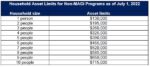

The California Department of Health Care Services will now participate in a Part A Buy-In program with Centers for Medicare and Medicaid Services (CMS) and cover the premiums for Part A. Medicare beneficiaries eligible to have their Part A premiums covered are: