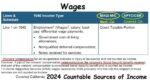

New for 2026 is an orange band on top of the table. This is the income range that California will provide additional subsidy to help lower health insurance premiums for low income families and individuals. The extra subsidy will be provided to incomes up to 165 percent of the federal poverty level. There is a new 165% column indicating the maximum annual income that the subsidy is eligible for.