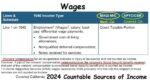

If one of the individuals in that two-person household is pregnant, the pregnant individual could gain Medi-Cal if the income is under $3,756 per month. This is based on the 213% column, full scope Medi-Cal for pregnant individuals. The other adult would still be eligible for Covered California and the subsidy since the monthly income is over 138% of the federal poverty level.