For households in Covered California where one family member has Medicare, the other family members may get trapped in Medi-Cal. This is an odd situation where Medi-Cal and Covered California view income differently. The result is frustrating hours working with Medi-Cal to restore the Covered California enrollment with a private health plan and subsidies.

This trap seems to have accelerated in the last year as county Medi-Cal offices automate more processes and have become more aggressive with attempting to extend Medi-Cal benefits to Medicare eligible individuals. I’ve had several clients who have had their Covered California enrollments cancelled because Medi-Cal determines if a Medicare family member was eligible for the Medicare Savings Program.

Medicare Medi-Cal Eligibility Triggers Loss of Covered California

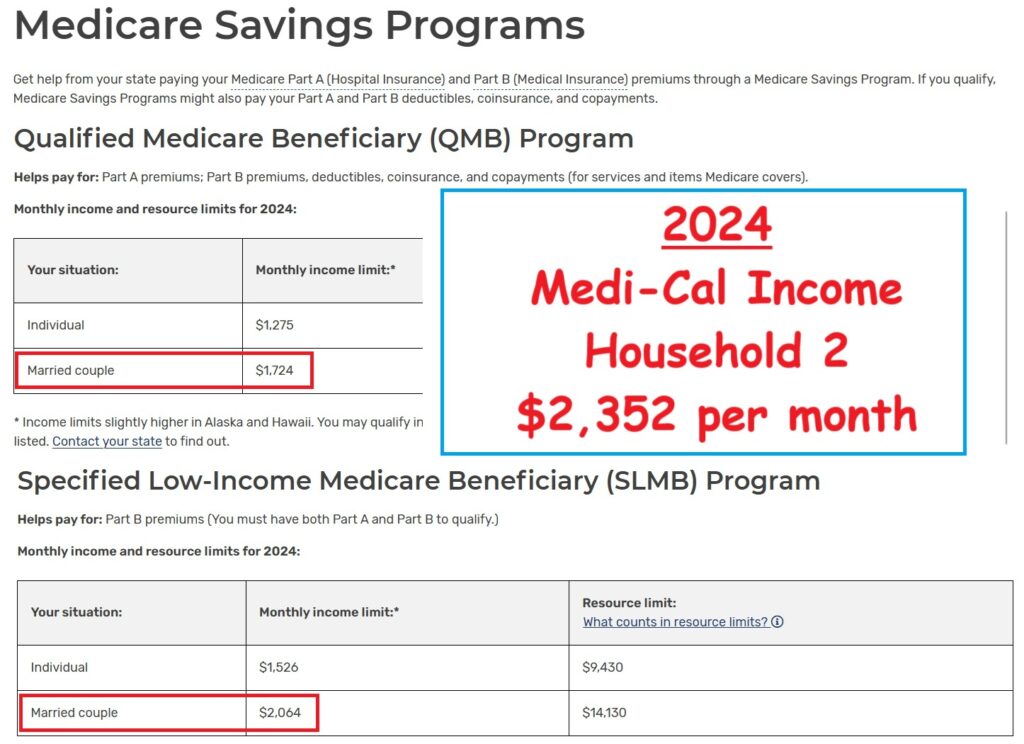

The Medicare Savings Program will cover Part B premium of Original Medicare and, for the lowest income beneficiaries, the cost-sharing of Medicare health care services. Eligibility for the Medicare Savings Program is based on the monthly household income. Medi-Cal administers the Medicare Savings Program in California. Medi-Cal determines is the Medicare beneficiary is eligible for the extra help provided by the Medicare Savings Program.

Generally, Medi-Cal reviews the family’s Covered California case when a family member gains Medicare eligibility. The county Medi-Cal office will send a letter to the Medicare beneficiary indicating they may be eligible for extra help paying for Medicare expenses. The Medicare beneficiary applies for the extra help sending information on income just for the person on Medicare.

Medicare Savings Program Income Below Medi-Cal

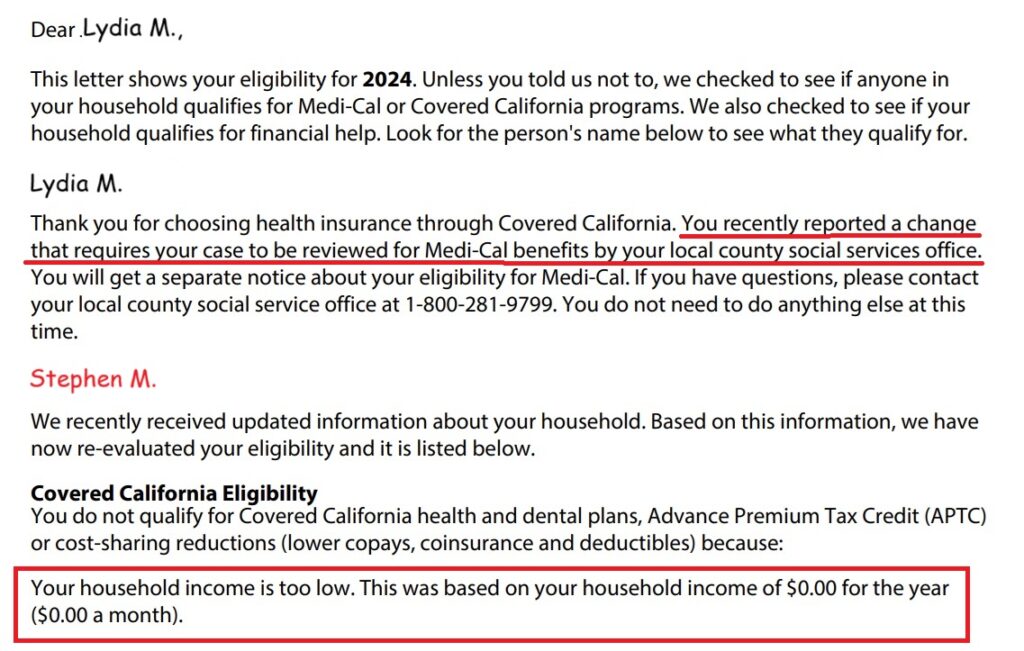

To be eligible for the Medicare Savings Program, extra help, the household income needs to be less than $2,064 (2024.) For a two-person household to be eligible for the Covered California health plans with subsidies, the monthly income must be greater than $2,352 (2024.) If the income information sent to Medi-Cal is under than minimum necessary for Covered California, Medi-Cal updates the Covered California application with the income information provided and the remaining family member – not on Medicare – is put into Medi-Cal.

Sometimes, this is a simple misunderstanding. The Medicare beneficiary only supplies their income and not that of the household. Other times, the Covered California income estimate includes income that is not received every month such as interest, dividends, capital gains, or retirement distribution.

Regardless of the error, Medi-Cal updates the Covered California income section denying the non-Medicare spouse their private health insurance with the subsidy. The spouse is determined Medi-Cal eligible and their health plan is terminated.

To resolve the Medi-Cal errors, the Covered California consumer must contact their county Medi-Cal office and explain their monthly income is higher than reported. Medi-Cal may not believe you as they like to see paper documents showing your monthly income. If you can prove your income is too high for MAGI Medi-Cal, the Medicare eligible family member will lose their extra help from Medi-Cal. All of this wrestling with Medi-Cal can take hours, days, and weeks to accomplish.

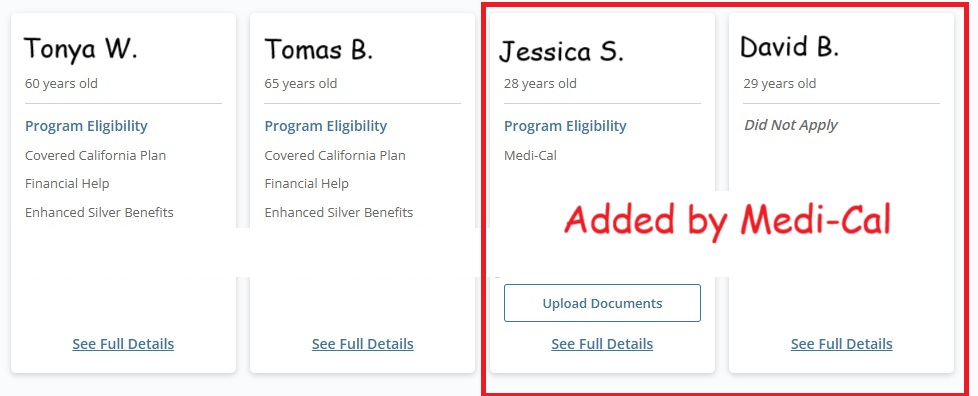

Medi-Cal Adds Young Adults into Covered California Account

Another odd occurrence when Medi-Cal sometimes meddles in a Covered California account is the addition of children who have long left the household. On several occasions, after Medi-Cal has updated the Covered California account, the children of the couple who have been removed from the household because they got married, moved to another state, or have their own Covered California account, those adult are included in the household. The inclusion of these adult children artificially increases the health insurance subsidy based on a larger household size. The excess subsidy must be repaid when the couple does their federal income tax return.

Medi-Cal Meddling Freezes Health Insurance Subsidy

On the flip side, there are instances when Medi-Cal tampers with a Covered California account freezing the subsidies. When this happens during Open Enrollment, the household receives the same Advance Premium Tax Credit subsidy in the new year as they did in the prior year. In most cases, the subsidy should increase year over year. If the subsidy is frozen by Medi-Cal, the family is paying too much for their health insurance.

Depending on the nature of the Medi-Cal intervention in the Covered California account, simply reporting a change in the account restores the subsidies to the proper level. When Medi-Cal has added family members – who should not be in the household – or improperly determined a family member is Medi-Cal eligible, the consumer must contact their county Medi-Cal office to correct the errors.

To avoid the Medicare Medi-Cal Covered California trap, carefully review any letters from the county about applying for extra help for the Medicare eligible household member. Consider that if approved, the remaining adults in the family in Covered California may lose their private health plans with the subsidies and be flipped into Medi-Cal.