Promissory notes

- Jewelry

- Business accounts and property

- Other property

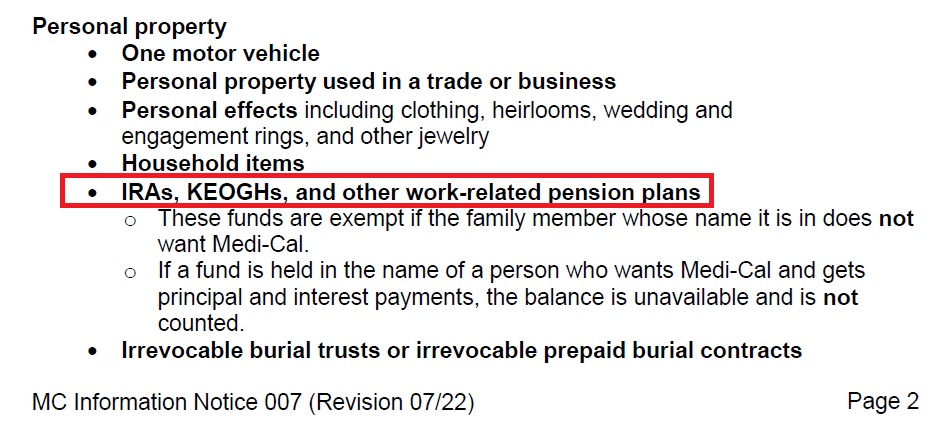

Certain Assets and Property will be Exempt from Calculations

The documents will also explain property that is exempt from the total dollar amount calculation.

The exemption rules note that Individual Retirement Accounts are exempt from the total except for the principal and interest when the balance is unavailable to the owner.

The General Property Limitation (MC 007 revised 2022) will outline the rules for spending down assets in order to qualify for Medi-Cal extra help.

Complicated Calculation Rules

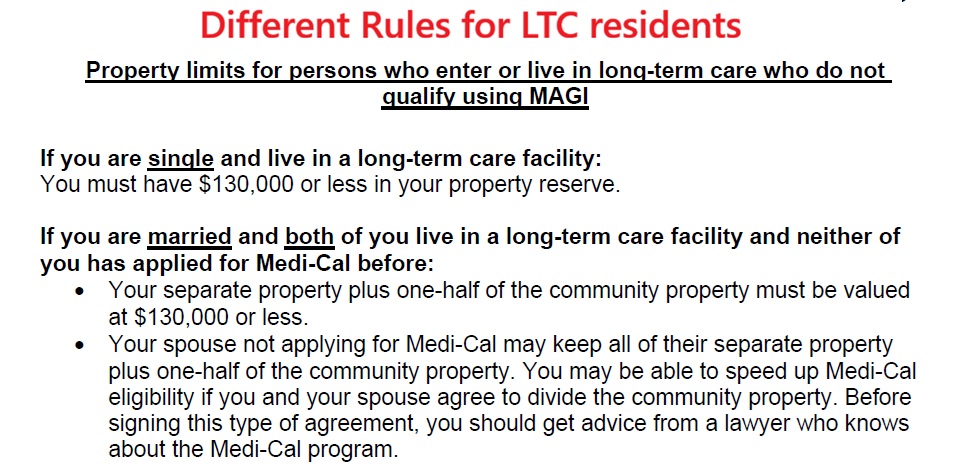

There are many different rules to determine if assets and personal property are exempt or counted. It quickly gets complicated if the applicant is married, but their spouse is not applying for the Medi-Cal extra help. Some of the spouse’s assets may not be counted toward the applicant’s total asset calculation. In addition, if one or both of the spouses are in a long-term care facility, there specific rules surrounding assets and spend down calculations.

In short, do not assume that you do or do not qualify based on your assets, especially if you are married or living in a long-term care facility. The best course of action if you receive the supplemental packet for Medi-Cal extra help is to fill it out as completely as you can. Let the county Medi-Cal office make the determination. You can always appeal their decision if you feel they counted an asset incorrectly.

2026 Asset Forms

YouTube video on new asset questions.