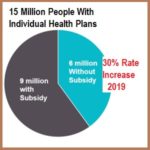

Why can’t people who earn too much money to qualify for either MAGI Medi-Cal or the subsidies through Covered California just be allowed to pay the monthly capitation rate for these plans? They are less expensive than private insurance and would offer some protection from the corona virus health care costs.