Under California legislation SB 78, employees of small groups who had previously waived coverage will have a Special Enrollment Period to sign up for health insurance through their employer for 2020.

Kevin Knauss: Health, History, Travel, Insurance

What all the deductibles, coinsurance, and copayments have in common is that they all accumulate toward meeting the plan maximum out-of-pocket amount (MOOP). When you reach your MOOP, then all the services and prescription drugs are covered 100% by the health plan. But it can seem like forever to reach your MOOP when you are going through lots of tests, procedures, and swallowing drugs like candy on Halloween.

California’s individual mandate penalty will require residents to prove they either had minimum essential coverage during the year, have a valid exemption, or pay a penalty. The penalty will be the greater of $695 per adult ($347 per child) OR 2.5% of the household income. The verification of creditable minimum essential coverage and/or the ultimate penalty will be reconciled when residents file their state income tax returns with the Franchise Tax Board.

Will I be able to keep my current health plan? If you have a health plan bought directly from a health insurance company – also known as off-exchange – you might be able to enroll in the same plan. Not all health plans offered direct to consumers off-exchange are available through Covered California. For example, if you have a Kaiser Silver HDHP HSA compatible plan, it is not offered through Covered California. You would need to select one of the plans Covered California offers in order to get the subsidy.

For the California Premium Subsidy, you will reconcile that subsidy amount with the Franchise Tax Board when you file your state income tax return. And this is where it gets complicated and a potential headache for tax prepares. If your income is between 200% and 400% of the FPL you potentially could be receiving 2 subsidies, one from the feds and one from the state. If you earn over 400% of the FPL you will only get a subsidy from California.

In California, there are thirteen counties where the Medicare Advantage capitation amount will exceed $1,000 per enrolled member. This does not include any possible bonuses based on quality scores OR for any Part D Prescription drug benefits included in the Medicare Advantage plan. The lowest capitation amount is $841.14 in Imperial County and the highest is $1,158.97 in Inyo County. These figures are from the Medicare RateBook2020 that lists the capitation amounts for all counties in the United States.

Between the single carrier option or the small group exchanges, it doesn’t appear that one has better rates over the other. In general, HMO plans will always be less expensive than PPO plans. You should get quotes for plans from a single carrier as well as the small group exchanges. Even though the information can seem overwhelming, that’s where your insurance agent can help filter out carriers and plans that don’t fit your needs.

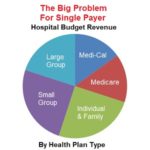

The single payer proposals I have read deal mainly with the consumer side regarding access to care and reduced patient costs. What seems to be missing is recognition that medical groups and hospital have built their budgets around the existing health insurance plan reimbursement rates. There is no mechanism in the single payer proposals to limit the costs such as the cost of labor (nurses) which is a significant financial element for hospitals. Until we get a handle on the cost of health care, health insurance rates will continue to rise and a viable single payer proposal, where you have more than one or two hospitals participating, will only be a dream.

If you have to move out of your county because of the wildfires you may be entitled to a Special Enrollment Period. California is broken into 19 different rating regions. Los Angeles County is actually two regions, 15 and 16. If you move to a different region, you have a qualifying event for a Special Enrollment Period IF you already have health insurance.

Spam prevention powered by Akismet