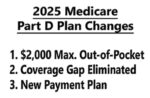

Medicare allows alternate cost structure designs. These designs must be as good as the standard cost structure. One alternate structure only has drugs in tiers 3, 4, 5 subject to the pharmacy deductible. Generic drugs, tiers 1 and 2, are not subject to any deductible. The plan member goes straight into a set copayment or coinsurance for the prescriptions.