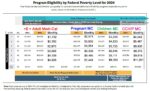

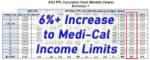

I have created this income table that has the monthly income numbers for Medi-Cal eligibility next to the 2024 annual income amounts for the Covered California subsidies.The Medi-Cal income columns of the Covered California income table are 138% FPL for adults, 213% FPL for pregnant women, 266% FPL for children 18 years and younger, and 322% FPL for children in certain counties of California.