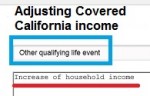

The Special Enrollment Period, Qualifying Life Events, and changes to income are VERY date sensitive. It can also be a little confusing in terms of what dates to use. If you don’t enter the correct dates, such as when income stopped or started, the application process can go sideways and you might be determined eligible for Medi-Cal. When in doubt, call your agent or the Covered California customer service line to determine the correct dates for your qualifying life event.