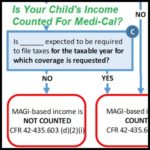

When your son or daughter is earning money from a job, but still living at home, it can be a bit confusing when applying for health insurance through Covered California. When do you count your child’s income for Medi-Cal or Covered California? Should your child have their own health plan? Do they file their own taxes? Are they still going to school?