With a few clicks on a computer keyboard, a county Medi-Cal worker ripped Phoebe’s health insurance away leaving her completely uninsured. It didn’t even show that she was pending Medi-Cal eligible. She had become uninsured.

Kevin Knauss: Health, History, Travel, Insurance

Posts related to how California MAGI Medi-Cal works, especially with Covered California, enrollment, termination, household income.

In order to avoid some people bouncing back and forth between Medi-Cal and private health insurance, the Department of Health Care Services applied for a waiver to review the assets of the non-MAGI Medi-Cal beneficiaries through the end of 2023. This waiver was granted by the federal Centers for Medicare and Medicaid Services (CMS.)

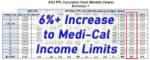

In 2022, a single adult earning $1,564 or less per month (138% FPL) was eligible for Modified Adjusted Gross Income (MAGI) Medi-Cal. The 2023 FPL income levels increases approximately 6.70 percent. This means that a single adult can qualify for MAGI Medi-Cal in 2023 with a monthly income of $1,677. For 2 adults, the household income can go as high as $2,269 per month and still maintain Medi-Cal eligibility.

Because Medi-Cal workers don’t understand or comprehend some of these sources of income, they terminate the Covered California enrollments of adults and children. This creates chaos for these families. An unknown, uninvited, and unauthorized individual accesses a Covered California application and makes an uneducated determination of the household’s income. Then this same elusive individual terminates coverage for individuals and families, some of them undergoing health care treatment with specific providers not in any Medi-Cal HMO network.

Many people do not update their income every year. While the income stays static, the threshold for Medi-Cal creeps up. The 2022 federal poverty levels are being applied for the 2023 Covered California subsidy and Medi-Cal eligibility. Many families are being caught by surprise that their current income is too low to maintain subsidies for their children.

The income chart uses columns with specific percentages to display the annual income amounts necessary for different program eligibilities based on household size, rows. What can be confusing is that an income chart will be published where the math doesn’t work. For example, the federal poverty level (FPL) income for an individual is the 100% column. The next column is 138% FPL. On the 03/2022 income chart, the annual income amount in the 138% FPL column, $18,755, is higher than the 100% column of $12,880 x 1.38 = $17,774.

Some young adults, who lacked proper immigration documents, were granted Medi-Cal prior to or during the Public Health Emergency. Those individuals have now aged out of that program and risk losing Medi-Cal coverage when the system resumes normal operations. This means they will have a gap in coverage until January 1, 2024, when they would once again be eligible for Medi-Cal.

I have always felt uncomfortable asking the Covered California applicant if they or anyone in the household is pregnant. Basically, it is none of my business. It is additionally awkward asking a mother or father if their adult daughter is pregnant. Now that reproductive health care is under assault in our country, I’ve become even more sensitive to asking the question.

Your children could be flipped into Medi-Cal if you return to Covered California without having properly terminated Medi-Cal earlier. On numerous occasions, children were flipped from Covered California to Medi-Cal, even if the stated estimated income was high enough to make everyone eligible for the subsidies.

The Public Health Emergency (PHE) conditions state that no one will be terminated from Medi-Cal unless they move out of state. Of course, individuals can report a change to their situation, such as gaining employer sponsored health insurance, and seek a termination from Medi-Cal.

Spam prevention powered by Akismet